New Gold Inc. (NGD)

New Gold (NGD) Is Up 23.70% in One Week: What You Should Know

Does New Gold (NGD) have what it takes to be a top stock pick for momentum investors? Let's find out.

New Gold Inc. (NGD) Hits Fresh High: Is There Still Room to Run?

New Gold (NGD) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

Here is Why Growth Investors Should Buy New Gold (NGD) Now

New Gold (NGD) possesses solid growth attributes, which could help it handily outperform the market.

Are Basic Materials Stocks Lagging New Gold (NGD) This Year?

Here is how New Gold (NGD) and Wheaton Precious Metals Corp. (WPM) have performed compared to their sector so far this year.

Is It Worth Investing in New Gold (NGD) Based on Wall Street's Bullish Views?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Coeur Mining to acquire New Gold in $7B all-stock deal

Coeur Mining Inc (TSX:CDM) and New Gold Inc. (TSX:NGD) have announced a definitive agreement under which Coeur will acquire all outstanding shares of New Gold in an all-stock transaction valued at approximately $7 billion. The deal positions the new entity among the top 10 global precious metals producers and top five silver producers, with enhanced market liquidity and potential inclusion in major US indexes, Coeur said in a statement.

3 Reasons Why Growth Investors Shouldn't Overlook New Gold (NGD)

New Gold (NGD) could produce exceptional returns because of its solid growth attributes.

Is New Gold (NGD) a Buy as Wall Street Analysts Look Optimistic?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

New Gold to Report Q3 Results: What's in the Cards for the Stock?

NGD's Q3 earnings could shine on surging gold and copper prices, stronger output and lower costs as it readies results on Oct. 28.

New Gold (NGD) Registers a Bigger Fall Than the Market: Important Facts to Note

New Gold (NGD) closed at $7.21 in the latest trading session, marking a -1.37% move from the prior day.

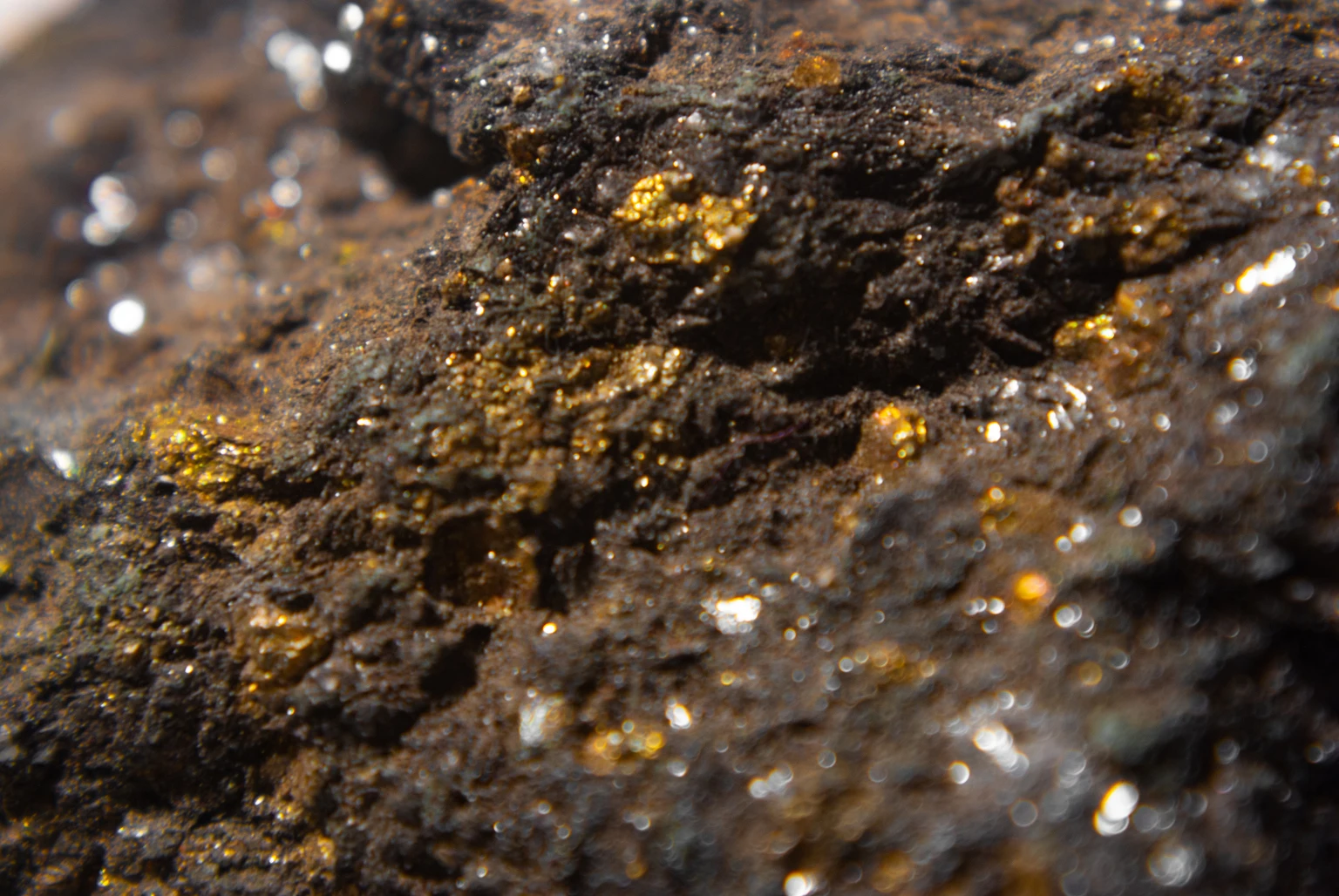

New Gold: New Exploration Results Will Boost Share Growth In 2026

New Gold is a Canadian gold miner with assets in stable jurisdictions, offering strong geopolitical security and operational focus. NGD demonstrates robust financials, with sector-leading margins and profitability, and is positioned for significant profit growth through 2026. Recent exploration at New Afton and production increases at Rainy River support a "Buy" rating, with a DCF-based target price of $11.20 per share (52% upside).

New Gold (NGD) Beats Stock Market Upswing: What Investors Need to Know

In the most recent trading session, New Gold (NGD) closed at $6.49, indicating a +2.37% shift from the previous trading day.