Hudbay Minerals Inc. (HBM)

Summary

HBM Chart

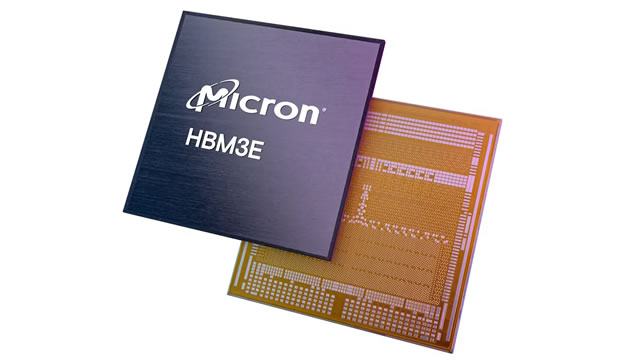

Micron's HBM-Driven DRAM Demand Rises: Can AI Keep Lifting the Growth?

MU rides on the surging HBM-fueled DRAM demand as AI workloads boost shipments, pricing strength and growth momentum into 2026.

Micron: Possibly The Best Remaining AI Upside Trade

Micron continues to transition from a cyclical memory supplier to a mission-critical AI infrastructure provider, driven by its strategic DRAM, NAND and HBM roadmap. The company's dual-track roadmap for standard and customized HBM4E with TSMC support starting 2027 preserves Micron's AI share gains amid shifting GPU vs. custom ASIC adoption trends in the long-run. Tight supply-demand dynamics and accelerating pricing power across both HBM and non-HBM memory is also materially improving durability in Micron's growth outlook and margin profile.

Can HBM Sustain Its Free Cash Flow Momentum Amid Copper Price Swings?

Hudbay Minerals extends its free-cash-flow momentum through low costs and gold leverage, but volatility and geopolitical risks loom.

Hudbay Minerals Inc. (HBM) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has Hudbay Minerals Inc. ever had a stock split?

Hudbay Minerals Inc. Profile

| - Industry | - Sector | Peter Gerald Jan Kukielski Bsc, Msc CEO | BVL Exchange | CA4436281022 ISIN |

| CA Country | 2,233 Employees | 2 Sep 2025 Last Dividend | 24 Dec 2004 Last Split | - IPO Date |

Overview

Hudbay Minerals Inc. stands as a diversified entity within the mining sector, with its operational focus spread across North and South America. The organization is dedicated to the exploration, development, operation, and optimization of its mining properties. It prides itself on producing a variety of concentrates and doré that include precious metals such as gold, silver, and molybdenum, alongside base metals like copper and zinc. The cornerstone of Hudbay Minerals Inc.'s operations is the Constancia mine, a wholly-owned project situated in the Province of Chumbivilcas, southern Peru. The company's roots trace back to its establishment in 1927, and it is headquartered in Toronto, Canada, marking nearly a century of participation in the mining sector.

Products and Services

- Copper Concentrates:

These are primarily composed of copper but also contain valuable by-products such as gold, silver, and molybdenum. Copper concentrates are a key product for Hudbay Minerals, sourced from its mining operations, and serve as a primary material for copper smelting industries worldwide.

- Gold Concentrates:

Aside from the copper-centric operations, Hudbay also produces gold concentrates, which interestingly contain zinc. This product caters to the need for raw materials in gold refineries and contributes to the company's revenue from precious metals.

- Zinc Concentrates:

With zinc being a crucial element for corrosion resistance in metals, Hudbay's zinc concentrates find their application in various industries, including steel manufacturing. This diversifies the company's metallic output and market reach.

- Molybdenum Concentrates:

Molybdenum is known for its strength and resistance to high temperatures, making it valuable for steel alloys. The production of molybdenum concentrates by Hudbay indicates the company's involvement in supplying materials for advanced engineering and manufacturing sectors.

- Silver/Gold Doré:

This product represents a semi-pure alloy of gold and silver, which is typically created at the mine site. It is then further refined to extract precious metals. The availability of silver/gold doré underscores Hudbay's position in the precious metals market and its capability to produce market-ready bullion.