Microsoft Corp. (MSFT)

AI momentum puts tech stocks on track for strong second half

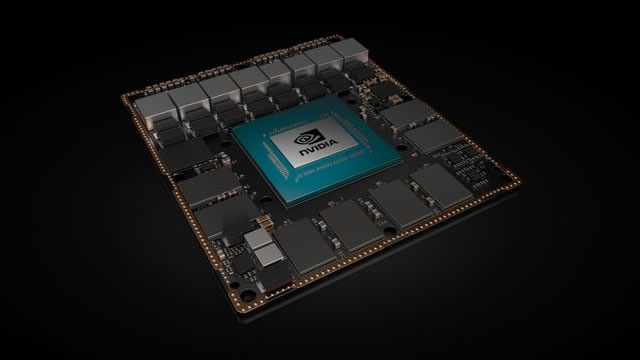

Technology shares are heading into the second half of the year on a bullish footing, with growing adoption of artificial intelligence expected to drive another leg higher in the sector's rally. Wedbush predicts a further 10% gain for tech stocks by the end of 2025, with Nvidia Corp (NASDAQ:NVDA, ETR:NVD), Microsoft Corp (NASDAQ:MSFT), Meta Platforms Inc (NASDAQ:META, ETR:FB2A, SWX:FB), Palantir Technologies Inc (NYSE:PLTR) and Tesla Inc (NASDAQ:TSLA) flagged as top picks.

Microsoft's Copilot Revenue May Trail ChatGPT And Anthropic

In 2023, analysts estimated Microsoft's Copilot AI chatbot would garner $30 billion in revenue. The software giant did not reveal Copilot revenue in its latest earnings call even as OpenAI reports $10 billion in annual recurring revenue.

Microsoft Layoffs Are Here and These 3 Games Have Already Been Canceled

Microsoft is cutting more than 9,000 jobs -- 4% of its global workforce -- and as a result, Everwild and the Perfect Dark reboot have been put out to pasture.

Microsoft announces new layoffs today, cutting 4% of its workforce

Microsoft is making a new round of deep cuts to its workforce, eliminating 9,000 jobs company-wide. The company began notifying employees of the layoffs, which will shrink the company by 4%, on Wednesday morning.

Microsoft plans to replace many of the salespeople it laid off with more technical roles to compete with OpenAI, Google

Microsoft's latest round of layoffs takes place as the company revises its strategy for selling AI tools. The layoffs target traditional sales roles, some of which will be replaced by technical salespeople.

Magnificent 7 Now The Troubling 3, Underscores Market Weakness

Market gains are driven by a concentrated group (NVIDIA, Microsoft, and Meta) raising concerns for Michael Kramer from Mott Capital Management and Reading The Markets about sustainability and overvaluation in tech. AI hype is real, but commoditization and high spending may limit long-term profits for current leaders.

Microsoft Layoffs Result in at Least 3 Games Being Cancelled

Microsoft is cutting upward of 9,000 jobs in its latest round of layoffs; Perfect Dark and Everwild among games to be cancelled.

Microsoft Layoffs Continue With Another 9,000 Cuts

Microsoft is cutting around 9,000 jobs in a second major wave of layoffs for the year. Bloomberg's Brody Ford discusses the plan with Caroline Hyde and Ed Ludlow on “Bloomberg Tech.

Microsoft Cuts 8K Jobs in 2025's 4th Round of Layoffs

Microsoft is cutting nearly 9,000 jobs, the latest in a string of recent layoffs. [contact-form-7] The cuts will impact under 4% of the tech giant's workforce, a spokesperson for the tech giant told PYMNTS Wednesday (July 2).

After Hitting All-Time High, Can Microsoft Reach $600 This Year?

Key Points in This Article: Microsoft's (MSFT) robust growth in Azure and AI-driven Copilot integrations positions it to reach $600 per share if revenue and EPS growth are sustained.

Microsoft Plans to Lay Off Thousands of Workers in Latest Round of Cuts

Microsoft (MSFT) plans to make more cuts to its global workforce, affecting thousands of workers.

Microsoft to Lay Off About 9,000 Workers

The cuts represent less than 4% of the company's global workforce and add to about 6,000 roles it eliminated in May.