Affirm Holdings, Inc. (AFRM)

Affirm's stock surges after Apple announces partnership on payment products

Shares of Affirm Holdings Inc. rallied Tuesday, after the provider of buy-now-pay-later payment options disclosed a partnership with Apple Inc.

Affirm Teaming Up With Apple ‘Is a Big Positive.' The Stock Is Up.

The payments company says it doesn't expect the partnership to have a material impact on revenue or gross merchandise volume in fiscal year 2025.

Affirm buy now, pay later loans will be embedded into Apple Pay later this year

Apple device users will soon be able to tap into buy now, pay later loans from Affirm for purchases, the companies said Tuesday. Affirm will surface as an option for Apple Pay users on iPhones and iPads later this year.

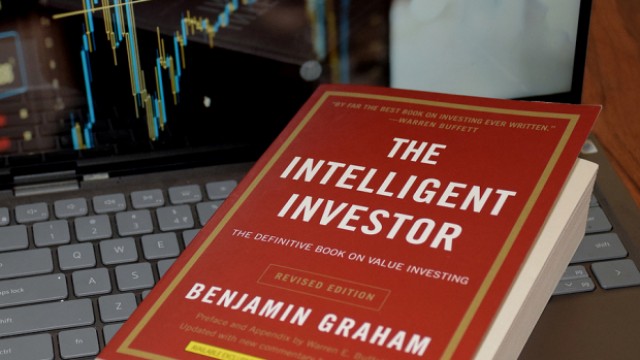

7 Hidden-Gem Growth Stocks Ready to Rocket

For investors seeking to give their portfolio a jumpstart, so-called hidden-gem growth stocks may have plenty to offer. By that, I'm talking about companies that are not exactly favored by Wall Street.

Here is What to Know Beyond Why Affirm Holdings, Inc. (AFRM) is a Trending Stock

Zacks.com users have recently been watching Affirm Holdings (AFRM) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Affirm (AFRM) Expands BNPL Offerings With New Payment Options

Affirm (AFRM) witnesses growth in cart conversion within its app following the introduction of the two payment options, signaling high demand.

Here's Why Affirm Holdings (AFRM) Stock is a Great Pick Now

Affirm Holdings (AFRM) is currently riding on growth in its active merchant base and consumers.

Affirm (AFRM) and Alterra Expand Partnership for Wider Reach

Affirm (AFRM) expands its partnership with Alterra in a bid to reach more customers in the United States and Canada.

Affirm introduces new buy-now-pay-later options to capture more daily spending

Affirm Holdings Inc. is introducing new installment options to add flexibility and benefit customers who get paid semimonthly or monthly.

Affirm Debuts Two New BNPL Options

Buy now, pay later (BNPL) provider Affirm has launched two new payment options. The company on Thursday (June 6) announced the debt of Pay in 2 and Pay in 30, designed to offer customers more flexibility and affordability.

3 Business Services Stocks to Consider Amid Industry Woes

Contracting economic activity in the manufacturing sector and labor market constraints make the prospects gloomy for the Zacks Business Services industry. Rising service activities and growing technology adoption being the saving graces, AFRM, MITFY and SGRP are likely to be the frontrunners.

Why You Should Add Affirm (AFRM) Stock to Your Portfolio Now

Affirm (AFRM) is expected to leverage its partners' penetration rate in the U.K. and other significant markets in Europe to further boost its GMV.