Flex Ltd. (FLEX)

Why Is Flex (FLEX) Down 10.2% Since Last Earnings Report?

Flex (FLEX) reported earnings 30 days ago. What's next for the stock?

Flex Stock Surges 39% in the Past Year: Will the Uptrend Continue?

FLEX is experiencing strong momentum across its data center, medical devices and consumer-related markets. Also, its strategic acquisition bodes well.

Why Flex (FLEX) is a Top Momentum Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

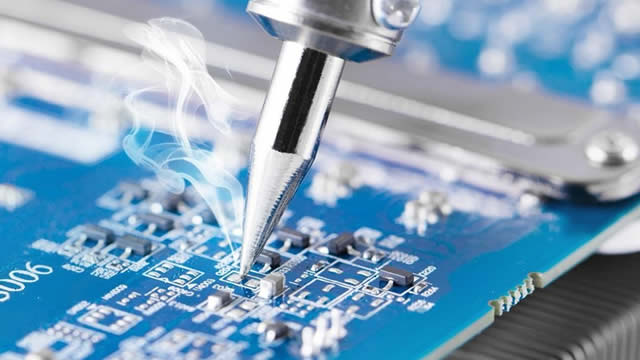

Flex Opens New Facility in Dallas to Support AI-Driven Power Demand

FLEX expands its U.S. manufacturing capacity with a new facility in Dallas, increasing capacity for power pods, distribution units and low-voltage switchgear.

FLEX or HOCPY: Which Is the Better Value Stock Right Now?

Investors interested in stocks from the Electronics - Miscellaneous Products sector have probably already heard of Flex (FLEX) and Hoya Corp. (HOCPY). But which of these two stocks presents investors with the better value opportunity right now?

Are Investors Undervaluing Flex (FLEX) Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Why Flex (FLEX) is a Top Value Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Is Flex (FLEX) Outperforming Other Computer and Technology Stocks This Year?

Here is how Flex (FLEX) and BWX Technologies (BWXT) have performed compared to their sector so far this year.

FLEX LNG: 11% Yield On LNG Shipping, Outperforming In 2025

FLEX LNG Ltd. benefits from long-term charters, insulating it from current low spot market rates and decreased European LNG imports. Despite lower TCE rates and earnings in 2024, FLNG maintains a high dividend yield of 11.55%, with a stable payout ratio. FLNG's valuations are higher than industry averages, leading to a cautious stance on acquiring new shares despite strong dividend coverage.

Flex: Data Center Growth And Margin Expansion Continue To Impress

I maintain a 'Buy' rating on Flex due to robust EPS growth driven by AI demand, particularly in data center power and cooling solutions. The Company's 3Q25 earnings exceeded expectations, with significant growth in data center revenue and management raising FY25 EPS guidance. The AI infrastructure investment supercycle, led by hyperscalers, provides strong growth visibility for FLEX, especially in power, cooling, and embedded computing solutions.

Flex's Q3 Earnings & Revenues Beat Estimates, Rise Y/Y, Stock Up

FLEX reports better-than-expected fiscal third-quarter results and raises revenue and EPS outlook for fiscal 2025.

Flex Ltd (FLEX) Q3 2025 Earnings Call Transcript

Flex Ltd (FLEX) Q3 2025 Earnings Call Transcript