ASML Holding N.V. New York Registry Shares (ASML)

ASML CEO says Dutch-China tension has not hit chip-gear maker

ASML's CEO said the Dutch chip-gear maker has not been affected by tensions between The Netherlands and China over the Dutch government's takeover of chipmaker Nexperia.

Artisan Value Fund Q3 2025 Top Contributors And Detractors

Our biggest source of underperformance was the consumer staples sector as we had a number of laggards, including Kerry Group, Philip Morris and Diageo. On the positive side, the three new purchases we made in Q2 during the post-Liberation Day market meltdown—Lam Research, ASML and Thermo Fisher Scientific—were each among our top contributors to returns in Q3. Our top contributor in Q3 was Alphabet, a long-time holding.

Top Wide-Moat Stocks to Invest in for Long-Term Wealth and Stability

LRCX, ASML, NVDA and MCO use strong moats to fend off rivals and deliver consistent returns amid market shifts.

ASML (ASML) Recently Broke Out Above the 20-Day Moving Average

ASML (ASML) reached a significant support level, and could be a good pick for investors from a technical perspective. Recently, ASML broke through the 20-day moving average, which suggests a short-term bullish trend.

ASML Holding N.V. (ASML) is Attracting Investor Attention: Here is What You Should Know

ASML (ASML) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

ASML Still Has Room To Run

ASML remains a buy due to strong innovation, robust bookings, and expansion into Advanced Packaging despite recent valuation expansion. Q3 results showed sluggish top line growth, but a 105% YoY increase in bookings signals sustained demand and future revenue acceleration for ASML. Margins remain healthy, with gross margin expanding slightly and profitability holding steady, reinforcing ASML's dominant industry position.

1 Super Semiconductor Stock to Buy Hand Over Fist (Hint: Not Nvidia)

Nvidia is a semiconductor powerhouse that is playing a pivotal role in the growth of AI. Without the necessary hardware, the fabrication of advanced semiconductors isn't possible.

ASML: I'm Selling 60% After A Beautiful Trade

ASML Holdings has delivered a +57.4% gain since my last 'strong buy' rating, far outperforming the S&P 500. ASML's strong margins, robust cash generation, and AI-driven revenue growth justify its premium valuation, despite some concerns over China demand in 2026. With shares near historical resistance and bullish signals overextended, I am selling 60% of my position to lock in profits.

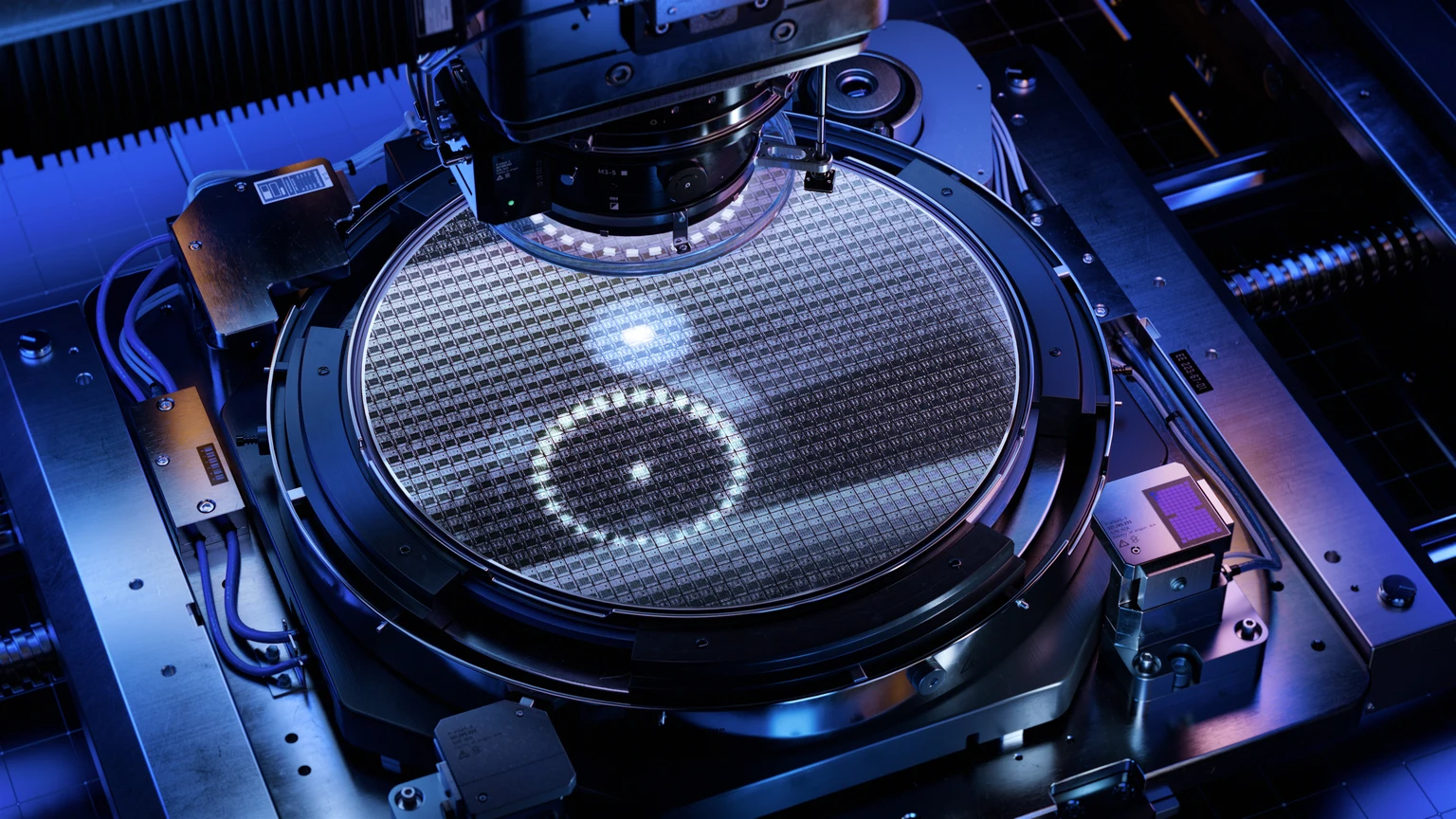

TSMC And ASML: The Deep Value Engine Of The AI Revolution

TSMC's Q3 2025 results confirmed its structural strength, posting 40.8% YoY revenue growth and a 50.6% operating margin, driven by expanding AI and HPC demand amid global capacity diversification. ASML's Q3 2025 reflected resilient EUV equipment demand, 51.6% gross margin, and €5.4 B in bookings, as management reaffirmed AI-driven lithography intensity and long-term revenue potential up to €60 B. ASML trades at a “perfection premium” near 35.7× P/E FWD and 27.5× EV/EBITDA, while TSMC's ~13.8× EV/EBITDA FWD and 35% ROE suggest undervaluation of its industrial and geopolitical power.

ASML Holding N.V. (ASML) Is a Trending Stock: Facts to Know Before Betting on It

ASML (ASML) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Is ASML's 1.3B Euro AI Bet the Catalyst for Its Next Growth Cycle?

ASML's investment of 1.3B euros in Mistral AI deepens its integration of AI into lithography systems, setting the stage for faster, smarter chipmaking innovation.

Bull of the Day: ASML Holding (ASML)

ASML Holding N.V. ( ASML ) is the world's sole manufacturer of extreme ultraviolet (EUV) lithography systems, indispensable for fabricating sub-4nm semiconductors that power AI, data centers, and advanced consumer electronics.