Applied Materials Inc. (AMAT)

Applied Materials: Strong AI Compounder

I believe revenue and EPS growth estimates over the next year are too conservative, making AMAT stock a strong buy. Applied Materials has shown strong revenue and EPS growth over the past 10 years, with revenue increasing by 353% from 2014 to 2024. Consensus revenue estimates suggest continued growth, with revenue projected to increase from $26.94 billion in fiscal 2024 to $37.36 billion in fiscal 2028.

Semi Equipment Still Overpriced: 3 Stocks on the Radar

The strong growth outlook for the Semiconductor - WFE industry and its relative stability in uncertain times have led investors to pile into the shares.

Applied Materials, Inc. (AMAT) is Attracting Investor Attention: Here is What You Should Know

Applied Materials (AMAT) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

3 Semiconductors to Buy as Nvidia Insiders Take Profits

As Nvidia's (NASDAQ: NVDA ) growth goes hyperbolic, the semiconductor industry seems left behind. After all, much of Nvidia's excitement and value generation comes from its dominance in the graphic process unit sector of semiconductor technology.

Applied Materials, Inc. (AMAT) Management presents at BofA Securities Global Technology Conference (Transcript)

Applied Materials, Inc. (NASDAQ:AMAT ) BofA Securities Global Technology Conference June 6, 2024 11:40 AM ET Company Participants Brice Hill - SVP & CFO Conference Call Participants Vivek Arya - Bank of America Vivek Arya Very good morning. Welcome to this session.

Applied Materials Stock Surges 30% This Year As Semiconductor Market Looks Up. Is The Stock Attractive?

Applied Materials stock has had a solid year thus far, rising by over 31% year-to-date. In comparison, Applied's semiconductor industry peer Texas Instruments stock has gained about 14% over the same period.

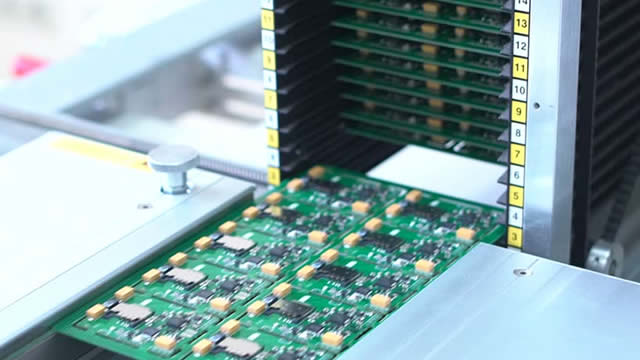

1 Top Semiconductor Stock for Massive AI Growth

A wave of new chip fabs is getting ready to come online, and they'll be in need of new equipment. Applied Materials has a broad portfolio of machinery needed for advanced chipmaking.

Applied Materials, Inc. (AMAT) Is a Trending Stock: Facts to Know Before Betting on It

Applied Materials (AMAT) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Applied Materials, Inc. (AMAT) Bernstein's 40th Annual Strategic Decisions Conference

Applied Materials, Inc. (NASDAQ:AMAT ) Bernstein's 40th Annual Strategic Decisions Conference May 30, 2024 2:30 PM ET Company Participants Gary Dickerson - President and Chief Executive Officer Conference Call Participants Stacy Rasgon - Bernstein Stacy Rasgon Thank you for coming. Good afternoon, I'm Stacy Rasgon, I cover the U.S. Semiconductor and semi cap equipment space here at Bernstein.

Silicon Sleepers: 3 Non-Nvidia Semiconductor Stocks to Own Now

At this point, directly betting against semiconductor stocks – especially if they're named Nvidia (NASDAQ: NVDA ) – should first come with a warning. The sector continues to defy gravity, with demand seemingly pointing to a limitless ceiling.

Applied Materials says received subpoena from US commerce department

Applied Materials received a subpoena from the U.S. Commerce department's Bureau of Industry and Security in May, it disclosed in a filing on Thursday.

Have $1,000? These 2 Stocks Could Be Bargain Buys for 2024 and Beyond

Micron Technology's growth has accelerated significantly and the company seems capable of sustaining its momentum thanks to AI. Applied Materials has been a top stock over the past decade, and it could keep heading higher as the demand for semiconductor equipment grows.