MACOM Technology Solutions Holdings, Inc. (MTSI)

Interpreting M/A-Com (MTSI) International Revenue Trends

Explore M/A-Com's (MTSI) international revenue trends and how these numbers impact Wall Street's forecasts and what's ahead for the stock.

MACOM Q4 Earnings Match Estimates, Revenues Rise Y/Y, Stock Up

MTSI's fourth-quarter fiscal 2024 results reflect robust growth across telecom, data center and industrial end markets, driven by strong product demand.

MACOM Technology Solutions Holdings, Inc. (MTSI) Q4 2024 Earnings Call Transcript

MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI ) Q4 2024 Earnings Conference Call November 7, 2024 8:30 AM ET Company Participants Steve Ferranti - Vice President, Corporate Development & Investor Relations Steve Daly - President & Chief Executive Officer Jack Kober - Chief Financial Officer Conference Call Participants David Williams - The benchmark company Harsh Kumar - Piper Sandler Tore Svanberg - Stifel Srini Pajjuri - Raymond James Karl Ackerman - BNP Paribas Peter Peng - JPMorgan Richard Shannon - Craig-Hallum Nick Doyle - Needham & Company Operator Welcome to MACOM's Fourth Fiscal Quarter 2024 Conference Call. This call is being recorded today, Thursday, November 7, 2024.

M/A-Com (MTSI) Meets Q4 Earnings Estimates

M/A-Com (MTSI) came out with quarterly earnings of $0.73 per share, in line with the Zacks Consensus Estimate. This compares to earnings of $0.56 per share a year ago.

M/A-Com (MTSI) Q4 Earnings Preview: What You Should Know Beyond the Headline Estimates

Get a deeper insight into the potential performance of M/A-Com (MTSI) for the quarter ended September 2024 by going beyond Wall Street's top -and-bottom-line estimates and examining the estimates for some of its key metrics.

Understanding M/A-Com (MTSI) Reliance on International Revenue

Explore M/A-Com's (MTSI) international revenue trends and how these numbers impact Wall Street's forecasts and what's ahead for the stock.

MACOM (MTSI) Q3 Earnings Meet Estimates, Revenues Rise Y/Y

MACOM's (MTSI) fiscal third-quarter results benefit from solid momentum across the data center, telecom, and industrial & defense markets.

Compared to Estimates, M/A-Com (MTSI) Q3 Earnings: A Look at Key Metrics

While the top- and bottom-line numbers for M/A-Com (MTSI) give a sense of how the business performed in the quarter ended June 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

M/A-Com (MTSI) Meets Q3 Earnings Estimates

M/A-Com (MTSI) came out with quarterly earnings of $0.66 per share, in line with the Zacks Consensus Estimate. This compares to earnings of $0.54 per share a year ago.

MACOM Technology Profits Drive Share Increases

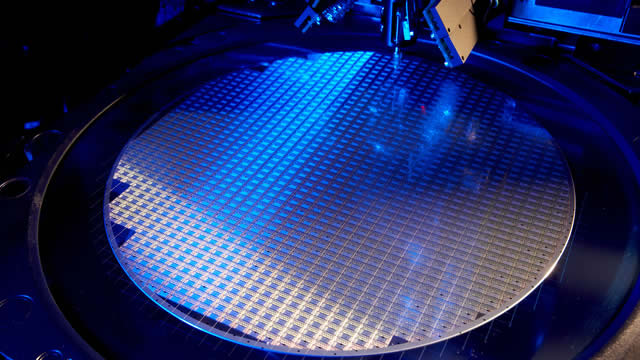

MACOM Technology Solutions Holdings, Inc. (MTSI) offers more than 2,700 high-performance analog semiconductor solutions and has grown profits by 64.8% in the last five years.