Pinterest Inc. (PINS)

Meta Stock Vs. Pinterest: Which Internet Giant Offers The Better Bet?

Pinterest decreased by 17% over the last month. You might feel inclined to purchase more or consider decreasing your holdings.

Meta Vs Pinterest - Which Internet Stock To Bet On?

Pinterest decreased by 17% over the last month. You might feel inclined to purchase more or consider decreasing your holdings.

Pinterest (PINS) Up 6.5% Since Last Earnings Report: Can It Continue?

Pinterest (PINS) reported earnings 30 days ago. What's next for the stock?

Wall Street Bulls Look Optimistic About Pinterest (PINS): Should You Buy?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Pinterest, Inc. (PINS) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching Pinterest (PINS) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Pinterest Post-Q3: Strong Growth Amid Ad-Spend Pressures - A GARP Opportunity

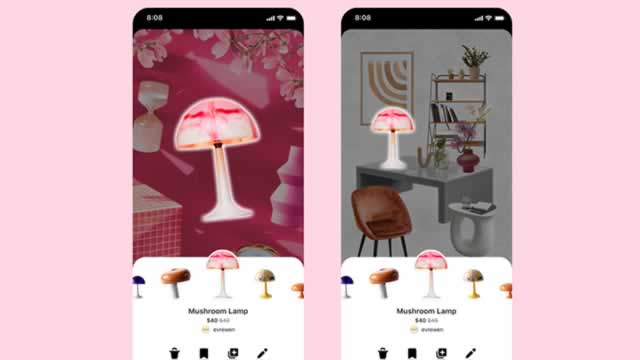

Pinterest shows steady user growth and mid-teens revenue expansion, outperforming peers during downturns, driven by intent-based engagement and high ROI ad conversions, particularly in performance and commerce campaigns. Emerging markets and Europe offer significant upside; AI enhancements, Gen Z adoption, and visual discovery can improve ARPU and monetization in underpenetrated regions. Free cash flow margins exceed 25%, reflecting asset-light operations and scalable growth; AI-driven ad targeting can boost efficiency without major cost increases.

3 High Growth Revenue Stocks That Wall Street Loves

Investors looking for growth stock momentum in a challenging macroeconomic environment may want to focus on companies showing consistent revenue gains. As the broader economy presents challenges to everyday consumers, sending sentiment to multi-year lows, firms that are still winning at sales stand out.

Pinterest: Valuation Makes No Sense, Focus On International Momentum (Upgrade)

Pinterest is now valued as a value stock despite strong revenue and earnings growth, a net cash balance sheet, and aggressive share repurchases. PINS trades at just 13x forward earnings, with double-digit growth expected, and pessimism appears overdone given its profitability and ongoing buybacks. While PINS underperforms Meta Platforms, international monetization and margin expansion offer upside, with 12%-18% annual returns projected over five years.

Pinterest: Focus On User Expansion, Not Near-Term Headwinds

Pinterest presents a compelling dip-buying opportunity, as macro headwinds and weak ad demand have driven shares down sharply, despite healthy U.S. user growth. Slowing revenue is driven by cyclical macro headwinds, as brands pull back their advertising budgets. This is more of a near-term reduction rather than a structural concern. At current valuations, PINS trades well below social media peers, with a solid balance sheet and resilient EBITDA margins supporting the investment case.

Australia adds Amazon's Twitch to teen social media ban, spares Pinterest

Australia's internet watchdog on Friday said it would include Amazon.com-owned live streaming service Twitch in its upcoming teen social media ban, but will not add image-sharing platform Pinterest to the list.

Pinterest Rides on Solid ARPU Growth: Will the Uptrend Continue?

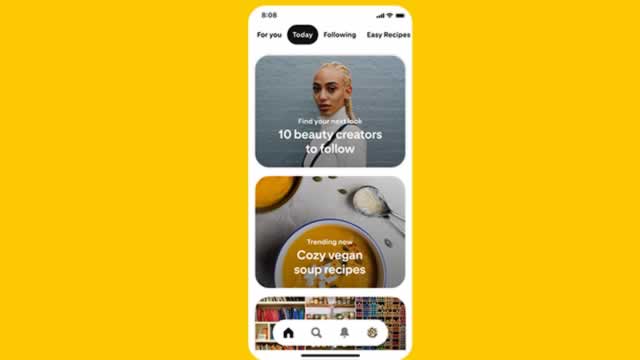

PINS' rising ARPU across regions and expanding Gen Z user base spotlight its momentum as AI-driven personalization lifts engagement.

Why Pinterest (PINS) International Revenue Trends Deserve Your Attention

Explore how Pinterest's (PINS) revenue from international markets is changing and the resulting impact on Wall Street's predictions and the stock's prospects.