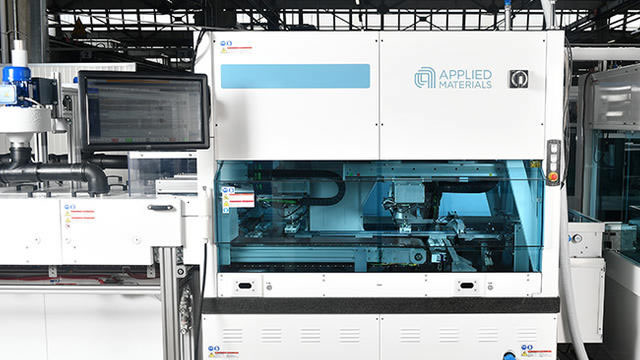

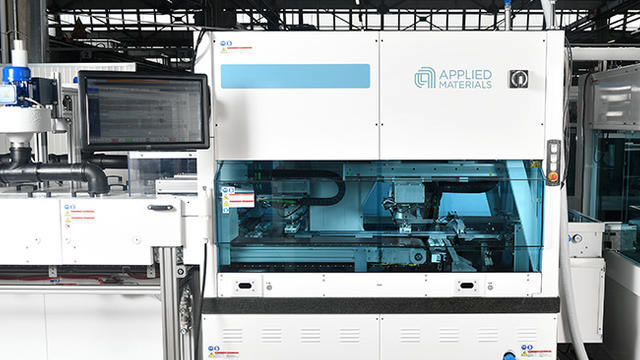

Applied Materials Inc. (AMAT)

Applied Materials stock suffers a harsh reversal: Aug 15 will be key

Applied Materials (AMAT) stock price has moved into a deep bear market as concerns about the semiconductor industry continued. It has crashed by more than 25% from its highest point this year and is hovering near its lowest point since April.

4 Solid Semiconductor Stocks to Buy on Accelerating Sales

Stocks like Taiwan Semiconductor Manufacturing Company Limited (TSM), RF Industries, Ltd. (RFIL), Micron Technology, Inc. (MU) and Applied Materials, Inc. (AMAT) are poised to benefit from the jump in semiconductor sales.

Applied Materials (AMAT) Increases Despite Market Slip: Here's What You Need to Know

In the closing of the recent trading day, Applied Materials (AMAT) stood at $181.87, denoting a +0.03% change from the preceding trading day.

Will AI Demand Lift Applied Materials Q3 Earnings?

Applied Materials stock has had a solid year thus far, rising by about 31% year-to-date. In comparison, Applied's semiconductor industry peer Texas Instruments stock has gained about 21% over the same period.

Are Computer and Technology Stocks Lagging Applied Materials (AMAT) This Year?

Here is how Applied Materials (AMAT) and RF Industries, Ltd. (RFIL) have performed compared to their sector so far this year.

Applied Materials (AMAT) Gains 21.4% YTD: Is It Worth Buying?

Applied Materials (AMAT) is riding on its leading position in the semiconductor technology inflections.

Is Trending Stock Applied Materials, Inc. (AMAT) a Buy Now?

Applied Materials (AMAT) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Applied Materials (AMAT) Stock Sinks As Market Gains: Here's Why

Applied Materials (AMAT) closed at $205.57 in the latest trading session, marking a -0.44% move from the prior day.

3 Hidden Stocks Ready to Explode Into Trillion-Dollar Giants

Certain companies rise above the rest in the technology sector, quietly positioning themselves as trillion-dollar companies with explosive growth. Here, the focus is on the secrets of three such hidden titans.

Here's Why Applied Materials (AMAT) Fell More Than Broader Market

In the closing of the recent trading day, Applied Materials (AMAT) stood at $219.65, denoting a -1.71% change from the preceding trading day.

Is Most-Watched Stock Applied Materials, Inc. (AMAT) Worth Betting on Now?

Applied Materials (AMAT) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

S&P 500 Gains and Losses Today: Chip Stocks Fall on Possible Export Restrictions

Tech stocks, and particularly shares of semiconductor firms, have played a key role in driving major U.S. equities indexes to record highs, but the tides changed on Wednesday.