Advanced Micro Devices, Inc. (AMD)

AMD Isn't What It Seems

Advanced Micro Devices' data center revenue grew 94% YoY in 2024 to $12.6 billion, driven by MI300X and EPYC demand. Full-stack integration via ZT Systems and ROCm positions AMD to deliver sovereign-ready, hyperscaler-optimized AI infrastructure platforms. ROCm 6.4 now supports top-tier LLMs like Llama 3.1, enabling 3x training and 17x decoder speed improvements.

AMD's Profitability Trends: A Buy Signal For Savvy Investors

Advanced Micro Devices, Inc.'s P/S ratio is 6.053, below its historical medians, suggesting potential undervaluation with a possible 27.77% price increase to $131.40. Despite strong AI data center market growth, AMD's lagging profitability and FCF generation compared to peers like Nvidia may limit valuation gains in the short term. AMD's first quarter earnings report showed improving profitability and free cash flow generation.

Can Saudi AI Deals Boost AMD Over NVIDIA, and Is It a Buy?

With AMD partnering with Humain in Saudi Arabia, the query arises about AMD's ability to outperform NVIDIA and its investment potential.

AMD Has A Bright Future Ahead

Advanced Micro Devices, Inc. remains undervalued at 18x 2026 EPS, with strong AI prospects and a recent 60% rebound from lows. Blockbuster Q1 earnings beat expectations, with AI sales up 57% YoY and client segment sales up 68%. Major $10B AI partnership with HUMAIN and a $6B buyback boost long-term growth and EPS potential.

AMD's AI Data Center Strategy Is Working; And It's Still Trading Like A Legacy Chip Stock

In its Q1 2025 earnings, AMD highlighted key wins, including Oracle and a major frontier model player leveraging Instinct GPUs for real-world inference at scale, not just in pilot tests. These public use cases add credibility to AMD's position in AI beyond hardware specs alone. Despite external challenges, AMD is sticking to its annual cadence of GPU releases MI300, then MI350, followed by MI400. Net income rose 55% year-over-year, free cash flow reached $727 million, and the company secured $2.45 billion in capital through a debt raise and commercial paper, giving it the flexibility to fund the ZT acquisition and invest in R&D without compromising its balance sheet.

AMD: Something Bigger Than The $6B Buyback Comes Next Month

Advanced Micro Devices, Inc.'s outlook brightens with positive U.S.-China trade developments and upcoming MI350 AI accelerator launch at the Advancing AI event, maintaining my Strong Buy rating. AMD's Data Center business shows robust growth, with MI300 AI accelerator driving revenues; MI350 expected to further boost this segment. Management is expected to announce critical changes to ROCm, its software stack, with some updates already underway. Plus, updates on its rack-scale level designs will also follow per my analysis.

What's Next For AMD Stock After Recent 20% Gain

Advanced Micro Devices stock (NASDAQ:AMD) increased by more than 4% during Tuesday's trading session and has risen by nearly 20% over the last month. What factors are contributing to the stock's upward trend?

AI chipmaker AMD unveils $6B buyback plan

AMD has been lauded as the most formidable competitor to Nvidia's dominance, but the firm now faces tough competition from custom processors and the larger rival's industry stronghold.

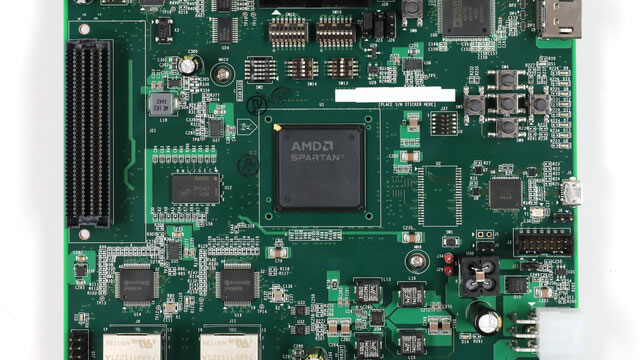

AMD vs. Lattice Semiconductor: Which FPGA Stock Has the Edge?

Advanced Micro Devices and LSCC are well-known players in the FPGA market. Let's find out which one is a better investment option.

AMD price jumps on $6 billion stock buyback plan: What that means and why it matters

Shares of semiconductor manufacturer Advanced Micro Devices (NASDAQ: AMD) rose 6% Wednesday on news the company is issuing a $6 billion stock buyback, which represents about 3.3% of the company's current market value, according to data from Bloomberg.

Nvidia, AMD extend stock gains. Why the AI trade is roaring back.

Nvidia's partnership with Saudi Arabia's Humain could help offset some of its revenue losses in China, analysts said.

AMD's AI-Powered Stock Price Rally Just Shifted Gears

Advanced Micro Devices' NASDAQ: AMD long-awaited AI-powered stock price rally is here. The stock is rocketing higher after a string of good news, including reduced trade tensions with China, a new deal with Saudi Arabia's HUMAIN, and a new $6 billion share buyback authorization.