Super Micro Computer, Inc. (SMCI)

Will Super Micro Computer Be the AI Comeback Stock of the Year?

Super Micro Computer (SMCI -5.40%), often called Supermicro, has taken investors on quite the roller-coaster ride since the start of 2024. Once the hottest stock on Wall Street, it now sits around 60% below its all-time high.

Super Micro Computer: Despite Risks, Big Upside Ahead

Despite big risks and share price volatility, Super Micro Computer, Inc. stock stands out in the AI megatrend due to its high-growth trajectory and unusually low valuation. Liquid cooling and the data center transition from Nvidia Hopper to Blackwell are key 2025 growth contributors. Obviously, SMCI shares have warts (new auditor, threat of delisting, dropped from Nasdaq 100, very high short interest), but these combine to form a powerful contrarian opportunity with growing momentum.

Options Trades: SMCI Filing Deadline & NVDA Earnings

Nvidia (NVDA) will undoubtably grab the market's attention next week with its earnings, though Kevin Hincks urges investors to keep an eye on Supermicro (SMCI), too. Kevin highlights a pair of example options trades heading into the big week.

Super Micro Stock Rises. Why Next Week Will Be Key for SMCI.

The server maker surged past Palantir to become the best S&P 500 performer of 2025 this week.

Super Micro Stock Slips. Why the SMCI Winning Streak Could Be in Danger.

The server maker is already up 98% this year, making it the best S&P 500 performer.

Super Micro Computer: The Worst Is Behind Us, But Credibility Takes Time To Rebuild (Rating Upgrade)

Super Micro Computer, Inc. stock fell 30% since my last rating before reaching the bottom, but it experienced a strong rally, particularly after the weak 2Q earnings and guidance. Management is confident that its FY2024 10-K and 1Q and 2Q FY2025 10-Q filings will be completed before the February 25 deadline, signaling that there are no major red flags. The company projected a strong FY2026 outlook, targeting $40 billion in revenue driven by NVIDIA's Blackwell, which has fueled investor optimism and helped them look past the gloomy FY2025.

Super Micro Computer Stock Got Its Mojo Back (Technical Analysis)

The technicals are undeniably strong with the chart, moving averages, and indicators converging to a consensus bullish outlook. Most recent preliminary quarterly results were mixed and guidance was overall weak as revenue growth is projected to slow and EPS growth expected to drop into negative territory. CEO Charles Liang's ambitious 2026 targets help to confirm that the AI growth story remains intact for the company over the long run.

Super Micro's stock is its most overbought in a year. Here's why that's bullish.

Super Micro's stock has soared till it has become the most technically overbought in a year, but that hasn't deterred bulls in the past.

Should You Buy, Hold, or Sell SMCI Stock Before Filing Deadline?

Super Micro Computer, Inc.'s SMCI shares have bounced back strongly this year after a weak performance last year. The recent business update has boosted momentum, with investors anticipating no hiccups in the company's highly-anticipated 10-K filing.

Why Super Micro Computer Stock Rocketed Higher Again Today

Super Micro Computer (SMCI 18.75%) stock is soaring again today. Shares were up by 17.3% as of 2:25 p.m.

Super Micro Computer: An Undervalued High-Growth Opportunity For Investors Willing To Accept Additional Risks

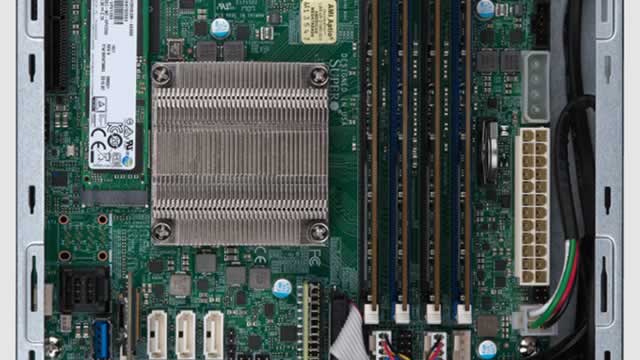

Super Micro Computer offers a rare buying opportunity, trading at a significant discount due to financial reporting issues and regulatory scrutiny. SMCI is a leader in server infrastructure technology, with strong growth prospects driven by AI data center adoption and innovative cooling solutions. Despite current challenges, SMCI's financial performance remains robust, with impressive revenue growth and profitability, supported by recent capital raises and strategic partnerships.

Super Micro Computer stock: 2 reasons why SMCI is surging this week as its latest delisting deadline nears

Shares in Super Micro Computer, Inc. (Nasdaq: SMCI) are once again rising in premarket trading this morning. As of the time of this writing, SMCI stock is up over 6% to $59.25 per share.