Advanced Micro Devices, Inc. (AMD)

AMD: Outperforming Nvidia GPUs In Some AI Inference Applications

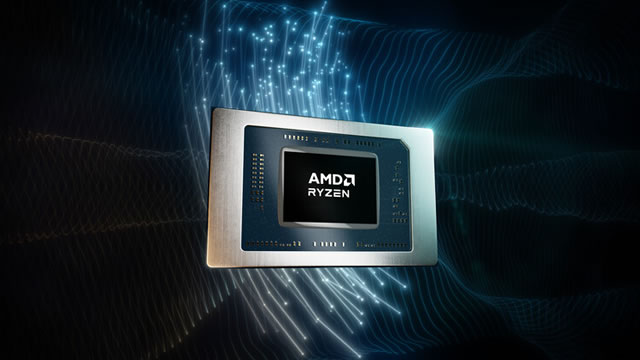

Over the last year, AMD's share price declined by -53.4% compared to a return of +22.3% for Nvidia's stock. When looking exclusively at market performance, one would think that AMD is significantly behind Nvidia in the AI GPU arms race. The reality is otherwise, as AMD's MI325X platform may actually surpass Nvidia's Hopper H200 GPUs in some inference applications.

Advanced Micro Devices (AMD) Advances While Market Declines: Some Information for Investors

Advanced Micro Devices (AMD) closed at $96.76 in the latest trading session, marking a +0.13% move from the prior day.

Ocular Therapeutix Axpaxli Advances In Phase 3 For Wet AMD, Analyst Forecasts Huge Upside

Needham initiated coverage on Ocular Therapeutix Inc OCUL, noting the company's lead asset, Axpaxli, an investigational axitinib-based intravitreal implant for wet age-related macular degeneration (wet AMD).

Time to buy AMD stock as it enters oversold territory?

Advanced Micro Devices can't seem to catch a break. AMD stock (NASDAQ: AMD) has been trending downward for an entire year.

Bold Prediction: 1 Stock That Could Be Worth More Than Nvidia 7 Years From Now

Nvidia (NVDA 1.92%) has been one of the best long-term investments of all time. Since 1999, shares have increased in value by more than 285,000%, pushing the company's market capitalization into the trillions of dollars.

Why Is AMD Stock Crashing, and Is It a Buying Opportunity?

AMD (AMD 1.48%) stock is falling considerably as it fails to gain substantial traction in the artificial intelligence market.

AI Chipmaker Stock Sell-Off: Here Are My Top 2 Semiconductor Stocks to Buy Now

In January, China's DeepSeek AI sparked a sell-off in artificial intelligence (AI) stocks after sharing breakthroughs in developing highly efficient training and inference algorithms for large language models. In other words, DeepSeek's AI models showed maybe big tech companies don't have to spend hundreds of billions of dollars on the most advanced GPUs available for their data centers.

1 Artificial Intelligence (AI) Semiconductor Stock to Buy on the Dip Hand Over Fist Right Now (Hint: It's Not Nvidia or AMD)

Chipsets known as graphics processing units (GPUs) are perhaps the most important hardware in generative AI development right now. For the last couple of years, investing in semiconductor stocks has generally been a great idea -- as you're nearly guaranteed some form of exposure to GPUs or data centers.

Technical analyst maps out the ‘massive buy' opportunity for AMD stock

Advanced Micro Devices (NASDAQ: AMD) has had a challenging start to 2024, sliding over 18% since the beginning of the year.

Should You Buy AMD Stock on the Dip?

Advanced Micro Devices (AMD -2.77%) has been one of the worst stocks to own over the past year. While investors were excited about AMD potentially taking market share from rival Nvidia in the all-important data center market, that hasn't manifested.

AMD: Interesting Combination Of Growth And Valuation

AMD's stock decline to $99 from $211 seems excessive; Wall Street analysts remain bullish, while Seeking Alpha analysts offer more moderate optimism. AMD's diversified business includes Data Center, Client, Gaming, and Embedded segments, with Data Center showing the most promise despite lagging behind Nvidia. Financially strong, AMD expects high double-digit growth in revenue and EPS, driven by their new MI350X architecture.

Advanced Micro Devices (AMD) Advances But Underperforms Market: Key Facts

In the closing of the recent trading day, Advanced Micro Devices (AMD) stood at $101.67, denoting a +0.91% change from the preceding trading day.