iShares MSCI South Korea ETF (EWY)

South Korea Political Tumult Could Sour Appetite for Korean Assets

While the unexpected declaration of martial law was promptly struck down by parliament, the episode is likely to leave a bad taste in investors' mouths.

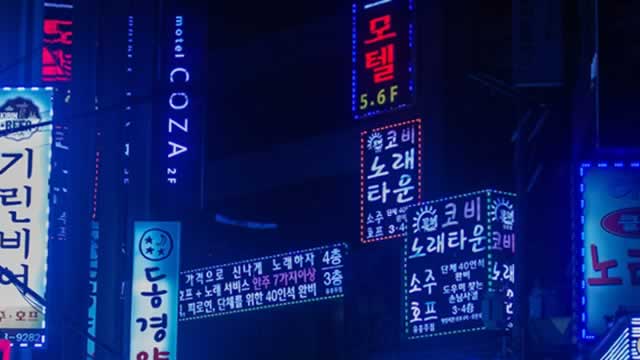

South Korean stocks tank as president declares martial law

South Korean stocks faced a sharp drop after president Yoon Suk Yeol moved to declare martial law on Tuesday. Yoon announced the decision in a late-night television address, dubbing the move necessary in a bid to protect the country from North Korea's communist forces.

EWY: South Korea Stocks Stumble Post-Election, Eyeing Downside Targets

Geopolitical tensions and a strong US Dollar contribute to bearish sentiment on the iShares MSCI South Korea ETF, despite its compelling valuation. EWY's significant exposure to Samsung Electronics and SK hynix, along with a high concentration in IT, adds to its risk profile. Technical analysis indicates bearish momentum, with key support levels identified around $55 and $47-$48, suggesting potential buying opportunities.

EWY: 3 Reasons Why Korean Stocks May Be A Good Buy

Korean equities have low multiples even compared to other emerging markets. The US dollar has likely peaked and will support emerging markets as it weakens further. Korea is looking to enact tax policies that specifically seek to improve shareholder returns.

EWY Set To Gain From Current Semiconductor Upcycle Led By SK Hynix, Samsung

The Korea-focused EWY ETF remains one of the best ways to gain exposure to chip giants Samsung and SK Hynix. Potential verification by Nvidia for Samsung's HBM3E memory will boost EWY's return. EWY stocks remains attractive value-wise at 13.4 time earnings and 1.1 times book value.

EWY: Undervalued Tech-Forward Play

The iShares MSCI Korea ETF is a tech-heavy fund with over $5 billion in assets, making it the largest South Korea-focused ETF. EWY is heavily weighted towards tech giants like Samsung and SK Hynix, and is currently trading at attractive valuation multiples. The South Korean government's $7 billion investment in AI and semiconductors could serve as a strong tailwinds for the fund.

Beacon Pointe Advisors LLC Purchases 18,082 Shares of iShares MSCI South Korea ETF (NYSEARCA:EWY)

Beacon Pointe Advisors LLC increased its position in iShares MSCI South Korea ETF (NYSEARCA:EWY – Free Report) by 116.3% during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 33,624 shares of the exchange traded fund’s stock after acquiring an additional 18,082 shares during the quarter. Beacon Pointe Advisors LLC owned about 0.06% of iShares MSCI South Korea ETF worth $2,203,000 at the end of the most recent quarter. A number of other institutional investors and hedge funds have also recently bought and sold shares of EWY. Geneos Wealth Management Inc. boosted its holdings in iShares MSCI South Korea ETF by 242.7% during the fourth quarter. Geneos Wealth Management Inc. now owns 1,131 shares of the exchange traded fund’s stock valued at $74,000 after purchasing an additional 801 shares in the last quarter. Manchester Capital Management LLC boosted its stake in iShares MSCI South Korea ETF by 225.0% in the 3rd quarter. Manchester Capital Management LLC now owns 1,300 shares of the exchange traded fund’s stock valued at $77,000 after buying an additional 900 shares in the last quarter. Advisors Preferred LLC grew its position in iShares MSCI South Korea ETF by 134.2% in the third quarter. Advisors Preferred LLC now owns 1,857 shares of the exchange traded fund’s stock valued at $109,000 after acquiring an additional 1,064 shares during the period. Global Retirement Partners LLC raised its stake in iShares MSCI South Korea ETF by 72.1% during the fourth quarter. Global Retirement Partners LLC now owns 1,745 shares of the exchange traded fund’s stock worth $114,000 after acquiring an additional 731 shares in the last quarter. Finally, Prudential PLC bought a new position in shares of iShares MSCI South Korea ETF during the third quarter valued at $160,000. iShares MSCI South Korea ETF Stock Performance EWY opened at $65.46 on Monday. The firm has a market cap of $5.20 billion, a price-to-earnings ratio of 9.60 and a beta of 1.25. The firm’s 50-day simple moving average is $65.12 and its 200-day simple moving average is $63.50. iShares MSCI South Korea ETF has a twelve month low of $54.49 and a twelve month high of $68.20. About iShares MSCI South Korea ETF (Free Report) iShares MSCI South Korea Capped ETF (the Fund) is an exchange-traded fund (ETF). The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI Korea 25/50 Index (the Index). The Index consists of stocks traded primarily on the Stock Market Division of the Korean Exchange. Read More Five stocks we like better than iShares MSCI South Korea ETF How to Start Investing in Real Estate Canada Goose Flies Higher Driven By DTC Growth What Are Growth Stocks and Investing in Them CVS Health Stock Has a Silver Lining Called Value What is a Special Dividend? Magnificent 7 Still Magnificent as the Halfway Mark Approaches? Want to see what other hedge funds are holding EWY? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for iShares MSCI South Korea ETF (NYSEARCA:EWY – Free Report).