Archer Aviation Inc. (ACHR)

Is Archer Aviation Stock a Buy Now?

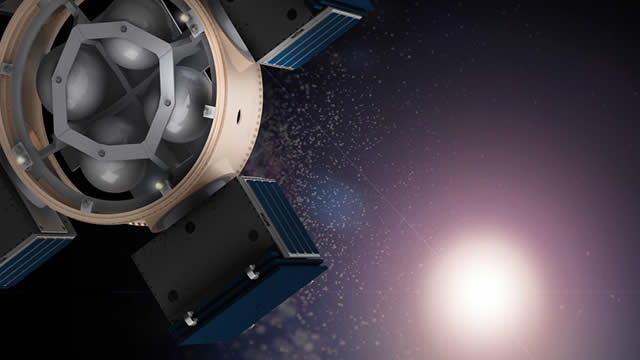

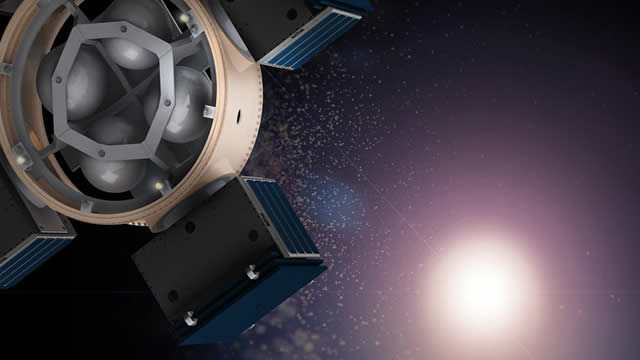

Archer Aviation (ACHR 2.93%) is selling a big idea: small electric vertical take-off and landing (eVTOL) aircraft, or so-called "air taxis." These sleek, battery-powered aircraft promise to turn 45-minute crosstown commutes through busy metropolises into 10-minute rides above the traffic.

Archer vs. Joby: Which eVTOL Stock Has an Edge Currently?

ACHR's partnerships and production ramp-up give it an edge over JOBY in the fast-growing eVTOL market.

Archer's Midnight Aircraft Reaches New Milestone: Should You Buy?

ACHR's Midnight aircraft completes a 55-mile flight, marking progress toward certification and upcoming commercial launch plans.

Archer's Flight Milestones & Defense Wins Excite Wall Street

Archer Aviation's NYSE: ACHR stock has recently captured significant market attention, with an increase in trading volume and positive price momentum that suggests a potential Wall Street frenzy is building. This renewed investor enthusiasm is grounded in a powerful series of back-to-back catalysts that demonstrate tangible progress for Archer.

Archer Aviation Flight Ramps Up Air-Taxi War With Joby. Why Both Stocks Are Down.

Archer Aviation's Midnight eVTOL recently completed a piloted 31-minute, 51-mile piloted test flight.

The Market Got It Wrong On Archer Aviation

Archer ended Q2 2025 with $1.724 billion liquidity after an $850 million raise, funding certification and manufacturing. Six Midnight aircraft are under build, three in final assembly, across Archer's 700,000 sq. ft. combined facilities. Midnight completed a record 55-mile, 31-minute piloted flight at 126 mph, validating safety envelope and regulator confidence.

On the Cusp of Generating Revenue, Can Archer Aviation Make You a Millionaire?

Key Points in This Article: Archer Aviation (ACHR) expects to generate revenue by year-end via its UAE Launch Edition program, with payments in the low tens of millions of dollars.

Archer Aviation: Unlikely To Be Stuck At $10 For Much Longer

Archer Aviation Inc. continues to unlock massive global opportunities in the air taxi and defense sectors. The company has disappointed the market with recent aircraft design changes and pilot testing; but progress towards commercialization is still being made. Strategic partnerships, especially with Anduril, and international contracts provide near-term revenue and position Archer for commercial and defense market growth.

Catalysts Align: Archer Beats Estimates, Delivers Aircraft to UAE

Archer Aviation's NYSE: ACHR second-quarter 2025 results have provided investors with the clearest signals yet of its transition from a developmental concept to a commercial reality.

Archer Aviation Q2: The Prove-It Phase Begins

Archer Aviation Inc. is at a critical inflection point, with high cash burn and pre-revenue status, but strong development momentum and $1.7B in cash. Despite a rich valuation and speculative fundamentals, I rate ACHR a cautious 'Buy' due to strategic partnerships and long-term market potential. Key Q3 metrics to watch include UAE commercial revenue, manufacturing progress, defense contracts, and FAA certification milestones for real business validation.

Ready For Take-Off: Maintaining Archer Aviation With A Buy

Archer Aviation Inc. reported wider losses and increased expenses on its Q2 '25 earnings results. This is a slow burning candle but patient investors should be well-rewarded. Despite regulatory and profitability challenges, strong government backing and commercial partnerships position Archer for significant long-term growth potential. The recent ACHR stock pullback offers an attractive risk-reward entry for patient investors, with technical support at $8.7 and upside potential toward $13.9.

Archer Aviation Q2: Revenue In Sight as eVTOL Aircraft Near Launch

Key Points in This Article: Archer Aviation‘s (ACHR) Q2 earnings showed a $206 million net loss, prompting an initial stock sell-off, but shares are rising 5% as investors recognized progress.