Flowserve Corporation (FLS)

Flowserve (FLS) Earnings Expected to Grow: Should You Buy?

Flowserve (FLS) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Why Flowserve (FLS) is a Top Growth Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Flowserve (FLS) is a Top-Ranked Value Stock: Should You Buy?

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Why Is Flowserve (FLS) Down 13% Since Last Earnings Report?

Flowserve (FLS) reported earnings 30 days ago. What's next for the stock?

Here's Why Flowserve (FLS) is a Strong Value Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

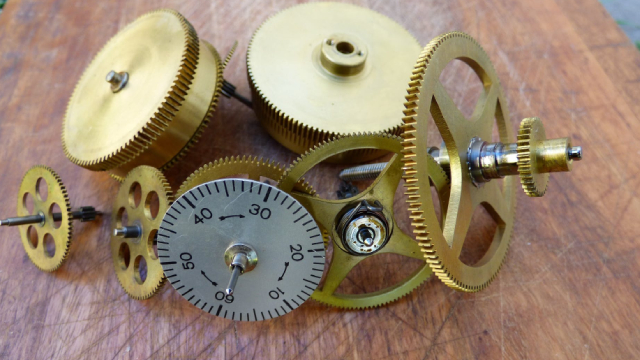

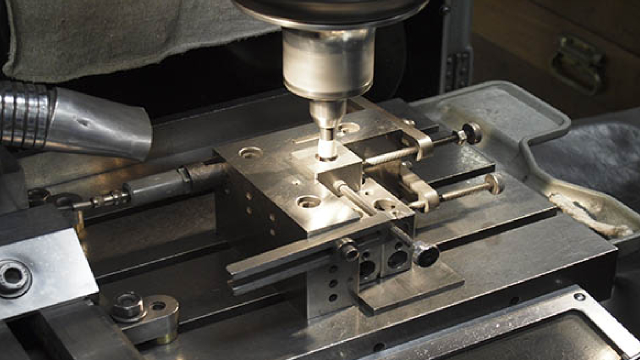

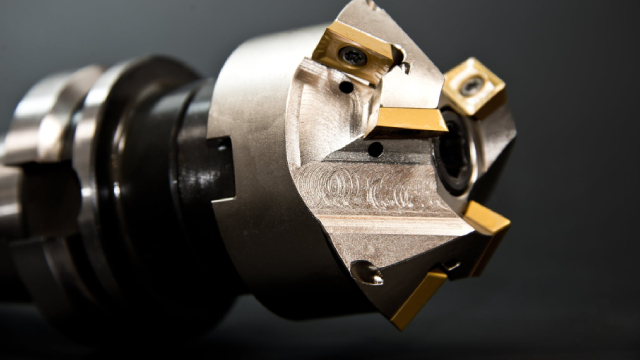

Flowserve Unveils Sealless Pump With True Secondary Containment

FLS introduces the INNOMAG TB-MAG Dual Drive Pump to help operators handle dangerous fluids safely by preventing leaks.

Flowserve Benefits From Business Strength & Buyouts Amid Risks

FLS gains from strength across its Pump Division and Flow Control Division segments, acquisitions and shareholder-friendly policies. High costs and long-term debt remain concerning.

Flowserve Corporation (FLS) Q4 2024 Earnings Call Transcript

Flowserve Corporation (NYSE:FLS ) Q4 2024 Earnings Conference Call February 19, 2025 10:00 AM ET Company Participants Brian Ezzell - VP, IR, Treasurer and Corporate Finance Scott Rowe - President and CEO Amy Schwetz - CFO Conference Call Participants Nathan Jones - Stifel Deane Dray - RBC Capital Markets Mike Halloran - Baird Joe Giordano - TD Cowen Brett Linzey - Mizuho Operator Good day, and welcome to the Flowserve Fourth Quarter and Year End 2024 Earnings Conference Call. Today's conference is being recorded.

Flowserve's Q4 Earnings Miss Estimates, Revenues Increase Y/Y

FLS' fourth-quarter 2024 revenues increase 1.3% year over year, driven by the impressive performance of its Flowserve Flow Control Division unit.

Compared to Estimates, Flowserve (FLS) Q4 Earnings: A Look at Key Metrics

While the top- and bottom-line numbers for Flowserve (FLS) give a sense of how the business performed in the quarter ended December 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Flowserve (FLS) Misses Q4 Earnings and Revenue Estimates

Flowserve (FLS) came out with quarterly earnings of $0.70 per share, missing the Zacks Consensus Estimate of $0.77 per share. This compares to earnings of $0.68 per share a year ago.

Flowserve Set to Report Q4 Earnings: Is a Beat in Store?

FLS' results are likely to benefit from strength in the power generation and chemical end markets and contribution from acquired assets. High operating expenses are expected to have affected its margins.