Airbnb, Inc. (ABNB)

ABNB Stock Down 14% After Airbnb Q2 Results Disappoint

Airbnb (NASDAQ: ABNB ) stock fell hard after second-quarter results were deemed disappointing. The company also warned of a slowdown in demand.

Airbnb Stock Sinks on Warning About Slowing US Demand

Airbnb (ABNB) shares sank Wednesday, a day after the vacation rental firm missed second-quarter profit forecasts and warned about slowing demand in the U.S.

Airbnb Stock Eyes Worst Day Ever After 15% Profit Slump

Airbnb Inc (NASDAQ:ABNB) stock is down 14.4% to trade at $111.64 at last check, brushing off better-than-expected revenue for the second quarter after the company's profits fell 15%, missing estimates despite rising bookings amid higher income taxes.

Airbnb Stock: Key Drivers Indicate Bright Future Despite Sell-Off

The stock market has been on a whipsaw in the past few trading days. As the so-called “Carry Trade” is now unwound in Japan after that country's central bank hiked interest rates, the bottom for the S&P 500 is now further away than most had initially thought.

Airbnb Reports Weak Earnings, Joins Cryoport, Tripadvisor, Lyft And Other Big Stocks Moving Lower In Wednesday's Pre-Market Session

U.S. stock futures were higher this morning, with the Dow futures gaining around 300 points on Wednesday.

Why Are Shares of Airbnb Plummeting After Earnings?

Investors should be looking to buy wonderful businesses at good prices.

Airbnb: Macro Headwinds Beginning To Bite

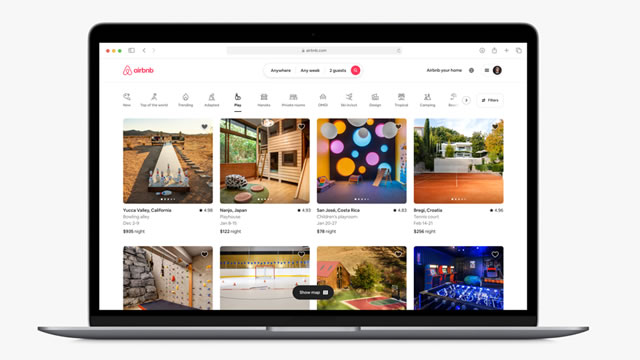

Airbnb reports solid Q2 results, but the stock is down due to slowing growth, declining margins and the rising possibility of an economic contraction. Airbnb is becoming more serious about strengthening its business, by expanding its offerings for travelers and introducing new tools and services for hosts. While this is supportive of long-term growth and margins, investments are likely to undermine profitability in the near term.

Airbnb's $10 Billion Opportunity

Airbnb could buy back over 10% of its stock immediately.

Airbnb: Travelers Delay Booking Accommodations Amid Macro Uncertainty

Airbnb has seen shorter booking lead times in recent weeks, with customers around the world booking their accommodations closer to their expected time of arrival. A growing share of customers are booking just days or a couple of weeks in advance, Airbnb executives said Tuesday (Aug. 6) during the company's quarterly earnings call.

Airbnb, Inc. (ABNB) Q2 2024 Earnings Call Transcript

Airbnb, Inc. (NASDAQ:ABNB ) Q2 2024 Earnings Conference Call August 6, 2024 4:30 PM ET Company Participants Angela Yang - Director, Investor Relations Brian Chesky - Co-Founder & Chief Executive Officer Ellie Mertz - Chief Financial Officer Conference Call Participants Ron Josey - Citi Doug Anmuth - JPMorgan Richard Clark - Bernstein Eric Sheridan - Goldman Sachs Brian Nowak - Morgan Stanley Justin Post - Bank of America James Lee - Mizuho Justin Patterson - KeyBanc Kevin Kopelman - TD Cowen Nick Jones - Citizens JMP Jed Kelly - Oppenheimer Naved Khan - B. Riley Securities Stephen Ju - UBS Mark Mahaney - Evercore ISI Lee Horowitz - Deutsche Bank Operator Ladies and gentlemen, good afternoon, and thank you for joining Airbnb's Earnings Conference Call for the Second Quarter of 2024.

Airbnb just dropped more bad news about the US consumer

Airbnb expects a slowdown in growth next quarter and weakening US demand. Shorter booking lead times and regulations in California impacted bookings, Airbnb's CFO said.

Airbnb shares tumble after warning of slowdown amid troubling trend by travelers

Domestic travel in the US has been pressured since the start of the year as more Americans have grown cautious about travel spending.