ASML Holding N.V. New York Registry Shares (ASML)

3 Cheap Tech Stocks to Buy Right Now

Despite two consecutive years of 20%-plus gains for the S&P 500 (^GSPC -0.29%), less than 30% of all stocks actually beat the index in both 2023 and 2024 -- a record-low percentage for the past 30 years.

ASML Could Surge From DeepSeek Revelations

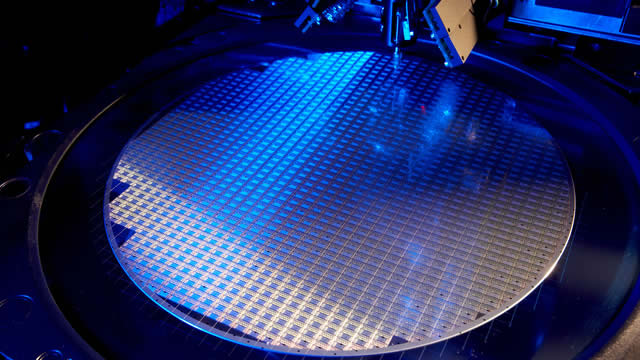

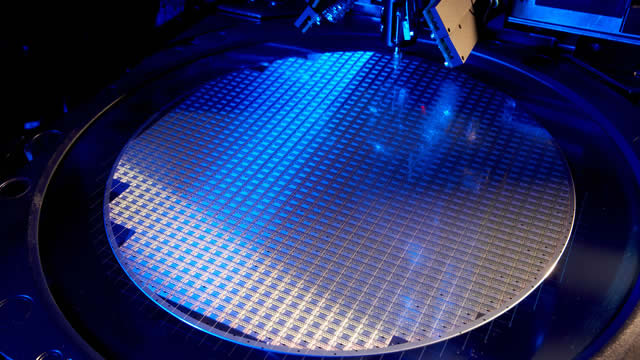

ASML's critical role in semiconductor manufacturing, driven by AI advancements, makes it a key player with significant growth potential, despite geopolitical challenges. Open-source AI models like DeepSeek-R1 democratize AI, increasing demand for advanced chips and benefiting ASML's specialized EUV lithography tools. ASML's robust financials, including a strong installed base services segment, provide stability and growth opportunities amid cyclical semiconductor market fluctuations.

3 Insanely Cheap Stocks to Buy

When it comes to investing, I am constantly searching for high-quality companies trading at great valuations. This does not mean I will time the exact bottom, but I will know I am buying a great company at a great price, otherwise I likely won't make a purchase.

Top 2 underperforming semiconductor stocks Jim Cramer recommends for buying in 2025

Chip stocks have been all the rage in financial markets ever since the whole AI frenzy started in late 2022. However, not all chip stocks were made equal.

Here's Why ASML (ASML) Fell More Than Broader Market

The latest trading day saw ASML (ASML) settling at $732.25, representing a -1.87% change from its previous close.

Dutch PM raised ASML in talks with China's Ding

Dutch Prime Minister Dick Schoof held "critical conversations" with visiting Chinese Vice Premier Ding Xuexiang, he said on Friday, including discussions on human rights and on semiconductor equipment supplier ASML.

ASML Q4 And FY25 Outlook: Buy ASML Stock Now To Stay Ahead Of The Curve

I forecast ASML Holding N.V.'s 2025/2026 revenue growth at 15% annually, buoyed by High-NA EUV adoption. My $1,290 price target indicates a 31.5% two-year CAGR. The current valuation includes a 25% safety margin. ASML's monopoly in EUV lithography, strategic partnerships, and AI-driven demand solidify its competitive moat, despite risks like reduced Chinese revenue and geopolitical tensions over Taiwan. ASML as a value trade offers 30%+ annual returns over two years, underpinned by a $39B FY26 revenue forecast and stabilized margins, with delayed customer acceptance risks already priced in.

Is It Worth Investing in ASML (ASML) Based on Wall Street's Bullish Views?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Eindhoven city plans to buy 'Brainport' tech campus

The City of Eindhoven plans to purchase an industrial park that serves as an incubator for the region's tech manufacturing industry and is used by computer chip equipment giant ASML , authorities said on Wednesday.

Should You Buy ASML Stock Before Jan. 29?

ASML (ASML 2.44%) stock investors got great news from Taiwan Semiconductor Manufacturing Company (TSM 1.07%), one of its largest customers.

ASML: Opportunity To Buy A Critical Component Of The AI Supply Chain

ASML's Q3 2024 results showed a significant drop in bookings, but the company's long-term growth is supported by its dominant position in EUV lithography machines. Despite cyclical revenue pressures, ASML's high profitability ratios and technological advancements ensure continued growth, driven by AI and semiconductor demand. The key risk is China's potential technological breakthroughs, but ASML's current lead and competitive moat make it a strong long-term investment.

ASML Stock Looks Tempting Now - Buy

ASML, a leading semiconductor company, holds a monopoly in EUV lithography, crucial for advanced chip manufacturing, with significant growth potential in the expanding semiconductor industry. Despite recent stock price weakness, ASML's strong market position and projected 10% annual sales CAGR make it a compelling buy, with EPS likely outpacing revenue growth. Key growth drivers include increasing demand from AI, energy transition, and EV sectors, with ASML's valuation appearing cheap relative to its historical norms.