AMC Entertainment Holdings Inc. (AMC)

Is Trending Stock AMC Entertainment Holdings, Inc. (AMC) a Buy Now?

AMC Entertainment (AMC) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

AMC shares higher on strong Wicked: For Good opening weekend

AMC Entertainment Holdings (NYSE:AMC) shares climbed almost 5% after the cinema chain reported a blockbuster opening weekend for the musical film Wicked: For Good, generating approximately $226 million globally, including $150 million in the US and Canada. The film marked AMC's biggest opening weekend for a PG- or G-rated movie since early 2023 and drove significant growth across admissions, food and beverage, merchandise sales, and special event attendance, the company said.

AMC Entertainment Holdings, Inc. (AMC) is Attracting Investor Attention: Here is What You Should Know

AMC Entertainment (AMC) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

AMC Entertainment Holdings, Inc. (AMC) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching AMC Entertainment (AMC) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

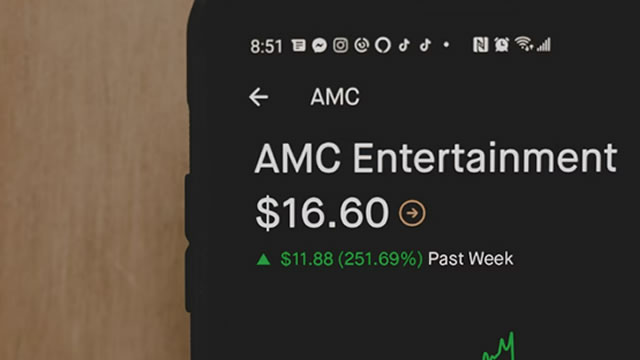

Is There Any Hope Left for This Former Meme Stock, Down 35% in 2025?

"Meme mania" has long since passed for AMC Entertainment, which has fallen over 99% from its 2021 highs, and more than 35% this year alone. Despite being far cheaper today, the stock is richly priced when using fundamentals-based valuation metrics.

AMC Entertainment tops Q3 revenue estimates despite softer box office

AMC Entertainment Holdings (NYSE:AMC) delivered better-than-expected financial results for the third quarter, driven by market share gains and strong per-customer spending, though profitability declined compared with a year earlier. The company posted revenue of $1.3 billion, down from $1.35 billion in the year-ago quarter but topping analyst estimates of $1.23 billion.

AMC Entertainment Pops Then Drops After Reporting Q3 Earnings

AMC Entertainment Holdings (NYSE: AMC) reported third-quarter results that beat revenue expectations but highlighted the tension between operational improvement and mounting losses.

AMC Entertainment Holdings, Inc. (AMC) Q3 2025 Earnings Call Transcript

AMC Entertainment Holdings, Inc. ( AMC ) Q3 2025 Earnings Call November 5, 2025 5:00 PM EST Company Participants John Merriwether - Vice President of Capital Markets and Investor Relations Adam Aron - Chairman, President & CEO Sean Goodman - Executive VP of International Operations, IT & Procurement, CFO and Treasurer Conference Call Participants Eric Wold - Texas Capital Securities, Research Division Presentation Operator Hello, and welcome, everyone, joining today's call, AMC Holdings Third Quarter 2025 Earnings Webcast. [Operator Instructions] Please note, this call is being recorded.

AMC Entertainment (AMC) Q3 Earnings: How Key Metrics Compare to Wall Street Estimates

While the top- and bottom-line numbers for AMC Entertainment (AMC) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

AMC Entertainment (AMC) Reports Q3 Loss, Beats Revenue Estimates

AMC Entertainment (AMC) came out with a quarterly loss of $0.21 per share versus the Zacks Consensus Estimate of a loss of $0.19. This compares to a loss of $0.04 per share a year ago.

AMC beats revenue expectations despite third-quarter softness. The stock is climbing.

AMC CEO Adam Aron says the third-quarter softness should not be cause for alarm.

AMC Entertainment poised to outperform Q3 expectations on international growth, premium screens

AMC Entertainment Holdings (NYSE:AMC) is expected to surpass Wall Street estimates for its third quarter results, which are scheduled for release on Wednesday, Wedbush analysts believe. The analysts see AMC posting revenue of $1.25 billion and adjusted EBITDA of $120 million, both above consensus estimates of $1.23 billion and $97 million, respectively.