NVIDIA Corporation (NVDA)

Blockbuster $40b AI Investment Is Only 10% of What's Coming (NVDA, MSFT, META, BLK)

Summary: AI giants including Meta, Microsoft, Amazon, and Oracle recently announced a $40 billion deal that will help them secure coveted computing capacity for artificial intelligence.

Nvidia (NASDAQ: NVDA) Stock Price Prediction for 2025: Where Will It Be in 1 Year (Oct 22)

Shares of Nvidia Corp. (NASDAQ: NVDA) are up 5.7% over the past 90 days, despite recently announced partnerships with Intel and OpenAI and several new products unveiled, as the company's market share in China dropped to zero.

Is the Magnificent Seven's Earnings Edge Fading?

The Magnificent Seven have been the stars of the S&P 500 for the past several years, but the group's period of exceptional earnings growth may be nearing an end.

Why Micron Stock Could Soar 35% on AI Memory Demand

The rally in Micron NASDAQ: MU has just begun because the hundreds of billions worth of datacenter-related business linked to NVIDIA NASDAQ: NVDA, Advanced Micro Devices NASDAQ: AMD, and Oracle NASDAQ: ORCL has yet to be reflected in its results or guidance.

Wall Street sets NVDA stock price for the next 12 months

Nvidia (NASDAQ: NVDA) is somewhat struggling to maintain a firm footing on Tuesday, October 21.

What Triggers The Next Rally In Nvidia Stock?

Historically, Nvidia has staged multiple powerful rallies - from riding the cryptocurrency boom to capitalizing on the Covid-era gaming and remote work surge. The stock's latest ascent, fueled by the generative AI revolution that began in 2022 has been the biggest and most transformative wave in the company's history.

Navitas Soars 78% on NVIDIA Update: Is This Rally Sustainable?

Navitas Semiconductor NASDAQ: NVTS has been one of the hottest stocks in the market thanks to its newly established relationship with NVIDIA NASDAQ: NVDA.

Prediction: This Is How Much NVIDIA Will be Worth At The End of 2026

Nvidia (NASDAQ:NVDA ) has been continuously delivering higher and higher gains, and its quarterly earnings reports have exceeded earnings expectations longer than any bull would have imagined two years ago.

Nvidia Stock Slips. Its $350 Billion OpenAI Deal Is an Opportunity—and a Big Risk.

The chip maker's shares were edging down as more details about its business arrangements with the ChatGPT-developer emerged.

Nvidia unveils first US-made Blackwell wafer

Nvidia Corp (NASDAQ:NVDA, ETR:NVD) has produced its first Blackwell wafer in the United States at Taiwan Semiconductor Manufacturing Company's (TSMC) Phoenix, Arizona, facility. The wafer is the base material for Nvidia's next-generation Blackwell AI chips, designed to improve performance while reducing energy consumption and cost compared with previous architectures.

Banking giant gives verdict on AI stocks bubble

Banking giant Citi has weighed in on the ongoing debate surrounding artificial intelligence (AI) valuations, concluding that despite rapid gains, AI stocks have not yet entered bubble territory.

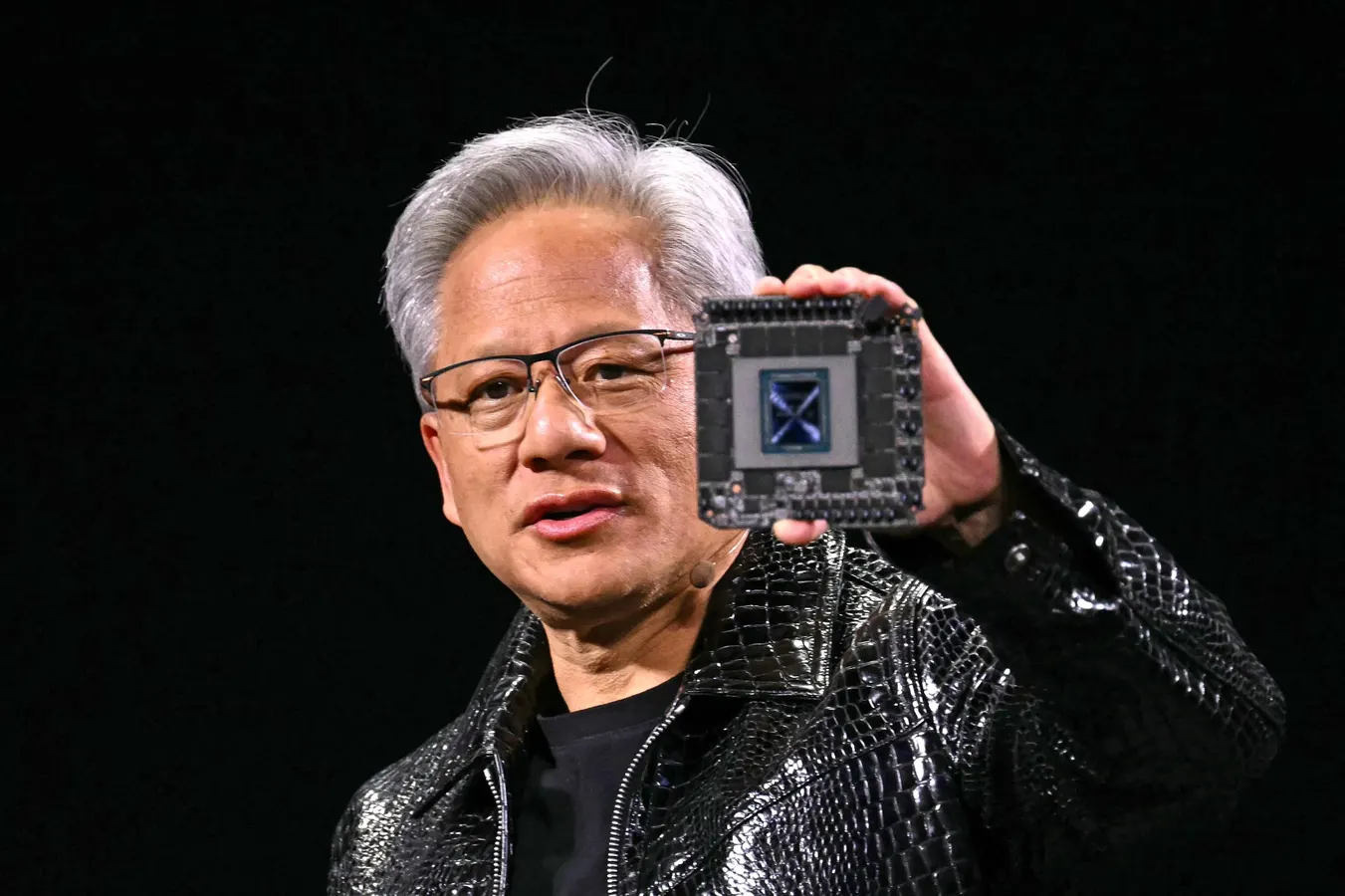

Nvidia CEO touts new AI 'industrial revolution,' praises Trump tariffs for role in chip production

Nvidia CEO Jensen Huang says the U.S. is entering an AI-powered industrial revolution, crediting President Donald Trump's tariffs for accelerating chip manufacturing.