Advanced Micro Devices, Inc. (AMD)

Higher High, Lower High; AMD Is A Buy

AMD's growth momentum is strong, with an expectation for the current trend to continue for the foreseeable future. Yet, due to the macroeconomic factors, the investor sentiment surrounding AMD has soured leading to a valuation multiple contraction. When investor sentiment returns, AMD will see valuation multiple expansion from a higher base or a higher EPS as a result of a continued growth.

If You'd Bought 1 Share of Advanced Micro Devices at Its IPO, Here's How Many Shares You Would Own Now

After its founding in 1969, Advanced Micro Devices (AMD -0.61%) didn't wait long before it decided to debut on public markets. The company held its initial public offering (IPO) three years later in 1972, issuing 620,000 shares of stock at $15.50 per share.

Advanced Micro Devices (AMD) and Teradyne (TER) Are Way Better AI Names Than NVDA Stock Right Now (and It's Not Even Close!)

Nvidia (NASDAQ:NVDA) has been an artificial intelligence juggernaut, racking up jaw-dropping numbers that make Wall Street drool.

Stock Market Correction: Here Are My Top 5 Stocks That Could Soar By The End of 2025

With the stock market in a correction, some investors are likely to remain a bit pessimistic. There are many unknowns about the effect of tariffs, and the market hates uncertainty.

This Analyst Thinks AMD Stock Could Soar Over 120%. Should Investors Buy This Beaten-Down AI Stock?

Advanced Micro Devices (AMD 0.93%) has been ahead of the curve in terms of the AI sell-off trend. The chip stock peaked in March 2024 and has trended lower ever since, and is now down by around 50% from its all-time high.

Is AMD the Most Undervalued Tech Stock Right Now?

In today's video, I discuss Advanced Micro Devices (AMD 0.93%) and its various growth opportunities. To learn more, check out the short video, consider subscribing, and click the special offer link below.

Better AI Chip Stock: AMD vs. Broadcom

When it comes to artificial intelligence (AI) chip stocks, Nvidia (NVDA 0.76%) has been crowned the king by market prognosticators. That doesn't mean there aren't other contenders for the throne.

AMD's Lisa Su has already vanquished Intel. Now she's going after Nvidia

AMD CEO Lisa Su has been the highest-paid female CEO for five years running, according to an AP survey. On Su's watch, AMD's market cap has grown from $2 billion to $175 billion in a decade, surpassing rival Intel along the way.

4 Top Artificial Intelligence (AI) Stocks Ready for a Bull Run

The marketwide correction was fueled by the hefty selling of artificial intelligence (AI) stocks. However, I think most of that selling is over, and it's time to start considering which stocks are primed for a strong bull run.

Should You Forget Nvidia and Buy These 2 Tech Stocks Instead?

Investors have been buying Nvidia (NVDA 1.74%) shares like hotcakes over the past several years -- and that's helped the artificial intelligence (AI) leader to jump more than 2,000% since 2020.

AMD: The Margin Of Safety Gives A Fantastic Opportunity

Advanced Micro Devices, Inc.'s fundamentals remain strong with promising AI and data center growth, making the recent stock price dip an attractive buying opportunity. The Data Center segment's rapid revenue growth and profitability are expected to boost AMD's overall EBIT margin organically. Despite competition concerns, AMD's consistent innovation and market share gains in CPUs and GPUs suggest a solid margin of safety.

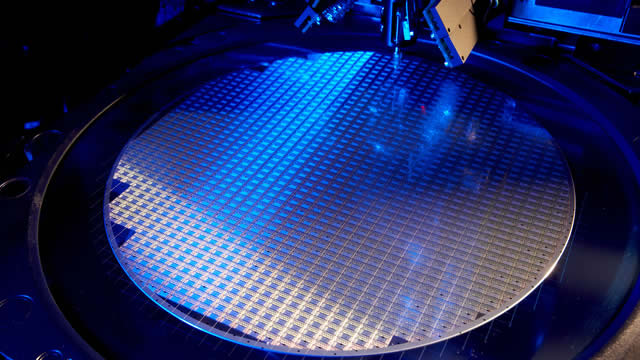

Can AMD's Expanding EPYC Portfolio Push the Stock Higher in 2025?

Advanced Micro Devices is benefiting from an expanding partner base amid stiff competition from NVIDIA in the data center and AI space.