Hudbay Minerals Inc. (HBM)

HudBay Minerals (HBM) Sees a More Significant Dip Than Broader Market: Some Facts to Know

The latest trading day saw HudBay Minerals (HBM) settling at $15.89, representing a -2.09% change from its previous close.

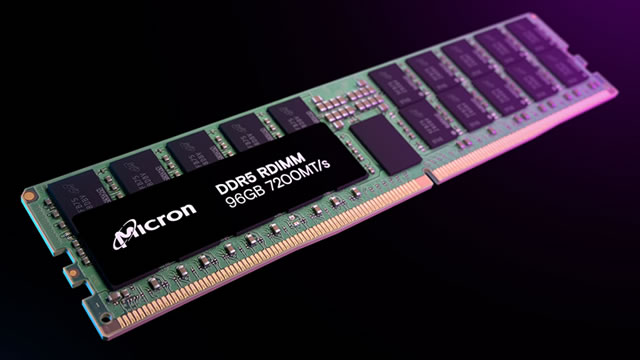

Micron Bets Big on HBM4E: Will Custom Chips Lift Revenues Further?

MU's upcoming customizable HBM4E chips aim to boost AI memory performance and margins, extending its record revenue momentum over the long run.

HudBay Minerals (HBM) Exceeds Market Returns: Some Facts to Consider

HudBay Minerals (HBM) closed at $17.31 in the latest trading session, marking a +1.64% move from the prior day.

HudBay Minerals (HBM) is an Incredible Growth Stock: 3 Reasons Why

HudBay Minerals (HBM) is well positioned to outperform the market, as it exhibits above-average growth in financials.

New Strong Buy Stocks for Oct. 14: HBM, GCT, and More

HBM, GCT, WFRD, MMS and JXN have been added to the Zacks Rank #1 (Strong Buy) List on October 14, 2025.

Micron: HBM On Rocket Fuel And NAND Shortage Tailwinds

Micron Technology's FY25 earnings results confirmed a sharp turnaround, an event I anticipated in April this year. Revenue hit $37.4B (+49% yoy), and gross margin expanded 17 pts to 41%. DRAM remains the growth engine: tight supply lifted ASPs by low double-digits sequentially; DRAM revenue rose 69% yoy and now represents 79% of total revenue. A new pillar for my bull case is emerging: industry-wide NAND chip shortages could improve ASPs and margins, supporting triple-digit EPS growth over the next three quarters.

Breaking The Cycle: How AI Transforms Memory Stock Micron

Micron is well-positioned to benefit from surging AI datacenter memory demand, driven by high-performance HBM products and tight DRAM supply. AI model complexity, larger context windows, and the rise of AI agents are fueling unprecedented memory requirements, outpacing even GPU demand growth. MU's forward-looking CapEx, secured HBM3E contracts, and anticipated HBM4 launch position it as a performance leader in a seller's market.

Micron: Don't Repeat The Same Mistakes Again

Micron Technology has surged on AI CapEx momentum and HBM leadership, but post-earnings selling suggests caution near previous highs. MU's earnings and HBM4 ramp support bullish sentiment, yet cyclicality risks and compressed free cash flow margins remain justified concerns. Sustained AI-driven demand is critical; watch for broad enterprise SaaS adoption to justify current valuations and aggressive spending.

Micron Technology: Strong Buy As HBM Chips Power The Next Wave Of AI Growth

Micron Technology, Inc. has surged 30.2% since the last report, outperforming the S&P 500, and remains rated a "Strong Buy." MU posted robust Q4 results with 46% YoY sales growth, driven by DRAM and High Bandwidth Memory (HBM) strength, and expanding margins. Guidance for Q1 2026 forecasts 10% sequential revenue growth and improved gross margins, with HBM4 ramp-up expected to drive further gains.

Micron: A Steal For AI Investors

Micron Technology, Inc. delivered record fiscal Q4 earnings, fueled by surging AI-driven demand for its high-bandwidth memory products in Data Centers. MU's revenue soared 46% year-over-year to $11.3B, with free cash flow up 149% Y/Y, reflecting explosive growth in its HBM segment. Revenue related to HBM, high-capacity DIMMs and LP server DRAM reached 10.0B in Q4'25, due to considerable demand strength for high-bandwidth memory solutions from hyperscalers.

Micron: Time To Jump Back On The AI Bullet Train (Rating Upgrade)

I'm upgrading Micron back to a buy from strong sell after management raised guidance, confirming that more favorable DRAM/HBM demand and pricing is at play. Micron is a leader within the High Bandwidth Memory (HBM) market, putting it at the core of the AI infrastructure boom, with sold-out capacity for 2025 and improving margins. I watch memory pricing closely and I'm pleasantly surprised at how resilient DRAM prices are holding up. I'm expecting to see this show up as upside surprise next quarter.

Micron: Strong Buy On AI-Driven HBM Growth

Micron Technology is upgraded to "Strong Buy" with a new price target of $146.88, reflecting robust earnings momentum and upwardly revised guidance. The company is significantly undervalued versus peers, with strong EBITDA growth, improving free cash flow, and a projected net cash position next year. Micron's DRAM and HBM segments are driving growth, supported by AI and data center demand, while NAND risks are being proactively managed.