Flowserve Corporation (FLS)

Flowserve (FLS) Surges 6.8%: Is This an Indication of Further Gains?

Flowserve (FLS) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road.

Here's Why Investors Should Retain Flowserve Stock in Portfolio

FLS gains from strong bookings and the MOGAS acquisition, but rising costs and high debt weigh on investor sentiment.

Here's Why Flowserve (FLS) is a Strong Growth Stock

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

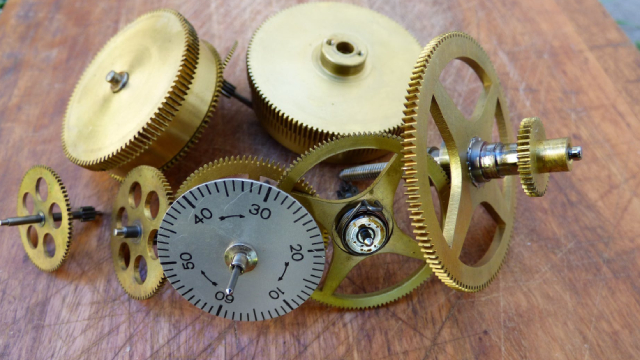

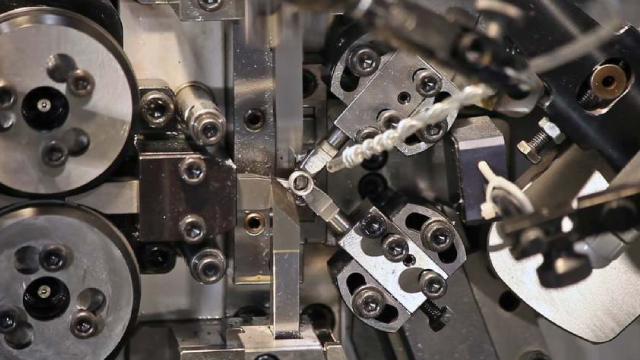

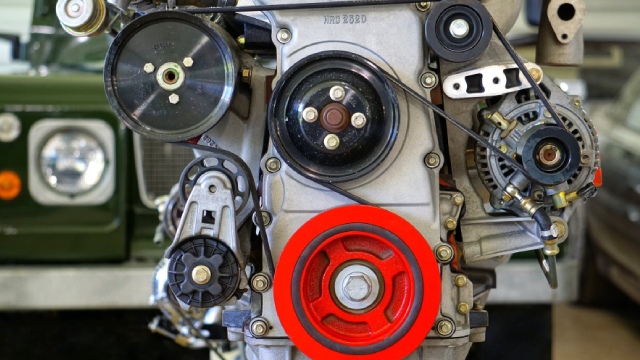

Chart Industries and Flowserve to Merge in $19 Billion Deal

The $19 billion deal will bring together two manufacturers of industrial processing equipment.

Why Is Flowserve (FLS) Up 11.7% Since Last Earnings Report?

Flowserve (FLS) reported earnings 30 days ago. What's next for the stock?

Is the Options Market Predicting a Spike in Flowserve (FLS) Stock?

Investors need to pay close attention to Flowserve (FLS) stock based on the movements in the options market lately.

Here's Why You Should Hold on to Flowserve Stock Right Now

FLS is set to benefit from strength across its segments. Shareholder-friendly policies add to the stock's appeal.

Flowserve: An Underdog That Will Continue To Outperform The Market

Contrary to the sentiment from a couple of years ago, Flowserve stock is now outperforming the broader equity market. In spite of short-term volatility, the stock will continue to benefit from a multi-year trend of higher investments in the Energy sector. Improved efficiency and realized economies of scale will continue to be the key drivers of Flowserve's future valuation multiples.

Flowserve Corporation (FLS) Q1 2025 Earnings Conference Call Transcript

Flowserve Corporation (NYSE:FLS ) Q1 2025 Earnings Conference Call April 30, 2025 10:00 AM ET Company Participants Brian Ezzell - VP, IR, Treasurer and Corporate Finance Scott Rowe - President and CEO Amy Schwetz - CFO Conference Call Participants Andy Kaplowitz - Citigroup Mike Halloran - Baird Deane Dray - RBC Capital Markets Nathan Jones - Stifel Joe Giordano - TD Cowen Operator Good day and welcome to the Flowserve First Quarter 2025 Earnings Call. Today's conference is being recorded.

Flowserve's Q1 Earnings Beat Estimates, Revenues Increase Y/Y

FLS' first-quarter 2025 revenues increase 5.2% year over year, driven by the impressive performance of its Flowserve Flow Control Division unit.

Flowserve (FLS) Q1 Earnings: How Key Metrics Compare to Wall Street Estimates

While the top- and bottom-line numbers for Flowserve (FLS) give a sense of how the business performed in the quarter ended March 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Flowserve (FLS) Beats Q1 Earnings and Revenue Estimates

Flowserve (FLS) came out with quarterly earnings of $0.72 per share, beating the Zacks Consensus Estimate of $0.59 per share. This compares to earnings of $0.58 per share a year ago.