Goldman Sachs Group Inc. (GS)

The Goldman Sachs Group, Inc. (GS) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to Goldman (GS). This makes it worthwhile to examine what the stock has in store.

Goldman Sachs stock is thriving ahead of a $3 trillion tailwind

Goldman Sachs (GS) stock price has been a top-performer in the past few decades. After bottoming at $35.31 at the height of the Global Financial Crisis (GFC), the stock has soared to almost $520, a 1,375% increase.

Goldman Stock Up on Its Plans to Reduce Workforce Under SRA Strategy

GS plans to lay off more than 1,300 employees under its annual performance review, yet expects to have a larger workforce in 2024 compared with the 2023 level.

After more than a decade of underperformance it's time to ‘Buy British' says Goldman Sachs

Big yield and low valuations make British stocks attractive says Goldman Sachs

HEDGEFLOW Hedge funds bet against banks, insurance and property, says Goldman Sachs

Hedge funds continued to take bets against bank and financial stocks in the week to Friday, Goldman Sachs wrote in a note seen by Reuters on Monday, amid reported job cuts and reduced dealmaking.

Goldman Sachs Begins Layoffs as Part of Annual Review Process

Goldman Sachs reportedly plans to lay off between 3% and 4% of its workforce — amounting to about 1,300 to 1,800 people — as part of its annual review process.

Goldman Sachs set to fire more than 1,300 employees, WSJ reports

The Goldman Sachs CEO will slash more than 1,300 jobs as part of the bank's ongoing review to cull poor performers, the Wall Street Journal reported.

Will Goldman Stock Benefit as Fed Lowers Its SCB Requirement?

GS' SCB level is reduced to 6.2% from the 6.4% suggested initially following the June stress test.

Goldman Sachs Trims Oil View: What's Next for Energy Stocks?

Despite Goldman Sachs' downward revision to the oil price forecast, the space still looks good for investment. We recommend buying stocks like SM, FTI and TUWOY.

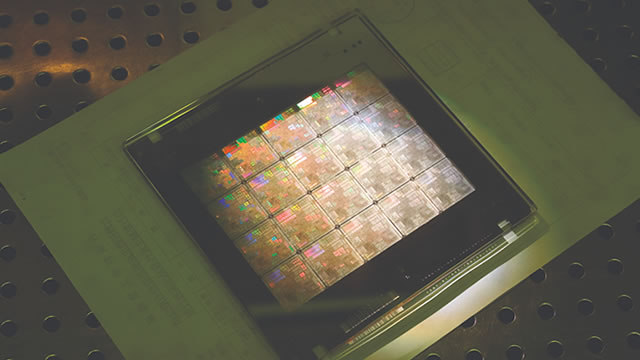

Nvidia market cap set for $300 billion surge, predicts Wall Street

As investors worldwide are waiting for the new quarterly earnings report from the technology behemoth Nvidia (NASDAQ: NVDA), analysts from Goldman Sachs (NYSE: GS) believe the report could trigger a $300 billion swing in its market value – in either direction.

Goldman Sachs (GS) Stock Slides as Market Rises: Facts to Know Before You Trade

Goldman Sachs (GS) reachead $507.26 at the closing of the latest trading day, reflecting a -0.12% change compared to its last close.

Is Goldman Sachs One of the Top Bank Stocks to Buy Now?

There's a solid case to be made for Goldman Sachs despite a few past missteps by the investment banking giant.