Zions Bancorporation, National Association (ZION)

What Makes Zions (ZION) a New Buy Stock

Zions (ZION) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

Is Zions Bancorporation (ZION) Stock Undervalued Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Zions Bancorporation: Credit Concerns Overshadow Brighter Underlying Trends

After outperforming over the summer and the early part of the fall, shares of Zions Bancorporation have been a weaker performer more recently. This coincides with Zions' disclosure of impairment charges relating to loans to financial borrowers made by one of the bank's subsidiaries. While the market's concern is understandable, credit has actually been a bright spot here in recent years, while current asset quality metrics also remain robust.

Why Is Zions (ZION) Down 6.4% Since Last Earnings Report?

Zions (ZION) reported earnings 30 days ago. What's next for the stock?

Should Value Investors Buy Zions Bancorporation (ZION) Stock?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Zions Bancorporation, National Association (ZION) Presents at The BancAnalysts Association of Boston Conference Transcript

Zions Bancorporation, National Association ( ZION ) The BancAnalysts Association of Boston Conference November 6, 2025 3:05 PM EST Company Participants R. Richards - Executive VP & CFO Conference Call Participants Ryan Nash - Goldman Sachs Group, Inc., Research Division Christopher Spahr - Wells Fargo Securities, LLC, Research Division Sun Young Lee - TD Cowen, Research Division Manan Gosalia - Morgan Stanley, Research Division Presentation Unknown Analyst I am here with Zions Bancorp.

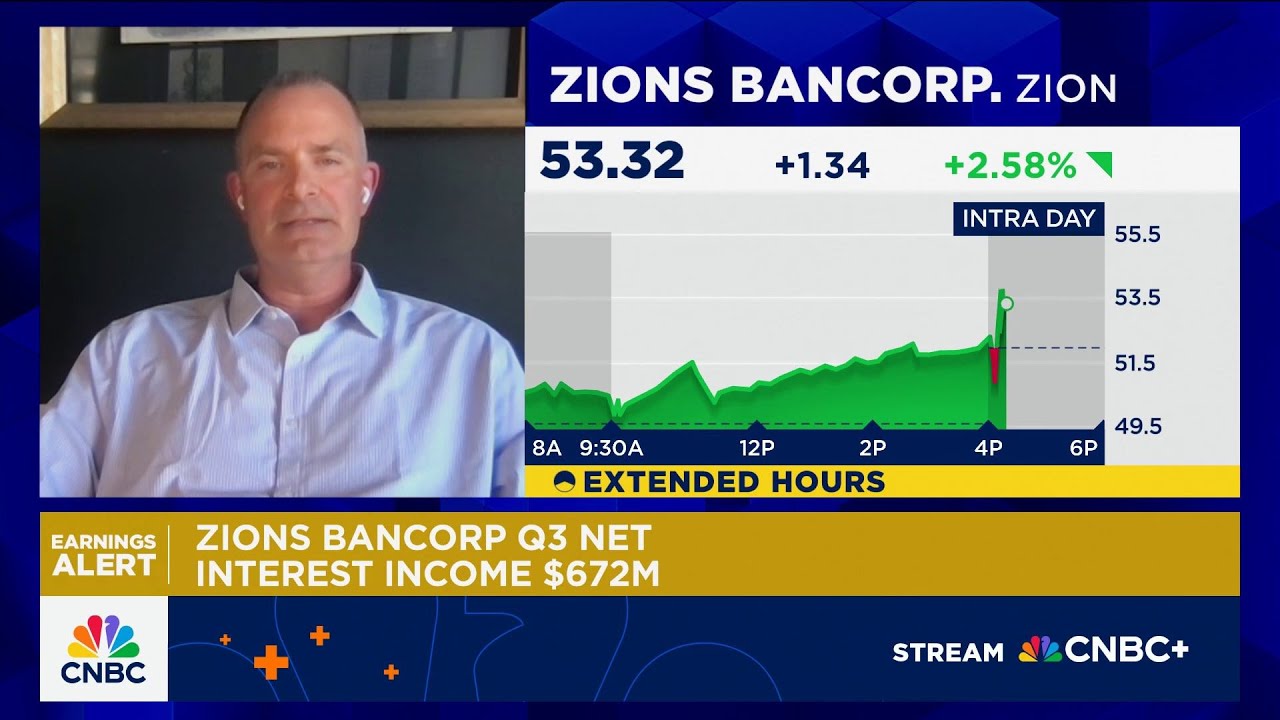

Zions' Q3 Earnings Beat Estimates on Higher NII & Fee Income, Stock Up

ZION's third-quarter 2025 earnings beat forecasts as higher net interest and fee income lifted profits, sending the stock up in after-hours.

Zions (ZION) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

While the top- and bottom-line numbers for Zions (ZION) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Zions (ZION) Q3 Earnings and Revenues Beat Estimates

Zions (ZION) came out with quarterly earnings of $1.54 per share, beating the Zacks Consensus Estimate of $1.19 per share. This compares to earnings of $1.37 per share a year ago.

Zions' earnings show its core business continues to perform well, says Baird's George

CNBC's “Closing Bell Overtime” team discusses regional banks and Zions Bancorp's latest earnings report with David George, senior research analyst at Baird.

Markets Retreat on Regional Bank Issues

A $50 million wrinkle at Zions Bancorp was enough for traders to start questioning the bull market.

Concerns About Bad Loans Rocked Bank Stocks on Thursday—How Many More 'Cockroaches' Are Out There?

Regional bank stocks tumbled on Thursday after Zions Bancorp said it would write off fraudulent loans made to two borrowers, adding to investors' fears about lending standards and stress in credit markets.