Flowserve Corporation (FLS)

Flowserve Set to Report Q4 Earnings: What's in the Offing?

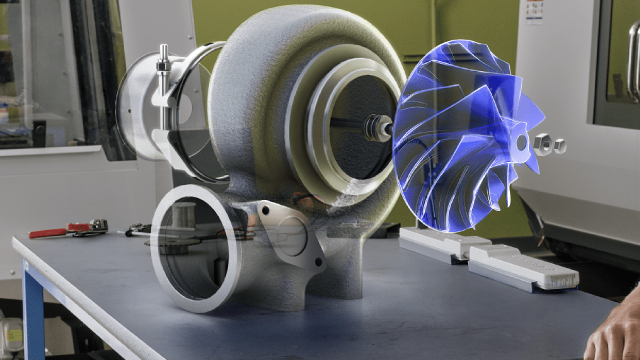

FLS' fourth-quarter 2024 results are likely to benefit from strength in its Pump Division segment, driven by strength in the aftermarket and original equipment businesses.

Flowserve Corporation: Still Not Primed For An Upgrade

Flowserve Corporation has shown strong performance, with a 22.4% stock increase, but its current valuation limits further upside potential, leading me to maintain a 'hold' rating. Despite revenue and profit growth, including a 3.5% revenue increase and significant cost savings from restructuring, the stock remains fairly valued compared to peers. Management's optimistic future projections, including a $5 billion revenue target by 2027, are encouraging, but the stock's valuation still appears high.

Flowserve (FLS) Earnings Expected to Grow: Should You Buy?

Flowserve (FLS) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Flowserve Gains From Business Strength & Buyouts Amid Headwinds

FLS benefits from strength across its Pump Division and Flow Control Division segments, acquisitions and shareholder-friendly policies. However, rising costs and expenses remain concerning.

Flowserve Stock Gains From Business Strength Despite Headwinds

FLS benefits from strength across its original equipment and aftermarket businesses, solid bookings and shareholder-friendly policies. However, rising costs and expenses remain concerning.

Flowserve: The Case For Picks And Shovels

Flowserve is yet another good example of why index exclusions tend to outperform index inclusions. Although the stock has skyrocketed over the past two years, the long-term opportunity has not been diminished. I show why the company is well-positioned to capitalize on expected oil & gas production increases over the coming years.

Flowserve Corporation (FLS) Q3 2024 Earnings Call Transcript

Flowserve Corporation (NYSE:FLS ) Q3 2024 Results Conference Call October 29, 2024 10:00 AM ET Company Participants Brian Ezzell - VP, IR, Treasurer and Corporate Finance Scott Rowe - President and Chief Executive Officer Amy Schwetz - Senior Vice President and Chief Financial Officer Conference Call Participants Andy Kaplowitz - Citigroup Nathan Jones - Stifel Deane Dray - RBC Capital Markets Mike Halloran - Baird Andrew Obin - Bank of America Joe Giordano - TD Cowen Damian Karas - UBS Saree Boroditsky - Jefferies Joe Ritchie - Goldman Sachs Eric Look - Mizuho Operator Ladies and gentlemen, good day, and welcome to the Q3 2024 Flowserve Corporation Earnings Conference Call. Today's conference is being recorded.

Flowserve's Q3 Earnings Miss Estimates, Revenues Increase Y/Y

FLS' third-quarter 2024 revenues increase 3.5% year over year, driven by the impressive performance of its Flowserve Pumps Division and Flow Control Division units.

Flowserve (FLS) Reports Q3 Earnings: What Key Metrics Have to Say

Although the revenue and EPS for Flowserve (FLS) give a sense of how its business performed in the quarter ended September 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Flowserve (FLS) Misses Q3 Earnings Estimates

Flowserve (FLS) came out with quarterly earnings of $0.62 per share, missing the Zacks Consensus Estimate of $0.67 per share. This compares to earnings of $0.50 per share a year ago.

Here's Why Flowserve (FLS) is a Strong Growth Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Curious about Flowserve (FLS) Q3 Performance? Explore Wall Street Estimates for Key Metrics

Get a deeper insight into the potential performance of Flowserve (FLS) for the quarter ended September 2024 by going beyond Wall Street's top -and-bottom-line estimates and examining the estimates for some of its key metrics.