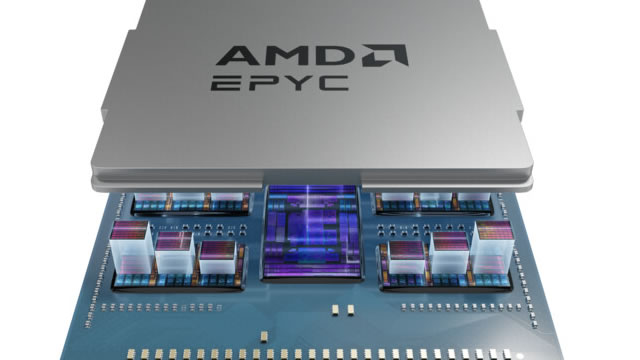

Advanced Micro Devices, Inc. (AMD)

AMD's Growth Is Just Kicking Off

AMD is delivering strong data center growth, with operating profits and margins rising sharply due to surging AI chip demand. The company announced a $6 billion share buyback, signaling confidence and enhancing shareholder value at current valuations. AMD trades at a significant discount to Nvidia and peers, offering a favorable risk/reward profile and potential for a 32%+ re-rating.

Banking giant just identified Nvidia's competitor to watch out for

Banking giant Citi has named chipmaker Advanced Micro Devices (NASDAQ: AMD) better positioned to challenge industry leader Nvidia (NASDAQ: NVDA) following recent strategic developments.

AMD strikes a deal to sell ZT Systems' server-manufacturing business for $3B

Semiconductor giant AMD followed through with its plan to spin out ZT Systems' server-manufacturing business.

Buybacks and Big-Time Developments: 3 Stocks Making Huge Moves

Several large-cap stocks recently announced buybacks worth billions, boosting their ability to return capital to shareholders. However, these names also have other important recent developments surrounding them that have big implications for shareholders.

AMD: 16 Billion Positive Signals

AMD got some major positive signals with the $10B Saudi AI deal and a $6B buyback. The chip company reported Q1 Data Center sales surged 57% YoY, and the MI350 GPU launch boosts AMD's competitiveness against Nvidia. Despite China export headwinds, AMD's guidance implies robust growth and significant upside versus current analyst expectations.

Artificial Intelligence (AI) Infrastructure Spend Could Hit $6.7 Trillion by 2030, According to McKinsey. 4 Data Center Stocks to Load Up on Right Now Like There's No Tomorrow.

Global management consulting firm McKinsey & Company recently published a report detailing compelling trends in research and development (R&D) and capital expenditure (capex) related to artificial intelligence (AI) investments over the next five years.

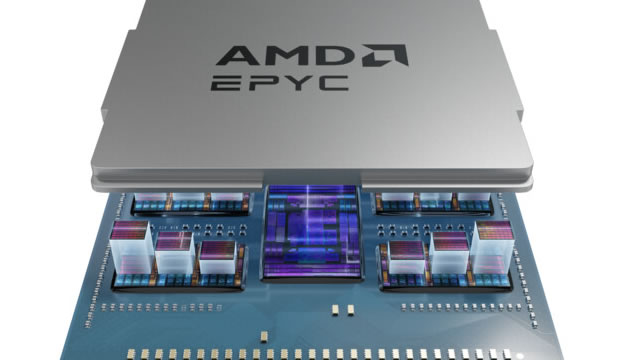

Tech Corner: AMD

AMD Inc. (AMD) shares surged this week on news of partnerships in Saudi Arabia and an increase to its share buyback program. George Tsilis explains why AMD's business model makes it unique among the semiconductor industry, but also why it faces stiff competition from companies like Intel (INTC) and Nvidia (NVDA).

AMD's AI Strategy Sprints Past Intel, Firmly In The Fast Lane

AMD's Q1 2025 earnings exceeded forecasts with a 36% revenue increase, driven by AI demand and upcoming "Advancing AI 2025" event. AMD's GPUs, particularly the MI300X and the upcoming MI350 Series, lead in AI inference performance, challenging Nvidia's dominance. AMD's forward P/E ratio of 24.45 and PEG ratio under 1 indicate undervaluation, with earnings expected to grow 31.26%-45% annually.

AMD Rises 31% in One Month: Should You Buy, Hold or Sell the Stock?

Advanced Micro Devices stock benefits from a strong portfolio and key partnerships despite stiff competition and export restrictions on GPUs to China.

AMD: Inference Is Hitting An Inflection Point

AI inference demand is at an inflection point, positioning Advanced Micro Devices, Inc. for significant data center and AI revenue growth in coming years. AMD's MI300-series GPUs, ecosystem advances, and strong cloud adoption are driving double-digit AI revenue growth and attracting major hyperscaler customers. Valuation remains attractive, with AMD shares trading at a discount to sector PEG ratios; I see potential for over 50% upside as fundamentals improve.

AMD: A Losing Bet On AI

Advanced Micro Devices, Inc. faces several major risks, which in our opinion are likely to undermine AMD's growth opportunities. The loss of China-related revenues as a result of the stricter export restrictions and the overvaluation of the company's shares makes us believe that AMD remains uninvestable. We continue to rate AMD as a SELL.

AMD: China Trade Talks Could Be A Catalyst For AI Sales Growth

AMD posted revenues that came in better than guided on data center revenues decline that was better than expected and an increase in Client and Gaming sales. Advanced Micro Devices expects $1.5 billion in headwinds from tariffs. The Company expects to benefit from the MI350 Instinct GPU ramp-up and replacement cycle for gaming PCs.