Antofagasta Plc (ANFGF)

Antofagasta shares edge higher after Elliott reveals £79m short position

Shares in Antofagasta PLC (LSE:ANTO) rose mid-morning on Tuesday after The Times reported that Elliott Investment Management had disclosed a £79 million short position against the FTSE 100 copper miner. Filings with the Financial Conduct Authority show the Florida-based hedge fund has taken a position against 0.52% of Antofagasta's issued share capital.

Antofagasta takes a hit as trade war and recession fears hit copper sector

Antofagasta PLC (LSE:ANTO) shares dropped 7% in early Monday trading, as fears of a global recession sparked by President Trump's sweeping tariffs rattled commodities markets. The Chilean-focused miner, the UK's largest listed copper producer, has been particularly hard hit as investors brace for a slowdown in global demand.

Antofagasta: A copper miner with scale, margin - and room to grow

Berenberg has kicked off coverage of Antofagasta PLC (LSE:ANTO) with a bullish call, giving the FTSE 100 copper miner a £21.00 price target - about 25% above where shares currently trade. Antofagasta stands out in the London market as a pure-play copper producer, with all four of its operating mines based in Chile.

US bank lifts Antofagasta forecast on copper price but flags slow Q1

Citi has raised its 2025 earnings forecast for Chilean copper miner Antofagasta PLC (LSE:ANTO) by 15%, citing the sharp rise in copper prices. However, the bank expects a quieter start to the year when the company reports first-quarter production figures on 16 April.

Magnitude 6.3 earthquake strikes Antofagasta, Chile, EMSC says

A magnitude 6.3 earthquake struck Antofagasta, Chile region , on Thursday, the European Mediterranean Seismological Centre (EMSC)said.

Antofagasta bags double JPMorgan upgrade as copper prospects improve

Antofagasta PLC has bagged a double upgrade from JPMorgan analysts on expectations the miner could be a standout among peers on improving prospects for copper ahead. Granting an ‘overweight' rating, JPMorgan laid out expectations for fiscal stimulus measures at China's March National People's Congress meeting.

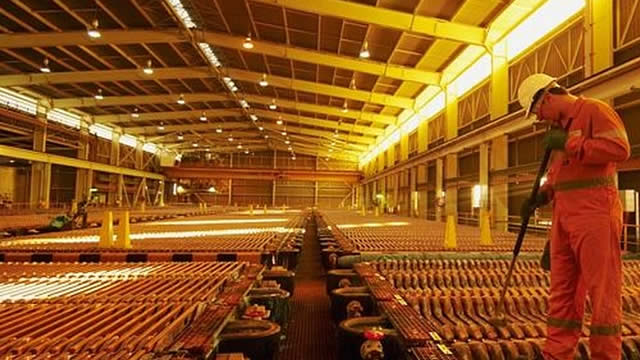

Copper supply is important for energy security, says Antofagasta CEO

Antofagasta CEO Iván Arriagada discusses the mining industry and the company's full-year earnings.

Antofagasta plc (ANFGF) Full Year 2024 Earnings Call Transcript

Antofagasta plc (OTC:ANFGF) Full Year 2024 Earnings Conference Call February 18, 2025 4:00 AM ET Company Participants Iván Arriagada – Chief Executive Officer Mauricio Ortiz – Chief Financial Officer Alejandra Vial – Vice President Sustainability Conference Call Participants Jason Fairclough – Bank of America Ian Rossouw – Barclays Dan Major – UBS Ioannis Masvoulas – Morgan Stanley Alan Spence – BNP Paribas Exane Bob Brackett – Sanford C. Bernstein & Co. Ben Davis – RBC Matt Greene – Goldman Sachs Edward Goldmith – Deutsche Bank Iván Arriagada So good morning and thank you to everyone.

Antofagasta, Glencore: Miners on the march in the wake of Trump tariff threat

Donald Trump's reciprocal tariff threat appears to have sparked life into the mining sector. Antofagasta PLC (LSE:ANTO) and Glencore PLC (LSE:GLEN) led the FTSE 100 leaderboard with gains of 4% and 3% respectively.

Antofagasta a better bet than Rio Tinto, says leading investment bank

UBS has taken a contrarian stance on two major mining stocks, backing Antofagasta PLC (LSE:ANTO) over Rio Tinto Ltd (LSE:RIO, ASX:RIO, OTC:RTNTF) despite broader market preference for the latter. While most analysts favour Rio due to its iron ore dominance, UBS believes Antofagasta's copper exposure offers a stronger long-term growth story.

Antofagasta jumps on stronger gold, copper production

Antofagasta PLC racked up a 3.9% gain on Thursday after unveiling stronger production figures for its latest quarter. Some 200.3 kilotons of copper were produced in the fourth quarter, up 11.9% on the third and taking the figure up 0.5% over the course of 2024.

Anglo American and Antofagasta lower after downgrade by Canadian investment bank

RBC Capital Markets has downgraded Anglo American PLC (LSE:AAL) and Antofagasta PLC (LSE:ANTO), highlighting challenges within the diversified mining sector. Anglo American's rating was reduced to 'underperform' from 'sector perform', with a lower price target of 2,200p, down from 2,400p.