Hudbay Minerals Inc. (HBM)

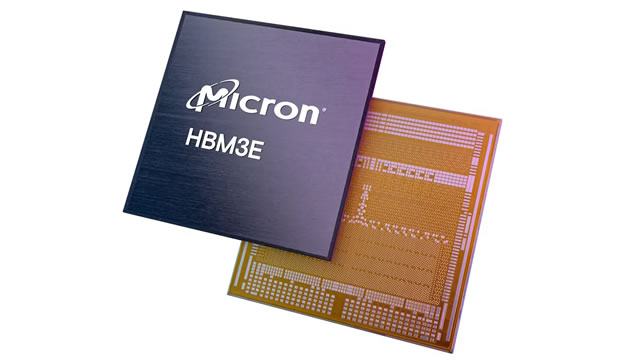

Micron's HBM-Driven DRAM Demand Rises: Can AI Keep Lifting the Growth?

MU rides on the surging HBM-fueled DRAM demand as AI workloads boost shipments, pricing strength and growth momentum into 2026.

Micron: Possibly The Best Remaining AI Upside Trade

Micron continues to transition from a cyclical memory supplier to a mission-critical AI infrastructure provider, driven by its strategic DRAM, NAND and HBM roadmap. The company's dual-track roadmap for standard and customized HBM4E with TSMC support starting 2027 preserves Micron's AI share gains amid shifting GPU vs. custom ASIC adoption trends in the long-run. Tight supply-demand dynamics and accelerating pricing power across both HBM and non-HBM memory is also materially improving durability in Micron's growth outlook and margin profile.

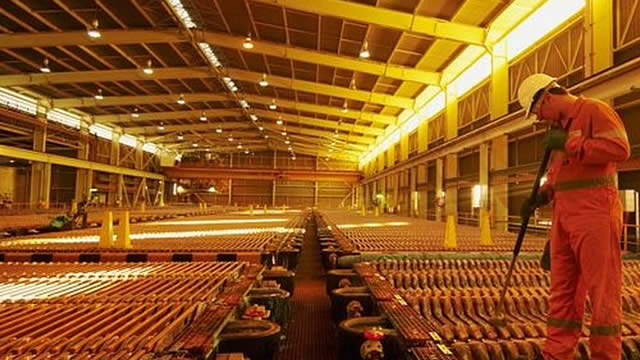

Can HBM Sustain Its Free Cash Flow Momentum Amid Copper Price Swings?

Hudbay Minerals extends its free-cash-flow momentum through low costs and gold leverage, but volatility and geopolitical risks loom.

Micron Technology: Top Stock To Watch For 2026 From My Quant 'Dean's List'

Micron is benefiting from a major shift toward AI-grade memory with HBM and data-center DRAM driving margin expansion and record earnings into FY25. The setup for 2026 is favorable: HBM is sold out through next year, pricing is improving, and Micron offers direct exposure to the ongoing infrastructure buildout. SSRM Mining earns Top Past Performer after a breakout year driven by higher production, stronger free cash flow, and a major tailwind from rising gold prices.

Micron: Here's Why The Stock Has Been Soaring (Hint: It's Not HBM) (Downgrade)

Micron Technology, Inc. shares are soaring, up close to 100% since August. While HBM is a factor in MU's rise, DRAM and NAND prices are surging. The memory supercycle marches on and MU is poised for a record 2026.

Is HBM's Copper World JV With Mitsubishi a Potential Breakthrough?

Hudbay Minerals has entered into a joint venture with Mitsubishi to build its Copper World project. The deal helps Hudbay reduce its capital contribution for the project.

HBM Gains More than 50% in 3 Months: How to Play the Stock?

HBM's 54.6% surge in three months spotlights Copper World momentum, gold strength and tight cost control amid ongoing operational hurdles.

HudBay Minerals (HBM) Q3 Earnings: How Key Metrics Compare to Wall Street Estimates

Although the revenue and EPS for HudBay Minerals (HBM) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Why HudBay Minerals (HBM) Outpaced the Stock Market Today

In the closing of the recent trading day, HudBay Minerals (HBM) stood at $16.13, denoting a +2.48% move from the preceding trading day.

Seeking Clues to HudBay Minerals (HBM) Q3 Earnings? A Peek Into Wall Street Projections for Key Metrics

Looking beyond Wall Street's top-and-bottom-line estimate forecasts for HudBay Minerals (HBM), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended September 2025.

Earnings Preview: HudBay Minerals (HBM) Q3 Earnings Expected to Decline

HudBay Minerals (HBM) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Samsung Electronics says it is in talks with Nvidia to supply next-generation HBM4 chips

Samsung Electronics said on Friday it is in "close discussion" to supply its next-generation high-bandwidth memory (HBM) chips, or HBM4, to Nvidia , as the South Korean chipmaker scrambles to catch up with rivals in the AI chip race.