Amgen Inc. (AMGN)

10 Undervalued Dividend Growth Stocks: February 2025

I rank a selection of undervalued dividend growth stocks in Dividend Radar and present the ten top-ranked stocks for consideration. I use two valuation screens, one based on my fair value estimate, and another comparing each stock's forward dividend yield with its 5-year average dividend yield. To rank stocks, I do a quality assessment and sort candidates by quality scores, breaking ties with additional metrics.

Amgen plans $200 million investment in India site, CEO says

U.S. drugmaker Amgen will invest about $200 million this year in its new technology centre in southern India, with further investments planned, Chief Executive Officer Robert A. Bradway said at the inauguration of the site.

Here is What to Know Beyond Why Amgen Inc. (AMGN) is a Trending Stock

Amgen (AMGN) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Amgen, Inc. (AMGN) Citi's 2025 Virtual Oncology Leadership Summit Conference (Transcript)

Amgen, Inc. (NASDAQ:AMGN ) Citi's 2025 Virtual Oncology Leadership Summit Conference Call February 19, 2025 3:00 PM ET Company Participants Jean-Charles Soria - Senior Vice President of R&D Justin Claeys - Vice President of Investor Relations Conference Call Participants Geoffrey Meacham - Citigroup Geoffrey Meacham Hello, good afternoon. My name is Geoff Meacham.

Amgen, Inc. (AMGN) Oppenheimer 35th Annual Healthcare Life Sciences Conference Call Transcript

Amgen, Inc. (NASDAQ:AMGN ) Oppenheimer 35th Annual Healthcare Life Sciences Conference Call February 12, 2025 11:20 AM ET Company Participants Narimon Honarpour - Senior Vice President, Global Development Justin Claeys - Head of Investor Relations Casey Capparelli - Investor Relations Conference Call Participants Jay Olson - Oppenheimer & Co. Jay Olson Hello, everyone. I'm Jay Olson, one of the biotech analysts at Oppenheimer, and it's a pleasure to welcome you to Oppenheimer's 35th Annual Healthcare Conference.

Is Trending Stock Amgen Inc. (AMGN) a Buy Now?

Amgen (AMGN) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Investing $1,000 in These 3 Beaten-Down Stocks Could Be a Brilliant Move

Investing in stocks that aren't performing well can be a good move, but only if there are good reasons to think they will recover. That isn't the case for many companies that have lagged broader equities.

Amgen: Multiple Strengths, But The Valuation Is A Concern

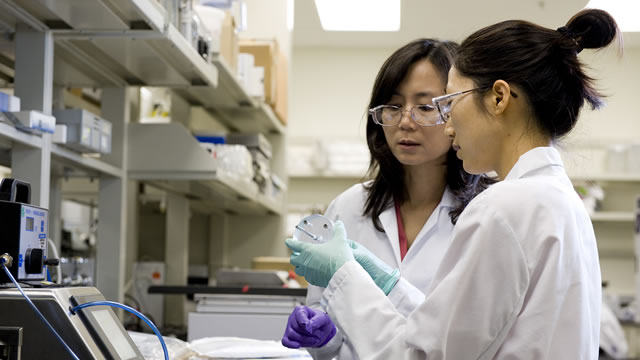

Amgen is a biotechnology leader with competitive advantages in scale, R&D, manufacturing efficiency, and distribution, bolstered by a robust pipeline and rising margins. I currently rate Amgen as a hold due to its fair valuation and intense competition from biosimilars. Amgen's dividend yield remains attractive, supported by a 14-year streak of increases, a moderate payout ratio, and strong free cash flow.

Amgen Stock Has Surged. Here's Where It's Headed Next.

The stock is up 15% since late December.

Amgen: The Charts Didn't Lie, Upgrade To Buy

Amgen is a "buy" due to its strong earnings beat, attractive dividend, and technical chart pattern forecasting positive future performance. I prioritize a balanced approach, focusing on risk and reward within a diversified portfolio, rather than relying solely on buy/sell/hold ratings, which I find to be misleading in many ways. AMGN's dividend safety and yield north of 3% make it appealing, despite concerns about valuation and growth.

Amgen Q4 Earnings: Good Quarter, Ok Guidance, But MariTide Concerns Me (Rating Downgrade)

Amgen's Q4 2024 earnings show a 19% revenue increase year-on-year, with non-GAAP EPS up 13% in Q4 and 6% for the full year. The company faces significant patent expiries but aims to offset losses with growth from newer drugs like Repatha, Evenity, and Horizon assets. MariTide's development in obesity treatment is crucial, but concerns about its progress and competition from Novo and Lilly remain.

Amgen Q4 Earnings: Strong Pipeline And Label Expansions Justify Buy Rating

Amgen Inc.'s Q4 2024 earnings beat expectations, with 11% YoY revenue growth and 13% EPS increase, showcasing robust performance for the company's growth strategy. Amgen's diversified portfolio includes 14 blockbuster medicines, with standout growth in Repatha and Evenity, and promising pipeline developments, particularly for MariTide. Despite patent expirations for Prolia and Xgeva, Amgen's strong pipeline and label expansions for existing drugs support continued growth and justify a BUY rating.