City Office REIT Inc. (5QV)

Summary

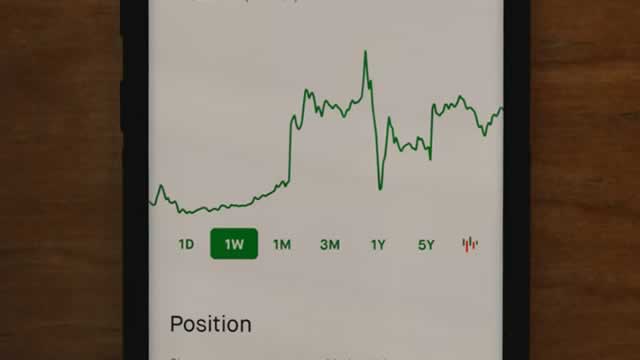

5QV Chart

T-bill and chill: Robinhood CIO on what to do after the selloff and the danger markets are ignoring

The best move investors can make right now may be to just ‘sit tight,' says Robinhood's CIO Stephanie Guild.

No reason to sell gold just yet - Tanglewood CIO Merrill

Neils Christensen has a diploma in journalism from Lethbridge College and has more than a decade of reporting experience working for news organizations throughout Canada. His experiences include covering territorial and federal politics in Nunavut, Canada.

CIO vs. EGP: Which Stock Is the Better Value Option?

Investors interested in REIT and Equity Trust - Other stocks are likely familiar with City Office REIT (CIO) and EastGroup Properties (EGP). But which of these two stocks presents investors with the better value opportunity right now?

City Office REIT Inc. (5QV) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

When is the next earnings date?

Has City Office REIT Inc. ever had a stock split?

City Office REIT Inc. Profile

| Office REITs Industry | Real Estate Sector | James Thomas Farrar CFA CEO | XFRA Exchange | US1785871013 ISIN |

| US Country | 20 Employees | 10 Jul 2025 Last Dividend | - Last Split | - IPO Date |

Overview

City Office REIT is an internally-managed real estate investment trust (REIT) that is predominantly focused on the acquisition, ownership, and operation of high-quality office properties situated in the Sun Belt markets. The company's strategic emphasis on these Sun Belt markets has positioned it as a key player in the real estate sector, catering to the growing demand for office spaces in these areas. By electing to be taxed as a REIT for U.S. federal income tax purposes, City Office REIT enjoys certain tax advantages that enable it to distribute a substantial portion of its taxable income to its shareholders in the form of dividends. Boasting a controlling interest or outright ownership of approximately 5.7 million square feet of office properties, the company is poised for growth and is well-equipped to meet the evolving needs of its tenant base.

Products and Services

-

Acquisition of Office Properties

City Office REIT specializes in identifying and acquiring high-quality office properties in strategic Sun Belt markets. These acquisitions are carefully selected based on specific criteria to ensure alignment with the company's investment goals and growth strategy.

-

Ownership and Management of Office Real Estate

Through direct ownership or controlling interests, City Office REIT manages a substantial portfolio of office properties. The company focuses on enhancing property value through active management, strategic capital improvements, and efficient operations to attract and retain tenants.

-

Operation and Leasing of Office Spaces

City Office REIT operates its portfolio of office spaces with a focus on maintaining high occupancy rates and achieving sustainable rental income. The company employs leasing strategies aimed at diversifying tenant mix and securing long-term leases, thus ensuring steady revenue streams.