Stock Market & Financial News

Gold And Silver Miners Are Printing Money

Rising gold and silver prices in 2025–2026 have driven a step-change in mining company profits and cash flow. Amplify Junior Silver Miners ETF returned 184.02% in 2025, far outpacing spot metals prices. Miners' net profit margins now rival tech giants, with cash flows accelerating—Newmont Mining's free cash flow rose 150% year-over-year.

Astellas collaborates with Vir to develop its experimental prostate cancer drug

Japan's Astellas and Vir Biotechnology said on Monday they will together develop and commercialize the U.S. drug developer's prostate cancer experimental drug.

IAI: Around Half Of Portfolio Is Countercyclical

The iShares US Broker-Dealers & Securities Exch ETF offers pro-volatility exposure, with brokerage and exchange holdings comprising the bulk of the portfolio. I view AI-related risks as overstated for IAI's core holdings; brokerage exchanges are already quite automated, and capital markets businesses remain resilient due to their human-centric nature. Asset Management and Wealth Management exposures face some risk from AI substitution and macro volatility, but these segments are a smaller part of IAI and unlikely to be fully displaced either.

France's Nuclear Pivot Serves as Catalyst for NUKZ

France has fundamentally shifted its energy strategy, providing a significant tailwind for the nuclear sector.

iShares Moves Short-Term Bond ETFs to the Big Board

As the hunt for yield and stability remains a cornerstone of portfolios in 2026, a group of iShares short-term bond ETFs have made a strategic move to the Big Board today. Four prominent short-term fixed-income vehicles have officially transitioned their primary listing to the New York Stock Exchange (NYSE).

Here's what airlines, hotels and Airbnb actually owe travelers stranded in Mexico

U.S. airlines canceled flights to and from the Mexican cities of Puerto Vallarta and Guadalajara on Monday amid cartel-related violence over the weekend, leaving tourists stranded.

Pan American Silver Corp. (PAAS:CA) Presents at 35th BMO Global Metals, Mining & Critical Minerals Conference Transcript

Pan American Silver Corp. (PAAS:CA) Presents at 35th BMO Global Metals, Mining & Critical Minerals Conference Transcript

Citi signs deal to sell 24% equity stake in Banamex

Citigroup said on Monday it had entered into agreements to sell a 24% stake in Banamex to a group of institutional investors and family offices for around $2.5 billion.

Russia made up to $1.68 billion selling 300,000 ounces of gold in January as prices hit record highs

Ernest Hoffman is a Crypto and Market Reporter for Kitco News. He has over 15 years of experience as a writer, editor, broadcaster and producer for media, educational and cultural organizations.

Emera Incorporated (EMA:CA) Q4 2025 Earnings Call Transcript

Emera Incorporated (EMA:CA) Q4 2025 Earnings Call Transcript

AirJoule Has Big Partners—So What's Still Holding the Stock Back?

AirJoule Technologies NASDAQ: AIRJ is a risky play, as it is a pre-revenue company yet to start sales, which are expected to begin in 2026. The questions are whether the company matters, if its product has utility, and if its stock is a Buy.

Canada and Mexico are the biggest winners from tariff relief, says Strategas' Dan Clifton

Dan Clifton, Strategas head of policy research, joins 'The Exchange' to discuss the economic fallout from the recent tariff push, the new rules and much more.

Dillard's (DDS) is a Top Buy the Dip Target Ahead of Q4 Earnings

Known for its remarkable probability, Dillard's (DDS) stock looks like a top buy-the-dip target ahead of its Q4 report on Tuesday, February 24.

BKGI: An Outperforming ETF In An Important Asset Class

The BNY Mellon Global Infrastructure Income ETF offers active, global infrastructure exposure with 33 holdings and a 0.55% expense ratio. BKGI has outperformed its S&P Global Infrastructure benchmark, delivering 19.4% annualized returns vs. 13.6% over the past three years. The fund targets macro themes: energy transition, 5G networks, healthcare infrastructure, and public-private partnerships, supporting long-term defensiveness.

Cerence Sees Initial Wins With xUI Platform But I'm Skeptical Of Durability (Downgrade)

My outlook on Cerence is downgraded to a 'Sell' due to concerns over its ability to compete durably and profitably against major technology players in automotive AI. The recent revenue surge was driven by a one-time $49.5 million Samsung settlement, not sustainable core growth, with forward revenue growth estimated at -4.8%. The xUI platform has secured five significant new clients at higher price points, but competitive threats from hyperscalers and replicable core features remain acute.

Kinder Morgan: Pipe Income To Your Portfolio

Kinder Morgan remains a solid buy-and-hold pick, supported by 96% fee-based or hedged cash flows and a $10 billion project backlog. KMI's Q4 2025 adjusted EBITDA rose 10% YoY, driven by LNG exports and surging natural gas demand, especially from the Haynesville system. With a 3.6% dividend yield, a 44% OCF payout ratio, and a BBB+/Baa2 balance sheet, KMI offers steady income and growth potential.

Applied Optoelectronics: The AI Networking Dark Horse Wall Street Underestimates

Applied Optoelectronics, Inc. is emerging as a key beneficiary of accelerating AI data center scale-out, as higher GPU density and larger cluster deployments increase demand for networking bandwidth and optical transceivers. AAOI's expanding U.S.-based manufacturing capacity for mainstream 400G transceivers and emerging high-speed 800G and 1.6T transceivers are poised to enable a multi-fold growth runway. The company's upcoming Q4 earnings update later this week (February 26) will be a key telling tale as it kicks off expectations for 2026.

Gossamer Bio, Inc. (GOSS) Discusses Topline Results of PROSERA Phase 3 Study in Pulmonary Arterial Hypertension Transcript

Gossamer Bio, Inc. (GOSS) Discusses Topline Results of PROSERA Phase 3 Study in Pulmonary Arterial Hypertension Transcript

Domino's just revealed how it plans to win the pizza wars after Pizza Hut's store closures—it's good news for fast food lovers

If Domino's earnings on Monday prove anything, it's that people are still eating pizza—even if fast food sales, in general, are slumping.

Ideal Power launches public offering to fund B-TRAN commercialization efforts

Ideal Power Inc (NASDAQ:IPWR, FRA:5ILA) announced it has commenced an underwritten public offering of its common stock, subject to market conditions. The company said it intends to use the net proceeds primarily to advance commercialization of its B-TRAN technology.

IBM Shares Plummet 13%—Worst Day Since 2000—After Anthropic Launches Programming AI Tool

$31 billion. That's about how much was cut from IBM's market value after its shares declined on Monday, falling from $240.8 billion on Friday to roughly $208.7 billion.

3 Dividend ETFs With Over 6% Yields That Don't Use Options or Gimmicks

When you look at dividend ETFs with high yields, most of them end up being options ETFs or have other dealbreakers attached.

This Schwab ETF Holds 100 Dividend Stocks, Charges 0.06% a Year, and Yields More Than Most Savings Accounts

Raisin is paying savers up to $1,500 in cash bonuses with code ‘HEADSTART' just for opening and funding a new high-yield savings or CD account through its platform.

U.S. Global Investors, Inc. (GROW) Q2 2026 Earnings Call Prepared Remarks Transcript

U.S. Global Investors, Inc. (GROW) Q2 2026 Earnings Call Prepared Remarks Transcript

Atlassian: This Is Not 2016 Anymore

Atlassian faces severe YTD underperformance, down 53%, despite accelerating Q2 FY26 revenue growth, backlog, and improved net retention rates. TEAM's AI-driven Collections and “System of Work” strategies have not yet offset rising commoditization risks in the Agentic AI era as the software tech stack gets rewritten. Consensus estimates point to declining forward revenue and earnings growth, with markets awaiting evidence of stable retention and backlog before a potential re-rating can occur.

Tesla sues California DMV to reverse ruling that company engaged in false advertising on FSD

Tesla is suing the California DMV to try to shed the label of "false advertiser." The California DMV previously ruled that Elon Musk's automaker falsely promoted its cars' self-driving capabilities.

Dominion Energy, Inc. (D) Q4 2025 Earnings Call Transcript

Dominion Energy, Inc. (D) Q4 2025 Earnings Call Transcript

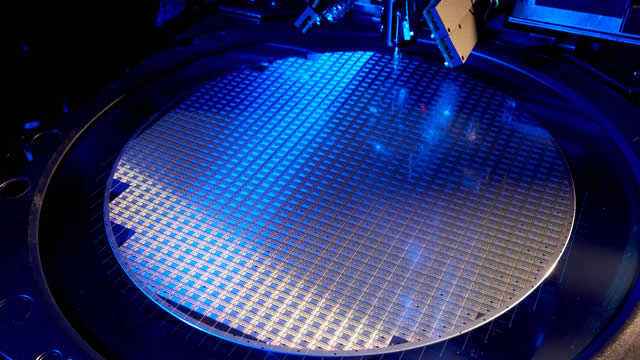

3 AI Stocks Outpacing NVIDIA in 2026 - With More Upside Ahead

TSM, Micron and Supermicro are outpacing NVDA as AI-driven data center demand, chip shortages and margin gains power bold revenue and earnings forecasts.

Is the Mag 7 Necessary to Navigate Global Equity Markets?

Traditionally, when folks look to play the equity market, many seek to maintain exposure to the Magnificent 7. However, that is not the only viable method for finding success through equities.