Coinbase Global, Inc. (COIN)

3 Fantastic Stocks That Could Join The S&P 500 by 2025

For a stock to gain entry into the S&P 500, it must meet a specific set of criteria. The Trade Desk stock far surpasses the S&P 500's minimum requirements.

Down 42%, Is It Time to Buy the Dip on This Growth Stock?

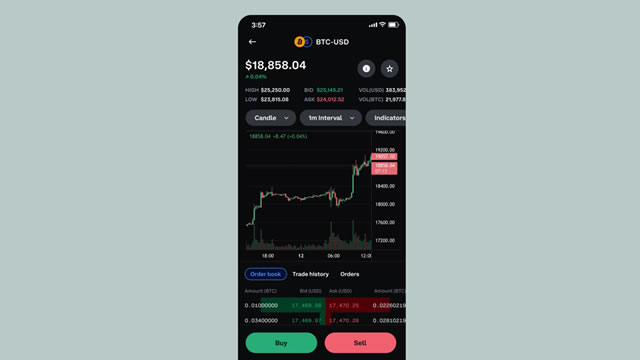

Shares of this top crypto enterprise have soared since the start of 2023. Coinbase's unpredictable financial results are heavily influenced by crypto asset prices.

Understanding new cryptocurrency listings

The environment of the cryptocurrency industry is always changing, with new coins appearing more quickly than you can say "blockchain". There are dozens of cryptocurrencies already in use, and more are constantly being created, so the search for the next big thing will never cease.

Coinbase Global, Inc. (COIN) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to Coinbase Global (COIN). This makes it worthwhile to examine what the stock has in store.

Jefferies lowers Coinbase target to $220: Is it time to sell?

Jefferies has revised its price target for Coinbase Global Inc. (NASDAQ: COIN) from $245 to $220, maintaining a Hold rating on the stock. This adjustment reflects growing concerns over market conditions and declining volatility in the cryptocurrency sector.

Coinbase: Still Overvalued After The Fall

Shares of Coinbase have continued a sharp correction after Q2 results showed a drop in trading revenue, with Q3 expected to continue at a weak pace. Crypto markets have shown less volatility driving lighter trading volumes, while institutional trading and larger coins like Bitcoin and Ethereum (where Coinbase makes thinner spreads) are gaining share. The company continues to face ongoing uncertainty from a pending SEC lawsuit and regulatory uncertainty.

3 Reasons to Buy Coinbase Stock Like There's No Tomorrow

Coinbase offers a straightforward investment path in the complex crypto market. With its revamped business model, Coinbase is better equipped for the long haul.

Investors Heavily Search Coinbase Global, Inc. (COIN): Here is What You Need to Know

Zacks.com users have recently been watching Coinbase Global (COIN) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

COIN price prediction as Coinbase teases new synthetic Bitcoin (cbBTC)

Coinbase Global Inc (NASDAQ: COIN),a leader in cryptocurrency exchange, has recently stirred the market with hints of an upcoming product launch, a synthetic Bitcoin (BTC) token named “cbBTC.”

A Few Years From Now, You'll Wish You'd Bought This Undervalued Stock

In the rapidly growing crypto market, Coinbase has already experienced exponential growth. Coinbase's diversification of revenue streams and focus on innovation highlight its potential for long-term success.

The 3 Best Blockchain Stocks to Buy in August 2024

While it's hard to look past blockchain's important role in driving the cryptocurrency ecosystem and leading coins like Bitcoin ( BTC-USD ) as a whole, the industry has a vast range of use cases that can help to drive innovation throughout the financial sector, cybersecurity and introduce next-generation digital ownership across virtually every industry. The blockchain technology market size is expected to grow at a rapid compound annual growth rate (CAGR) of 68% to a value of $69 billion by 2032.

7 Interest Rate Sensitive Stocks to Buy Before the First Rate Cut

JP Morgan (NYSE: JPM ) believes that there is a 35% chance of recession in the U.S. by the end of the year. Further, the odds of recession in the first half of 2025 are 45%.