Robinhood Markets, Inc. (HOOD)

Is Trending Stock Robinhood Markets, Inc. (HOOD) a Buy Now?

Robinhood Markets (HOOD) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Why Investors Need To Look Into Robinhood Again

Robinhood has achieved significant growth, with a 65% stock increase since October 5th, driven by profitability and expansion into new product lines. The company's Q3 revenue rose 36% YoY to $637 million, with notable increases in Average Revenue Per User and Gold Subscribers. Recent acquisitions and product launches, including TradePMR and new crypto offerings, position Robinhood as a more holistic financial services provider.

Here's why the Robinhood stock price could surge 133%

Robinhood stock price has been in a strong bull run since 2023, helped by the strong performance of American equities and cryptocurrencies. The HOOD share price peaked at $39.70, its highest level since October 2021, giving it a market cap of over $33 billion.

HOOD Stock is on a Tear Since Election Day: Buy or Wait for the Dip?

Robinhood is a clear winner of the post-election rally, having soared more than 50% since Nov. 5. Read on to know whether you should buy the stock now or wait.

Watch These Robinhood Price Levels as Stock Hits 3-Year High After Upgrade

Shares in Robinhood Markets (HOOD) will likely remain on investors' radar screens Tuesday after Morgan Stanley upgraded the stock and significantly raised its price target, saying that the company sits well-positioned to benefit from the outcome of the U.S. presidential election.

Robinhood's Dan Gallagher isn't interested in SEC Chair role

CNBC's Kate Rooney joins 'Squawk on the Street' to report on Robinhood's chief legal officer speaking out on potential SEC chair role.

Robinhood's chief legal officer Gallagher rules out becoming SEC chair, CNBC reports

Robinhood Markets' Chief Legal Officer Dan Gallagher, a former commissioner of the Securities and Exchange Commission who was reportedly the frontrunner to become its chair under Donald Trump, told CNBC on Friday he was not interested in the role.

Robinhood's 330% Surge: Sustainable Rally or Bull Market Mirage?

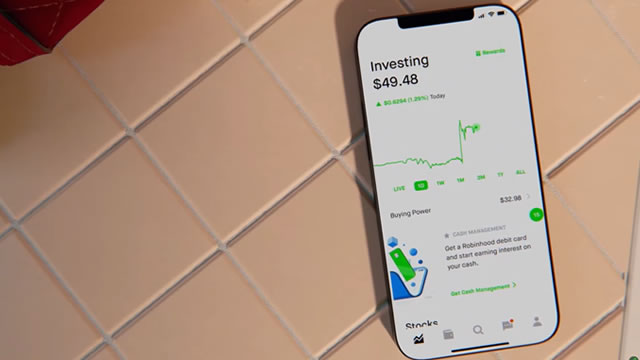

Robinhood NASDAQ: HOOD is the company that created the trading app that once epitomized the democratization of finance and the financial services sector. Robinhood's stock price has surged by over 330% this year, which is a dramatic rebound from its previous lows.

Robinhood: Big Acquisitions, Strong Upside

Robinhood's stock has surged over 50% due to strong crypto trading margins and strategic acquisitions, making it a strong buy despite traditional valuation concerns. The company's unique subscription model and recent acquisition of TradePMR position it well for growth in the investment advisory and retirement asset markets. Despite a high forward P/E ratio, Robinhood's projected revenue growth of 26.79% justifies its premium valuation, with an additional 20% upside potential.

Robinhood's Acquisition of TradePMR to Transform Wealth Management

In sync with its strategy to become a one-stop shop for financial services, HOOD announces an agreement to acquire TradePMR.

Analyst Upgrades Outperforming Robinhood Stock

Robinhood Markets Inc (NASDAQ:HOOD) stock is up 4.8% ahead of the open, after Needham upgraded the brokerage platform to "buy" from "hold" and set its price target at $40.

Robinhood to acquire TradePMR for $300 million: Here's what the CEOs have to say

Vlad Tenev, Robinhood Chairman & CEO, and Robb Baldwin, TradePMR founder & CEO, join CNBC's 'Halftime Report' to discuss the acquisition and what it means for the fintech landscape.