Crypto Company, Inc. (CRCW)

3 Crypto Stocks Surging as Bitcoin Climbs Back Above $90K

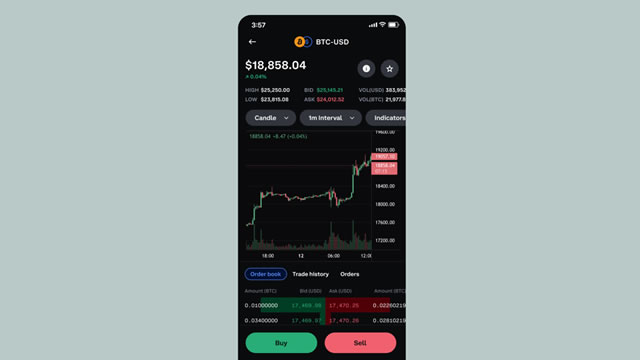

Bitcoin (BTC) was last seen trading back above $90,000, after U.S. exchange-traded funds (ETFs) that track its price reported the biggest daily inflows since January, totaling $381.4 million.

Hashdex's Kerbage Breaks Down Crypto Investing & NCIQ at Exchange

During VettaFi's Exchange conference in March, market experts from around the globe gathered to discuss the latest strategies and portfolio approaches. One such expert was Samir Kerbage, CIO of Hashdex.

Bitcoin Miners Hash Rate Move Could Bode Well for Crypto Prices

Cryptocurrency prices, including bitcoin's, have been turbulent this year — a scenario that's weighed on shares of miners. Some relief could be in sight because the largest digital currency gained nearly 6% for the week ending Monday, April 14.

Are These ETFs Cheap Yet? Crypto, Cannabis, Chips

When markets move, we can learn a lot from the outperformers. But we can also learn a lot from the underperformers — and maybe even find opportunities.

3 Crypto Stocks to Buy the Dip Before Bitcoin Regains Lost Ground

Crypto-centric stocks like IBKR, NVDA and HOOD are poised to benefit once the Bitcoin rally resumes.

Coinbase: Crypto Reset Near Complete (Rating Upgrade)

Coinbase Global is more appealing at yearly lows with a potential double bottom around $160, despite an expectation for weak Q2'25 targets. The crypto platform will likely reset revenue targets after a period of inflated crypto valuations while now focusing on a more stable subscription revenue. Coinbase remains highly profitable with a $9.3 billion cash balance.

Crypto-focused Janover skyrockets after completing its first Solana purchase

Earlier this week, Janover announced new leadership and introduced a treasury management strategy focused on acquiring Solana.

Cryptocurrencies and Crypto-Related Stocks Rise After Trump Pauses Tariffs

The prices of cryptocurrencies and crypto-related stocks leapt Wednesday (April 9) after President Donald Trump paused the new tariffs that he had placed on more than 75 countries. As of 2:55 p.m.

Bitcoin Price Retreats Sharply: Buy 3 Crypto-Centric Stocks on the Dip

Stocks like NVDA, HOOD and IBKR are poised to benefit once the Bitcoin rally resumes.

Eric Trump, Hut 8 CEO outline partnership to launch new bitcoin mining company: CNBC Crypto World

On today's show, bitcoin climbs to the $85,000 level to kick off April while notching back-to-back monthly losses in March. And, crypto investor Chun Wang blasts off into space in the first human spaceflight mission to fly over the Earth's polar regions.

Coinbase CEO: Crypto is 'the most bipartisan issue in D.C. right now'

Brian Armstrong, Coinbase CEO, discusses why crypto is "the most bipartisan issue" in Congress.

Coinbase CEO Brian Armstrong: Crypto is 'the most bipartisan issue' in D.C.

Brian Armstrong, Coinbase CEO, joins CNBC's 'Money Movers' to discuss why he's pushing for stablecoin legislation that would allow consumers to earn interest, whether offshore crypto companies should be allowed to enter the U.S., and more.