Advanced Micro Devices, Inc. (AMD)

This Nvidia competitor just received a Wall Street price increase

Advanced Micro Devices (NASDAQ: AMD), a rival to Nvidia (NASDAQ: NVDA), has received a bullish endorsement from BofA Securities, which maintained its ‘Buy' rating and raised its price target from $175 to $200.

Options Traders: Read This AMD Earnings Preview

Semiconductor standout Advanced Micro Devices Inc (NASDAQ:AMD) is up 4% to trade at $173.04 today, after UBS hiked its price target to $210 from $150.

AMD: Get Ready For Another Double-Beat As AI Demand Soars (Earnings Preview)

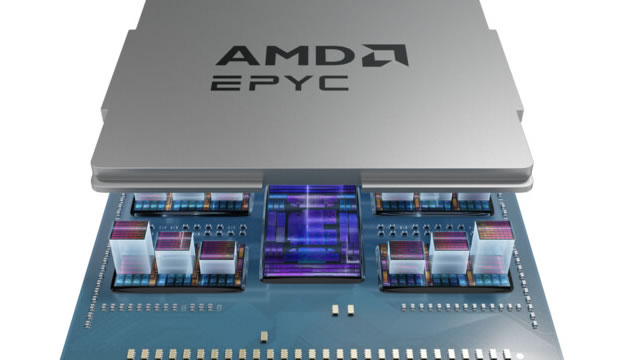

AMD heads into Q2 FY2025 earnings with strong momentum, driven by robust AI and data center demand, and a history of consistent double-beats. Q1 results saw revenue up 36% and EPS up 55% YoY, with data center sales surging 57% and gross margin reaching 54%. The company's AI partnerships, new product launches, and ZT Systems acquisition position AMD to capture a larger share of the $500B+ AI compute market.

AMD: The King Of Inference

AMD's stock remains highly volatile, reflecting ongoing uncertainty and rapid shifts in market sentiment, but still underperforms major indexes. Advanced Micro Devices is positioning itself for inference, which is predicted to be the larger TAM compared to training. China restrictions have been lifted, as the Saudi deal no longer covers for the China losses but could be considered additional revenue.

AMD CEO Lisa Su on the Cost of US Chips

AMD CEO Lisa Su says chips from TSMC's Arizona facilities will be between 5% and 20% more expensive than similar parts from factories in Taiwan. Su spoke to Bloomberg Tech Co-Anchor Ed Ludlow in Washington, DC.

Advanced Micro Devices (AMD) Stock Sinks As Market Gains: Here's Why

In the most recent trading session, Advanced Micro Devices (AMD) closed at $154.72, indicating a -1.45% shift from the previous trading day.

Wall Street analyst predicts 50% upside for this Nvidia rival

Bernstein has raised its price target on Advanced Micro Devices (NASDAQ: AMD) to $140 from $95, citing the company's growing role in the artificial intelligence hardware race.

Advanced Micro Devices, Inc. (AMD) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Advanced Micro (AMD). This makes it worthwhile to examine what the stock has in store.

Nearly 89% of Companies are Seeing Insider Selling, But these 3 are Seeing Substantial Buying

Corporate insiders have taken a sharply pessimistic turn – selling their companies' shares at the fastest rate in at least a decade.

AMD: The Rook In The AI Ecosystem

I rate AMD a Buy. AMD is the 'Rook' of the AI ecosystem, dominating AI and data centers, PCs and Laptops, Embedded systems, and networking. China is an important market for AMD. And the US just gave AMD permission to continue exporting its chips into China.

Advanced Micro Devices (NASDAQ: AMD) Price Prediction and Forecast 2025-2030 (July 2025)

Shares of Advanced Micro Devices ( NASDAQ:AMD ) exploded over the past month, gaining 24.45%.