Pfizer Inc. (PFE)

Pfizer (PFE) Surpasses Q3 Earnings and Revenue Estimates

Pfizer (PFE) came out with quarterly earnings of $1.06 per share, beating the Zacks Consensus Estimate of $0.64 per share. This compares to loss of $0.17 per share a year ago.

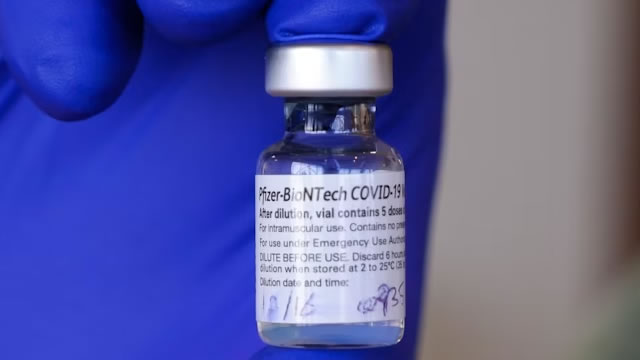

Pfizer ups guidance as demand for Covid-19 products grows

Pfizer Inc (NYSE:PFE, ETR:PFE) has lifted full-year revenue guidance on the back of a rebound in demand for its Covid-19 products. Revenue is expected to sit between $61 billion and $64 billion over the year, Pfizer said in third-quarter results on Tuesday, marking a $1.5 billion increase on previous expectations.

Pfizer Lifts Revenue Outlook, McDonald's Sees U.S. Sales Growth in Q3

Pfizer Q3 earnings beat expectations, driven by Paxlovid sales. Cost-saving goals aim for $4B by 2027 as Covid demand slows.

Pfizer's earnings crush estimates as company raises guidance

Drug company Pfizer saw strong growth for its heart-disease drugs and migraine treatment.

Pfizer raises profit forecast after beating third-quarter estimates

Pfizer raised its full-year profit forecast after better-than-expected sales of its COVID-19 treatment helped it beat Wall Street estimates for third-quarter earnings on Tuesday.

Pfizer tops earnings estimates, hikes full-year guidance as Covid products help sales

Pfizer reported third-quarter revenue and adjusted profit that blew past expectations. The company hiked its full-year outlook as its Covid vaccine and antiviral pill Paxlovid helped boost sales.

Pfizer, McDonald's Q3 Earnings to Set Early Market Tone; Alphabet, AMD Follow Post-Close

Pfizer's rebound and McDonald's E. coli impact headline pre-market earnings; post-close focus shifts to Alphabet and AMD.

Will Non-COVID Drugs Again Boost Pfizer's Top Line in Q3 Earnings?

Pfizer's non-COVID drugs and contributions from new and newly acquired products are likely to have driven top-line growth in the third quarter.

Will Pfizer Beat Earnings In Q3?

Pfizer (NYSE: PFE) is scheduled to report its Q3 2024 results on Tuesday, October 29. We expect the company to post revenue of $15.1 billion and earnings of $0.63 on a per share and adjusted basis, slightly above the consensus estimates of $14.9 billion and $0.62, respectively.

Pfizer management looks to show turnaround as Starboard looms

Pfizer's quarterly financial report on Tuesday comes at a critical moment for the U.S. drugmaker and its CEO, as activist hedge fund Starboard Value ramps up the pressure to demonstrate concrete results of a promised turnaround.

These 7 Blunt Words Just Opened a Can of Worms For Pfizer's Stock

The company's problems are no longer deniable.

Pfizer's Activist Battle Might Fizzle---but Its Stock Probably Won't

The pharmaceutical company's stock is relatively cheap, representing an opportunity for patient value investors.