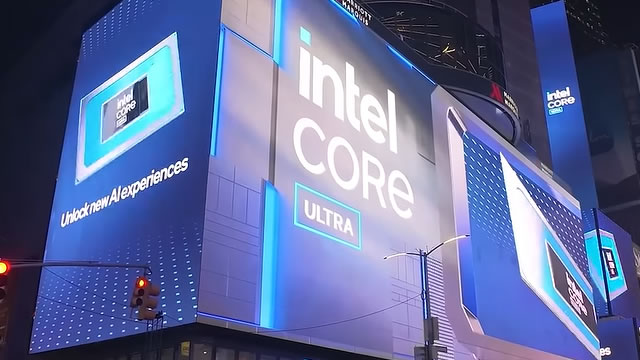

Intel Corporation (INTC)

Intel Sells 51% Stake in Altera Unit to Private Equity Firm Silver Lake

Shares of Intel (INTC) surged Monday morning after the chipmaker said it agreed to sell 51% of its programmable chip business Altera to private equity firm Silver Lake.

Intel sells majority stake in Altera to Silver Lake

Intel Corp (NASDAQ:INTC, ETR:INL) shares moved higher in early trade on Monday after the company announced the sale of a 51% stake in its programmable chip unit Altera to private equity firm Silver Lake, valuing Altera at $8.75 billion. Intel will retain a 49% stake in Altera, allowing it to benefit from future growth while establishing Altera as an independent entity specializing in FPGA (field programmable gate array) semiconductor solutions.

Intel Sells Majority Stake in Altera at $8.75 Billion Valuation. The Stock Is Rising.

The deal values Altera at $8.75 billion and Intel will retain a 49% stake in the business.

Intel agrees to sell controlling stake in Altera chip business

Intel on Monday announced that it has entered into a definitive agreement to sell 51% of its Altera semiconductor business to Silver Lake, a private equity firm.

Intel (INTC) Stock Slides as Market Rises: Facts to Know Before You Trade

The latest trading day saw Intel (INTC) settling at $19.74, representing a -0.7% change from its previous close.

Intel, Texas Instruments slump as China tariff guidance favors chipmakers outsourcing to Taiwan

Shares of Intel Corp (NASDAQ:INTC, ETR:INL) and Texas Instruments Inc (NASDAQ:TXN) slumped on Friday after China clarified that retaliatory tariffs on US goods would not apply to semiconductors manufactured outside the U.S., such as those made in Taiwan. Intel dropped 3.5% and Texas Instruments tumbled nearly 6.7%, while ON Semiconductor slid 3.6%, as investors digested guidance from China's main chip industry group suggesting that chips produced at US-based fabs would face steep new import duties.

Where Will Intel Stock Be in 3 Years?

Intel (INTC -7.62%), the world's largest manufacturer of x86 CPUs for PCs and servers, was once considered a reliable blue chip tech stock. It had a wide moat, generated stable profits, and paid out reliable dividends.

Intel (INTC) Moves 18.8% Higher: Will This Strength Last?

Intel (INTC) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions may not translate into further price increase in the near term.

Intel: Generational Buying Opportunity Approaches

Intel's stock remains a "strong buy" due to historically low price-book ratios and limited downside potential, despite recent declines in share prices. Intel's Q4 2024 earnings surpassed estimates, but revenue and net income showed declines, creating a challenging starting point for the new CEO. Comparatively, Intel's price-book ratio is significantly lower than key competitors like AMD, Qualcomm, and Nvidia, highlighting its undervaluation.

Will Intel Stock Be a Trade War Winner?

Semiconductor giant Intel (INTC -7.28%) has a new CEO ready to shake up the company after years of disappointing results. Intel has been losing market share to AMD in its core CPU businesses, struggling to gain a foothold in the AI accelerator market, and pouring billions into new factories and manufacturing technology.

Why Intel Stock Was Up 13.3% in Q1 as the S&P 500 Had Its Worst Quarter Since 2022

The first three months of 2025 were a tough run for the market. The S&P 500 lost 4.6% and the Nasdaq Composite lost 10.4%.

Intel-Taiwan Semiconductor Alliance Fuels Turnaround Hopes

Intel Corporation NASDAQ: INTC is the subject of intense market speculation following rumors of a potential landmark partnership with Taiwan Semiconductor Manufacturing Company NYSE: TSM, the world's leading contract chip manufacturer.