Taiwan Semiconductor Manufacturing Co. Ltd. ADR (TSM)

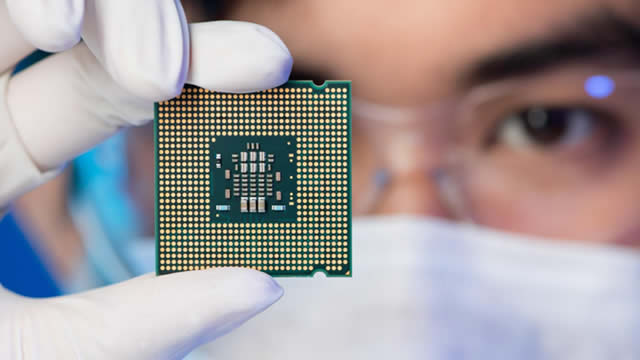

Taiwanese chip giant TSMC to reveal $100B US investment plan: report

A person briefed on the matter said Taiwan Semiconductor Manufacturing Co. is expected to announce a $100 billion investment in the U.S.

Taiwan Semiconductor to announce $100-billion investment in U.S. chip manufacturing plants

President Donald Trump is slated to a announce a $100 billion investment from Taiwan Semiconductor Manufacturing. The money will go toward building new chip manufacturing plants in the U.S. over the next four years.

TSMC poised to unveil new $100bn US investment - reports

Taiwan Semiconductor Manufacturing Co is reportedly poised to unveil a $100 billion investment in US chip manufacturing. According to The Wall Street Journal, the four year plan is set to be unveiled on Monday following a meeting with president Donald Trump.

Chip giant TSMC expected to announce $100B investment in US

Taiwan Semiconductor Manufacturing Co. is expected to announce a $100 billion investment in the U.S. at the White House that would bring more semiconductor manufacturing to the country.

TSMC to Spend $100 Billion in U.S. Over the Next Four Years

The company's chief executive is expected to announce the semiconductor's plans at the White House on Monday.

The Big 3: TSM, TJX, LOW

TSMC (TSM), TJX Companies (TJX) and Lowe's (LOW) take the attention of today's Big 3. Scott Bauer with @ProsperTradingAcademy turns to example options trades for all three names while Rick Ducat breaks down the technical trends.

TSMC pledges to spend $100B on US chip facilities

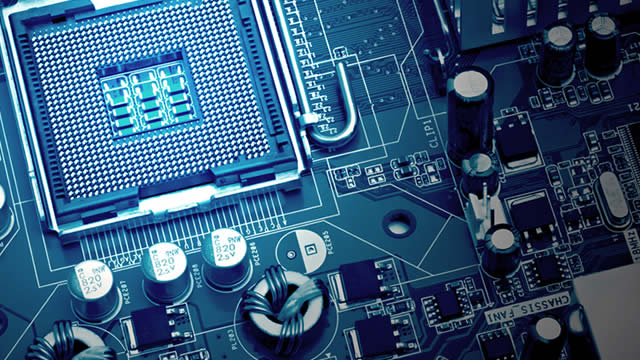

Chipmaker TSMC said it aims to invest $100 billion in chip manufacturing plants in the U.S. over the next four years as part of an effort to expand the company's global network of semiconductor factories.

Prediction: This Magnificent Artificial Intelligence (AI) Chip Stock Will Be Worth $2 Trillion in 5 Years

Semiconductor stocks have been in impressive form on the market over the past three years, as the demand for chips used for training and deploying artificial intelligence (AI) models in data centers has shot up remarkably during this period.

TSMC (TSM) Stock Sinks As Market Gains: Here's Why

TSMC (TSM) reachead $180.53 at the closing of the latest trading day, reflecting a -0.31% change compared to its last close.

TSMC: The Backbone Of The AI Industry Continues To Be Undervalued

TSMC's market position and growth prospects remain unparalleled, with significant upside potential due to a lack of real competition. TSMC's Arizona fab is well-received, potentially mitigating geopolitical risks but may reduce margins due to higher labor costs. TSMC is undervalued at a 26x multiple, with a fair value estimate of 30x, suggesting a 93% upside by FY26.

Taiwan Semiconductor: Don't Bet Against AI Acceleration And Leading 3 Nm Technology

Since my last writing, TSM's earnings have evolved more toward more advanced 3 nm and 5 nm technologies. This shift creates two critical advantages. It helps to expand profit margins and also reduces the normal seasonality for smartphones.

Report of TSMC chips made for Huawei "a huge concern", US Commerce nominee says

U.S. President Donald Trump's nominee to a post overseeing export policy for China on Thursday called a report about Taiwan Semiconductor Manufacturing Co producing hundreds of thousands of chips for Huawei "a huge concern."