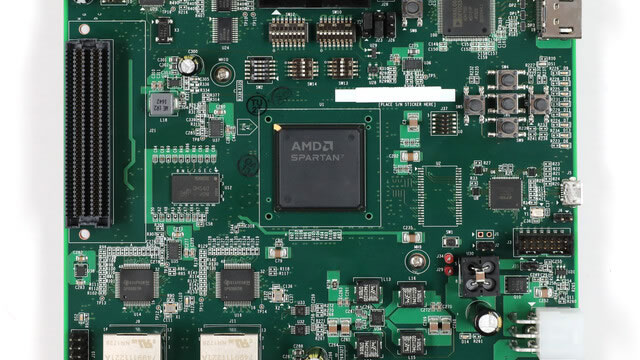

Advanced Micro Devices, Inc. (AMD)

Why Is Advanced Micro (AMD) Up 18.2% Since Last Earnings Report?

Advanced Micro (AMD) reported earnings 30 days ago. What's next for the stock?

Advanced Micro Devices (AMD) Beats Stock Market Upswing: What Investors Need to Know

In the latest trading session, Advanced Micro Devices (AMD) closed at $118.58, marking a +1.08% move from the previous day.

AMD takes aim at Nvidia's AI hardware dominance with Brium acquisition

AMD's latest acquisition could help reduce Nvidia's market dominance when it comes to AI hardware.

Advanced Micro Devices, Inc. (AMD) Bank of America Global Technology Conference - (Transcript)

Advanced Micro Devices, Inc. (NASDAQ:AMD ) Bank of America Global Technology Conference Call June 3, 2025 11:40 AM ET Company Participants Jean X. Hu - Executive VP, CFO & Treasurer Matthew D.

AMD: Take Full Advantage Of The Solid Nvidia Earnings

Nvidia Corporation's strong outlook and favorable tariff ruling has boosted semiconductor sentiment, mitigating China headwinds and supporting sector resilience. Advanced Micro Devices, Inc.'s Q1 results and ongoing data center momentum reinforce confidence in its core business, despite cyclical and competitive challenges. AI growth remains AMD's key catalyst; upcoming investor day is crucial for management to clarify long-term AI revenue outlook and drive re-rating.

Nvidia is surging; Here are 3 stocks to follow

Nvidia (NASDAQ: NVDA ) has just reported no less than $44.06 billion in revenue for the previous quarter and is up 6% premarket.

AMD Isn't The Next Nvidia, But It Doesn't Need To Be

AMD faces significant headwinds from China export restrictions and tariffs, impacting near-term revenue and gross margins, but maintains strong execution in CPUs and data centers. Despite lagging Nvidia in AI GPUs, AMD is well-positioned to capture niche AI demand and benefit from hyperscaler diversification away from Nvidia. Valuation has contracted to a fair 30x P/E, making risk/reward attractive given expected 12-15% annual top-line growth and expanding margins.

AMD Is Winning The Gaming Market

The gaming market remains out of focus for Nvidia, while Intel struggles with its latest CPU generations. Advanced Micro Devices, Inc., however, brought prominent improvement in its gaming infrastructure, which could challenge Nvidia more than ever before. I believe that with the current RDNA4 and Zen5 technology generations, AMD could be the only reasonable option for the gaming experience, strengthening the company's revenue mix.

Advanced Micro Devices: Growth Catalyst From Data Center Focus And Current Momentum

I rate AMD as a Buy, as its current share price undervalues its long-term prospects, especially with momentum in Data Center, Client, and Gaming segments. AMD's shift to the data center industry, strong financial growth, and a $10 billion AI deal position it for significant future revenue and profit expansion. Despite a recent debt increase for strategic investments, AMD maintains a healthy balance sheet and is well-placed to capitalize on industry growth and AI demand.

AMD buys silicon photonics startup Enosemi to fuel its AI ambitions

AMD has acquired Enosemi, a startup designing custom materials to support silicon photonics product development. The terms of the deal, announced Wednesday, weren't disclosed.

Advanced Micro Devices, Inc. (AMD) TD Cowen's 53rd Annual Technology, Media and Telecom Conference (Transcript)

Advanced Micro Devices, Inc.

Analyst raises AMD stock price target on AI momentum

Advanced Micro Devices (NASDAQ: AMD) received a notable upgrade on Tuesday as HSBC Global Research analyst Frank Lee, CFA, raised the stock's rating from ‘Reduce' to ‘Hold' and sharply increased the price target from $75 to $100.