Advanced Micro Devices, Inc. (AMD)

Better Artificial Intelligence Stock: Nvidia vs. AMD

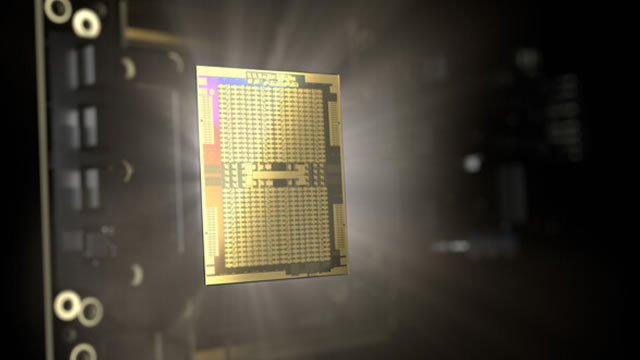

Discrete GPUs were initially designed for use in video games and professional graphics applications, but they've now become the backbone of data centers that use them to process all sorts of computations, especially those involving complex artificial intelligence (AI) functions. Unlike CPUs, which process a single piece of data at a time through scalar processing, GPUs use vector processing to manage a wide range of floating-point numbers and integers simultaneously.

AMD Before Nvidia's Earnings: Is It The Next Intel?

I see Advanced Micro Devices, Inc. at a crossroads — Is it going to be the Nvidia or the next Intel? I believe Nvidia's Q4 earnings will shed some light on this question. AMD's Q4 earnings show Data Center up 69%, well below Nvidia's Q3 results. AMD is failing to catch up. Yet, I think it is too early to call it quits. My bear case: AI might be a “winner-takes-all” market, leaving AMD with scraps, worsened by its known software issues.

AMD: Betting On The Next AI Chip To Boost Sales Momentum

AMD's recent earnings result did not go down well with Wall Street, as the company missed Data Center sales estimate. AMD reported $3.86 billion in data center revenue, which is 69% YoY growth but lower than the $4.14 billion consensus estimate. AMD's management has announced the early launch of MI350 chips, which should boost sales momentum.

AMD's AI Roadmap Is More Promising Than Most Realize

AMD's data center business, driven by AI, is experiencing significant growth, positioning it well in the competitive market. The MI300x chip series and ROCm software suite are enhancing AMD's standing in the AI space, surpassing competitors like Nvidia in some performance metrics. Despite appearing pricey, AMD's rapid growth and strong market position in AI-driven sectors justify its high valuation, making it a buy.

AMD Closing Competitive GPU Gap With Nvidia, Gains Market Share From Intel In Client And Server Markets: Analyst

Benchmark analyst Cody Acree reiterated Advanced Micro Devices AMD with a Buy and a $170 price target.

AMD is doing better in AI than Wall Street thinks, this analyst says

After Advanced Micro Devices Inc.'s disappointing earnings forecast last quarter, Wall Street soured a bit on the company's potential in the artificial-intelligence-chip market, but Benchmark Research believes in AMD's increasingly competitive stance.

3 Stocks for a Value Portfolio: Undervalued Gems to Watch

It has become clear to investors who know what to look for that value stocks are about to be the end game for 2025, especially considering all of the volatility breakouts that have come up over the past couple of weeks. These range from economic data surprises like inflation to new trade tariff announcements from President Trump and just broader rotations inside the S&P 500 and NASDAQ indexes.

AMD: Still A Buy In Nvidia's Shadow

AMD has declined 45% from its highs in early 2024. Nvidia leads in AI chip performance and ecosystem, but AMD offers better value for money. Considering the market growth rates of AMD's underlying business segments, the company could be undervalued by up to 34%.

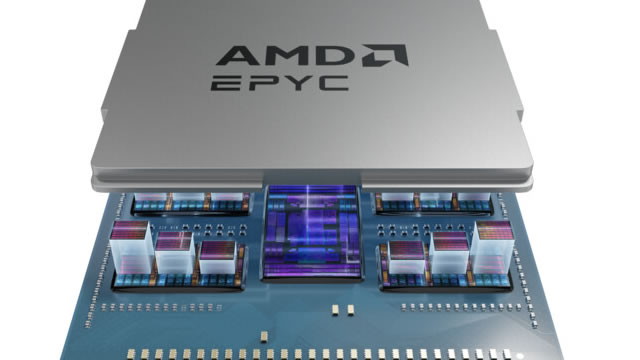

AMD Q4: MI350 With CDNA 4 Architecture Is Coming In Mid-2025

Reiterate a 'Buy' rating on AMD, citing strong data center growth, undervaluation, and a fair value of $180 per share. Highlight AMD's 69% data center revenue growth, driven by Instinct GPU and EPYC CPU sales, and strong industry adoption of EPYC platforms. Emphasize the faster-than-expected MI350 product ramp-up, expected to drive significant growth in FY25, and AMD's leading position in the AI PC market.

Better Artificial Intelligence (AI) Buy for 2025: AMD or Nvidia Stock?

Nvidia (NVDA 2.63%) has essentially owned the data center computing market, which is a huge deal, considering the hundreds of billions of dollars being spent on artificial intelligence (AI) infrastructure. Nvidia is one of the primary benefactors of this investment, although some of its competitors, like AMD (AMD 1.15%), are also benefiting.

6 High-Growth Stocks to Buy for 2025

Over the course of the past few years, growth stocks have led the charge for the stock market. However, every year presents different challenges, and I think a different set of stocks -- a few that have been left behind -- could provide some serious growth potential in 2025 and beyond.

AMD: Stop Dreaming Of Big Returns

The stock price of Advanced Micro Devices, Inc. could fall further after Nvidia Corporation reports earnings, as investors get a reality check regarding AMD's revenue growth potential following DeepSeek's rise. Research uncovers how crucial Nvidia's platform was to DeepSeek's success. Despite chip restrictions, NVDA's invaluable software layer enabled DeepSeek to optimize model performance, while AMD still struggles to catch up. On AMD's recent earnings call, executives barely convinced investors that they are strongly positioned to capitalize on the DeepSeek wave, while statistics reveal Nvidia capturing more inferencing workloads over AMD.