Pfizer Inc. (PFE)

Is This a New Reason to Buy Pfizer Stock Hand Over Fist?

Despite Pfizer's (PFE 0.23%) recent struggles with falling earnings and a bid by an activist investor to unseat its leadership, the pharma juggernaut is still actively advancing its core priorities and giving investors plenty of reasons to consider buying its stock while it's cheap.

Are Investors Undervaluing Pfizer (PFE) Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Eli Lilly, Pfizer, and AstraZeneca: 2025 Vaccine Makers to Watch

Leading vaccine makers like Eli Lilly and Co. NYSE: LLY, Pfizer Inc. NYSE: PFE, and AstraZeneca plc NASDAQ: AZN may have faded from the spotlight since the peak of the COVID-19 pandemic, but now there is reason to expect renewed interest. As investors look ahead to the second Trump administration, the incoming president's nomination of outspoken vaccine critic Robert F.

Is Pfizer Stock in Trouble?

One stock that just can't seem to catch a break of late is Pfizer (PFE 0.23%). Even though it posted some decent earnings numbers, investors can't shake the fear that the business is facing daunting headwinds that could send its $145 billion valuation lower in the months and years ahead.

High-Quality Dividend Growth Stocks Near 52-Week Lows: Pfizer Is Fun

A list of high-quality dividend-growth stocks trading near 52-week lows is evaluated based on historical and future fair values. Pfizer's financial health is concerning, with unsustainable dividend payout ratios and negative debt-to-equity ratios, but future projections suggest a potential recovery. Despite political risks and activist investor concerns, PFE's high initial dividend yield, solid ratings, and promising pipeline make it a potentially undervalued investment.

Billionaires Are Buying Up Beaten-Down Pfizer Stock. Should You Follow Their Lead?

Nobody can predict the future, but it's not hard to imagine increasing pharmaceutical sales. In 2022, prescription drug spending in the U.S. climbed more than 8% to reach $406 billion.

Pfizer Inc. (PFE) is Attracting Investor Attention: Here is What You Should Know

Pfizer (PFE) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

FDA Approves BridgeBio Pharma's Drug For Rare Heart Disease, Poised To Challenge Pfizer In Lucrative Yet Competitive Market

On Friday, the FDA approved BridgeBio Pharma, Inc.'s BBIO Attruby (acoramidis), an orally-administered near-complete (≥90%) stabilizer of Transthyretin (TTR) for adults with ATTR-CM to reduce cardiovascular death and cardiovascular-related hospitalization.

Pfizer Inc. (PFE) Jefferies London Healthcare Conference (Transcript)

Pfizer Inc. (NYSE:PFE ) Jefferies London Healthcare Conference November 20, 2024 4:00 AM ET Company Participants Dave Denton - CFO Andrew Baum - Chief Strategy and Innovation Officer, EVP Conference Call Participants Akash Tewari - Jefferies Akash Tewari Good to start. All right.

Pfizer: High Dividend And Low Price Might Still Offset The Expanding Risks

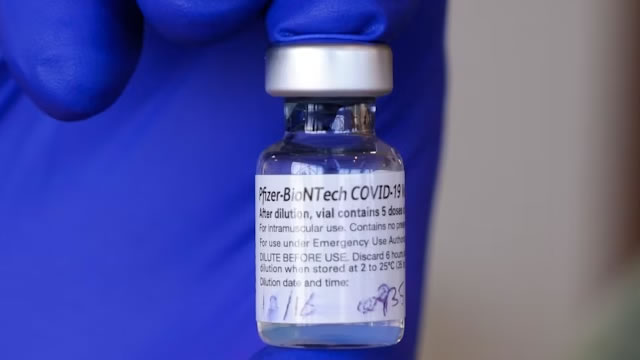

Pfizer's stock appears undervalued with a high dividend yield of 6.8%, making it a potential long-term investment despite low growth expectations. The company reported strong Q3 results with 31.2% YoY revenue growth, driven by products like Paxlovid and Comirnaty. Despite high valuation multiples, a DCF analysis suggests Pfizer's intrinsic value is $37.56 with 3% growth, indicating potential undervaluation.

PFE vs. NVO: Which Stock Is the Better Value Option?

Investors interested in stocks from the Large Cap Pharmaceuticals sector have probably already heard of Pfizer (PFE) and Novo Nordisk (NVO). But which of these two stocks offers value investors a better bang for their buck right now?

Pfizer Secures Approval for Hemophilia Drug Hympavzi in the EU

Following approval from the European Commission, PFE's Hympavzi becomes the first hemophilia medicine in the European Union to be administered via a pre-filled, auto-injector pen.