Quantum Corporation (QMCO)

3 Quantum Computing Stocks That Could Help Make You a Fortune

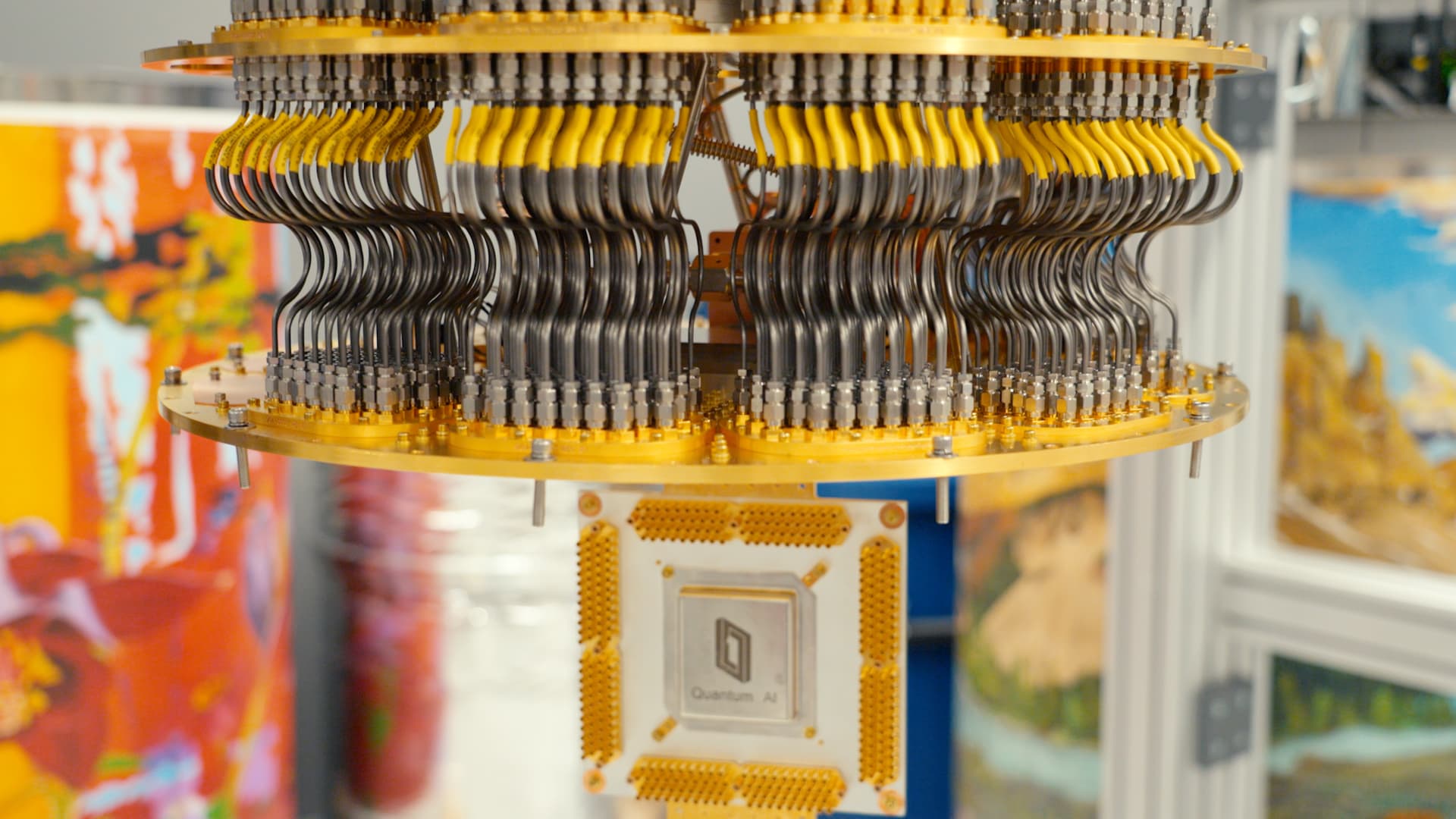

Although the artificial intelligence (AI) arms race is still ongoing and heating up, there's another important computing trend that's on the horizon: quantum computing. Quantum computing may not completely replace traditional computing, but it can aid in increasing the speed and efficiency of the computing infrastructure that we currently have.

2 Top Stocks in Quantum Computing and Robotics That Could Soar in 2026

As the generative artificial intelligence (AI) hype cycle gets long in the tooth, investors are on the lookout for the next big technology. Quantum computing might be it.

3 Quantum Computing Stocks that Could Be The Next Nvidia

As Wall Street's AI darling, Nvidia (Nasdaq: NVDA) is one of those wonders that appear to come along once in a lifetime.

Big Bank Sees Quantum Computing Market Hitting $4B by 2030. Here Are 2 Stocks to Make the Leap

The quantum computing market might overtake AI as the next big trade on Wall Street.

These Quantum Computing Stocks Could Be the Secret Winners of the AI Boom

Quantum computing isn't as big an investment theme as artificial intelligence (AI). AI is currently the market's fixation, and for good reason, as that's where a ton of investment dollars from companies around the globe are going.

Quantum stocks Rigetti Computing and D-Wave surged double-digits this week. Here's what's driving the big move

Rigetti Computing, D-Wave Quantum and Quantum Computing surged more than 20% this week. Rigetti announced purchase orders for two of its quantum computing systems totaling $5.7 million.

Will Rigetti's $5.8M AFRL Deal With QphoX Advance Quantum Networking?

RGTI secures a $5.8M AFRL contract with QphoX to tackle quantum networking bottlenecks and advance superconducting scalability.

Memes Are Back: Retail Investors Are Piling Into 3 Quantum Stocks

Are family and friends starting to discuss their favorite stocks with you again? Speculation is beginning to reemerge in the market, and retail investors are again leading the charge.

Can Rigetti's Recent Grants Accelerate Its Quantum Computing Roadmap?

RGTI secures major grants to tackle quantum networking, qubit fidelity and error correction, extending its runway and boosting investor confidence.

Quantum Computing Tumbles 16%. What Is Sending the Stock Lower.

Shares of the Hoboken, N.J.-based company fall sharply after the company unveils a $500 million private placement.

Why D-Wave Quantum Stock Skyrocketed This Week

D-Wave Quantum (QBTS 12.01%) stock recorded explosive gains over this week's trading. The company's share price surged 51.4% in a stretch that saw the S&P 500 rise 1.2% and the Nasdaq Composite rise 2.2%.

Stock-Split Watch: Is D-Wave Quantum Next?

In the public markets, companies are always trying to make their stocks more attractive to investors. One way publicly traded companies can do this is through stock splits and reverse stock splits, which are tools that artificially manipulate share price and outstanding share count but don't change the overall value of a company.