ASML Holding N.V. New York Registry Shares (ASML)

The Zacks Analyst Blog ASML Holding, NVIDIA, Intel and Taiwan Semiconductor Manufacturing Company

ASML Holding, NVIDIA and Taiwan Semiconductor Manufacturing Company are included in this Analyst Blog.

ASML CEO sees growing economic 'uncertainty' from tariffs

Dutch tech giant ASML warned on Wednesday of growing economic uncertainty due to US tariffs but the company kept its 2025 sales forecast intact.

ASML Stock Drops After Earnings. Sales Guidance Hit by Trump Tariffs Uncertainty.

The chip-making equipment company is feeling the pressure of the U.S. trade war.

ASML, a key microchip bellwether, disappoints on orders

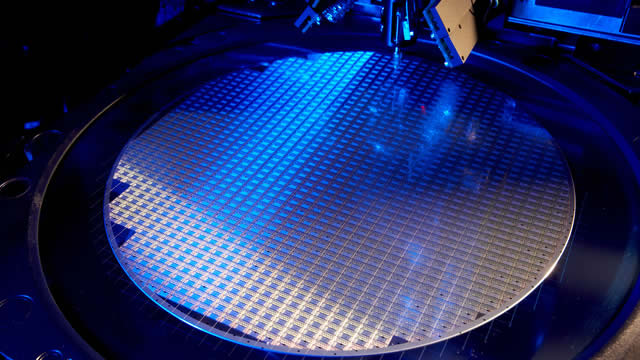

Dutch semiconductor equipment group ASML Holding reported disappointing orders for the first quarter and flagged growing uncertainty surrounding U.S. tariffs on Wednesday.

ASML Orders Fall Short of Estimates

ASML reported lower-than-expected orders, citing weakness in the chip sector. The Dutch company reported bookings of €3.94 billion ($4.47 billion) in the three months through March, lower than the average analyst expectation of €4.82 billion.

ASML Orders Miss Forecasts as It Warns on Tariff Volatility

The supplier of semiconductor-making equipment posted first-quarter orders below analysts' projections as chip makers held back spending on machinery.

Critical chip firm ASML posts lower-than-expected net bookings in first quarter

Dutch semiconductor equipment firm ASML on Wednesday missed on net bookings expectations, suggesting a potential slowdown in demand for its critical chipmaking machines. Global chip stocks have been fragile over the last two weeks amid worries about how U.S. President Donald Trump's tariff plans will affect the semiconductor supply chain.

2 Wide Moat Semiconductor Stocks a Bargain Buy Now: ASML and NVDA

Now is a great opportunity to invest in ASML and NVIDIA, both set to thrive after a recent drop in share prices.

The Tariff Game Just Changed: 7 Blue-Chip Bargains To Buy Now

Unprecedented Opportunities: Recent market panic has created deep discounts among world-class blue-chip companies trading at 52-week lows, offering up to 100% potential returns and secure yields approaching 8%. Trade War Realities: Despite severe pessimism driven by historic tariff increases (highest since 1909), the actual economic impact might be significantly less dire, potentially avoiding recession altogether. Institutional strategies, such as pensions and risk parity funds, may soon trigger substantial stock-buying due to automatic rebalancing. This would provide strong support and fuel market rallies from oversold conditions.

ASML Holding: A Strong Buy Into Earnings

For a company that dominates the lithography market, ASML is extremely likely to demonstrate benefits from AI tailwinds in its Q1 2025 performance and guidance for the remainder of 2025. Other large positive indicators include recent aggressive EPS revisions, and a significant bookings backlog of €7.1 billion. ASML's forward P/E ratio trajectory is bullish, and my DCF analysis indicates a fair share price close to $840, with Wall Street targeting $969.

Tariffs uncertainty clouds outlook for ASML's earnings

Investors will seek clarity on the risks posed by tariffs U.S. President Donald Trump plans to impose on the semiconductor industry when computer chip equipment maker ASML reports first-quarter earnings on Wednesday.

5 Low-Leverage Stocks to Add to Your Portfolio as U.S. Inflation Eases

The crux of safe investment lies in choosing a company that is not burdened with debt. You can buy BILI, WLDN, STRL, ASML and DRS.