Abbott Laboratories (ABT)

Abbott Labs beats Q3 sales and earnings expectations, raises full-year outlook

Abbott Laboratories on Wednesday reported better-than-expected third-quarter earnings and sales, boosted by strength in the company's medical-devices business.

Abbott slightly raises profit forecast on strong medical device sales

Abbott Laboratories slightly lifted its annual profit forecast on Wednesday, after beating Wall Street estimates for quarterly earnings on strong sales of its medical devices including its glucose-monitoring products.

Abbott Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Abbott Laboratories ABT will release earnings results for its third quarter, before the opening bell on Wednesday, Oct. 16.

3 Top-Rated Stocks to Watch as Earnings Approach: ABT, EFX, SLG

Sporting a Zacks Rank #2 (Buy), here are three top-rated stocks that investors will want to consider as their Q3 results approach on Wednesday, October 16.

Is a Surprise Coming for Abbott (ABT) This Earnings Season?

Abbott (ABT) is seeing favorable earnings estimate revision activity and has a positive Zacks Earnings ESP heading into earnings season.

Abbott: Challenging Comparables, Unappealing Value Limit The Incentive To Go Long Ahead Of Q3 Event

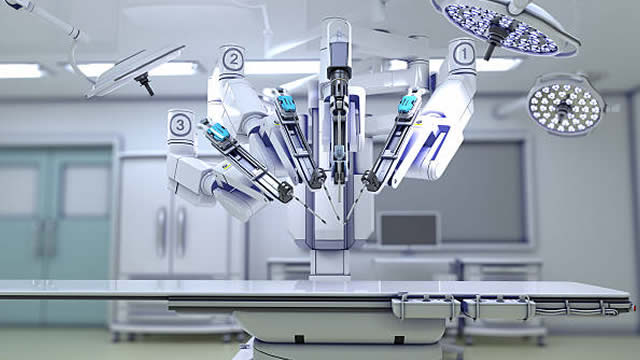

Abbott Laboratories will announce its Q3 results on the morning of 16th October, with earnings and topline growth largely expected to be in line with the Q2 trend. A year ago, all of Abbott's divisions had generated double-digit topline growth, making the base effect quite challenging to overcome. We touch upon some of the important goings-on in Abbott's two largest divisions - Medical Devices and Diagnostics - which jointly account for two-thirds of group sales.

Diabetes Products To Drive Abbott's Q3

Abbott (NYSE: ABT) will report its Q3 2024 results on Wednesday, Oct 16. We expect the company to post revenue of $10.6 billion and earnings of $1.20 on a per share and adjusted basis, aligning with the street expectations.

Abbott (ABT) Q3 Earnings Preview: What You Should Know Beyond the Headline Estimates

Evaluate the expected performance of Abbott (ABT) for the quarter ended September 2024, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

Abbott (ABT) Earnings Expected to Grow: Should You Buy?

Abbott (ABT) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Investors Heavily Search Abbott Laboratories (ABT): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to Abbott (ABT). This makes it worthwhile to examine what the stock has in store.

Why Abbott (ABT) Outpaced the Stock Market Today

Abbott (ABT) closed at $114.63 in the latest trading session, marking a +1.12% move from the prior day.

Abbott Laboratories Analyst Is Bullish About MedTech, Non-MedTech Growth

Abbott Laboratories's ABT MedTech portfolio is growing at a CAGR (compounded annual growing rate) of 11%-13%.