Robinhood Markets, Inc. (HOOD)

Consider Selling Robinhood Stock Post Election Surge

Robinhood Markets, Inc.'s share price surged post-election, but the company remains overvalued with a P/E of 50x, needing substantial growth to justify its valuation. The company has grown revenue to $2.4 billion and increased gold subscribers, but high expenses and stock-based compensation hinder true profitability. Robinhood's 1% deposit match has driven asset growth but is unsustainable, adding $230 million in unamortized obligations, impacting long-term growth.

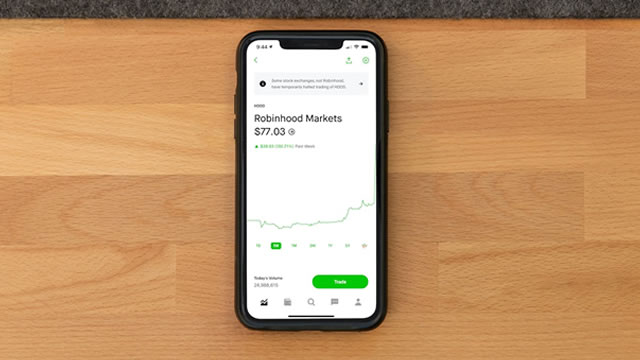

Robinhood Markets Hits 52-Week High: Should You Buy the Stock Now?

HOOD stock hits a new 52-week high. Can the newly elected government's stance and the company's growth efforts keep the momentum going?

Robinhood Chief Brokerage Officer Steve Quirk talks post-election trading and betting trends

Steve Quirk, Robinhood chief brokerage officer, joins 'Closing Bell Overtime' to talk the impact of the election and aftermath on the platform.

Robinhood attorney, Republican regulators being considered for Trump financial agency short list

Trump transition team officials are considering retail brokerage Robinhood's top lawyer, as well as bank regulators and corporate attorneys, for a short list of key financial agency heads they expect to present to the president-elect soon, according to multiple people with knowledge of the matter.

Why Wall Street Got Robinhood's Earnings All Wrong

Robinhood's earnings weren't great, but they didn't deserve the market's reaction.

Robinhood Markets, Inc. (HOOD) Is a Trending Stock: Facts to Know Before Betting on It

Robinhood Markets (HOOD) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Robinhood Price Levels to Watch as Stock Drops After Promotion Causes Revenue Miss

Shares in Robinhood Markets (HOOD) plunged Thursday after the online brokerage missed Wall Street's quarterly revenue expectations due to a customer promotion program.

Robinhood tumbles as customer incentives eat into results

Robinhood Markets Inc (NASDAQ:HOOD) sunk over 15% on Thursday after reporting incentives aimed at drawing in customers had eaten into revenue over the third quarter. Matches on asset transfers and individual retirement arrangement (IRA) contributions caused a $27 million reduction in revenue over the quarter, the company said in results.

Robinhood shares down as promotions eat into profits

CNBC's Kate Rooney joins 'Squawk on the Street' to discuss Robinhood earnings.

Robinhood Stock Sinks as Promotions Lead To Weaker-Than-Expected Results

Robinhood Markets (HOOD) shares sank 15% Thursday, a day after the online brokerage posted worse-than-expected results as a promotion to get more customers impacted performance.

Analyst talks 'bigger picture' in Robinhood earnings

In its third quarter earnings, trading platform Robinhood Markets (HOOD) fell short of revenue estimates ($637 million vs. the $663.5 million that was expected) while posting adjusted earnings of $0.17 per share, just one cent shy of estimates of $0.18.

Robinhood shares drop as growth push takes a toll on Q3 results

Shares of Robinhood Markets fell nearly 11% before the market open on Thursday after more than doubling in value this year, as incentives aimed to attract customer assets hurt third-quarter results.