Interface Inc. (TILE)

SoundHound Is Embedding Itself Into The Future Through Interface And Integration

Soundhound AI's stock soared on early AI hype but quickly fell, leading many to dismiss it as another overhyped tech play. However, the company has been methodically building a durable business with a dual moat: a superior voice interface and deep workflow integration. Its proprietary Speech-to-Meaning architecture and multimodal generative AI give it a significant edge over legacy voice assistants in speed, accuracy, and conversational ability.

3 Reasons Why Interface (TILE) Is a Great Growth Stock

Interface (TILE) could produce exceptional returns because of its solid growth attributes.

Interface, Inc. (TILE) Q1 2025 Earnings Call Transcript

Interface, Inc. (NASDAQ:TILE ) Q1 2025 Earnings Conference Call May 2, 2025 8:00 AM ET Company Participants Christine Needles – Global Communications Laurel Hurd – Chief Executive Officer Bruce Hausmann – Chief Financial Officer Conference Call Participants Brian Biros – Thompson Research Group Alex Paris – Barrington Research David MacGregor – Longbow Research Operator Thank you for standing by, and welcome to the Interface, Inc. First Quarter 2025 Earnings Conference Call. All lines have been placed on mute to prevent any background noise.

Interface (TILE) Beats Q1 Earnings and Revenue Estimates

Interface (TILE) came out with quarterly earnings of $0.25 per share, beating the Zacks Consensus Estimate of $0.20 per share. This compares to earnings of $0.24 per share a year ago.

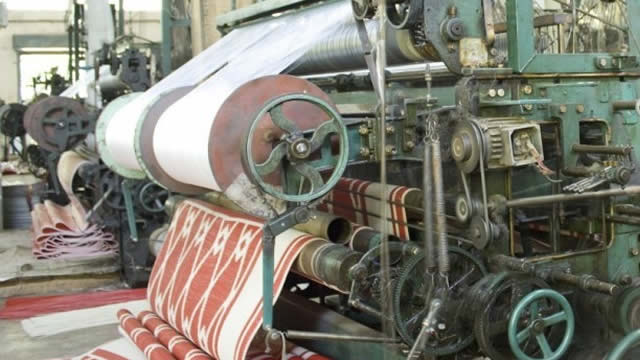

Interface: A Flooring Company At An Inflection Point

Interface, Inc. is poised for growth, with earnings projected to grow at least twice as fast as revenue over the next three years. Despite recent slower growth and the possibility of a fundamentals pullback, Interface gets a Buy rating with a one-year price target of $21.25. Competitive advantages include innovative design, global manufacturing capabilities, and optimization initiatives like automation and a globalized supply chain team.

Qualcomm CEO: AI Is the New User Interface for Devices

Qualcomm CEO Cristiano Amon said Tuesday (March 11) that artificial intelligence (AI) is ushering in the next fundamental shift in how humans interact with technology, describing it as a “generation change” poised to reshape the tech landscape and redefine user experiences across devices.

Interface: Strengthening Financials And Market Expansion Poised For Long-Term Growth.

Interface: Strengthening Financials And Market Expansion Poised For Long-Term Growth.

Interface (TILE) is on the Move, Here's Why the Trend Could be Sustainable

Interface (TILE) could be a solid choice for shorter-term investors looking to capitalize on the recent price trend in fundamentally sound stocks. It is one of the many stocks that passed through our shorter-term trading strategy-based screen.

Interface Stock Reaches 52-Week High: Time to Buy or Wait for a Dip?

TILE marks a new 52-week high by reaching $27.34, backed by favorable demand trends and growth initiatives.

Interface, Inc. (TILE) Hits Fresh High: Is There Still Room to Run?

Interface (TILE) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

Recent Price Trend in Interface (TILE) is Your Friend, Here's Why

Interface (TILE) could be a solid choice for shorter-term investors looking to capitalize on the recent price trend in fundamentally sound stocks. It is one of the many stocks that passed through our shorter-term trading strategy-based screen.

Best Growth Stocks to Buy for November 6th

TWLO, TILE and ZIM made it to the Zacks Rank #1 (Strong Buy) growth stocks list on November 6, 2024.