International Business Machines Corporation (IBM)

IBM Debuts AI-Powered Threat Detection Tools

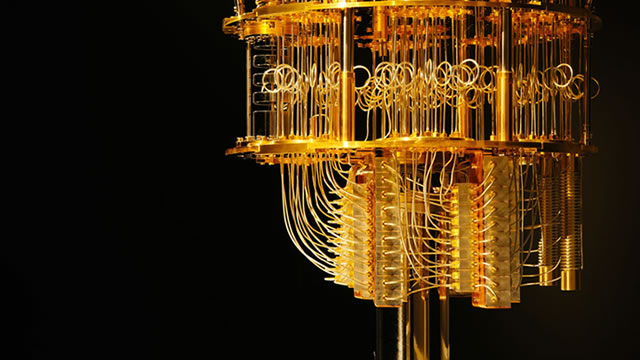

IBM has added generative artificial intelligence (AI) capabilities to its managed threat detection and response services. Built on the company's watsonx data and AI platform, the new IBM Consulting Cybersecurity Assistant is designed to speed and improve the identification, investigation and response to critical security threats, IBM announced Monday (Aug. 5).

2 Artificial Intelligence (AI) Stocks to Buy Now and Hold for Decades

Amazon's AWS holds 31% of the global cloud computing market, making it a cornerstone of the AI industry. No other company comes close to matching IBM's massive volume of patented AI innovation.

Is It Time to Buy IBM Stock?

IBM beat analyst estimates for revenue and earnings in the second quarter as software sales jumped. The consulting business was a mixed bag, but demand for generative AI services is booming.

IBM's Generative AI Business Is Small but Booming

IBM has now booked more than $2 billion worth of generative AI business. Most of that comes from consulting signings, with the rest coming from software.

International Business Machines Corporation (IBM) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching IBM (IBM) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Don't Overlook IBM (IBM) International Revenue Trends While Assessing the Stock

Examine the evolution of IBM's (IBM) overseas revenue trends and their effects on Wall Street's forecasts and the stock's prospects.

3 Must-Own Dividend Aristocrats for Reliable Income

With the S&P 500 providing a paltry 1.32% dividend yield today, income-focused investors must be selective in their search for yield. That's where the Dividend Aristocrats come in.

3 High-Yield Dividend Stocks That Also Deliver Solid Gains

High-yield dividend stocks allow investors to generate steady cash flow while holding onto their shares. However, most of these same stocks tend to underperform the stock market.

Compared to Estimates, IBM (IBM) Q2 Earnings: A Look at Key Metrics

The headline numbers for IBM (IBM) give insight into how the company performed in the quarter ended June 2024, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

IBM: AI Peanuts

IBM has surged on generative AI hype, but the company still lacks significant growth to justify excitement over AI capabilities. Despite some positive trends in software growth, IBM's overall revenue growth remains stagnant, with concerns over a lack of investment in AI. The stock trades at 19x EPS targets and IBM isn't producing the type of growth to warrant this valuation.

Why IBM Stock Popped After Tuesday's AI-Themed Earnings Report

IBM reported Q2 earnings of $2.43 per share, beating Wall Street's $2.20 estimate. Management raised their full-year free-cash-flow guidance to "greater than $12 billion.

IBM Q2: Software Growth Potential Supports Buy Thesis

IBM's Q2 earnings beat expectations, triggering a stock price rally. I expect the developments reported in Q2 to support further stock price advances. Top return drivers include growth potential for its software segment, robust profit metrics, and strong free cash generation.