ATI Inc. (ATD)

Summary

ATD Chart

Wall Street Bulls Look Optimistic About ATI (ATI): Should You Buy?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

ATI Inc. (ATI) Hit a 52 Week High, Can the Run Continue?

ATI (ATI) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

Strength Seen in ATI (ATI): Can Its 5.3% Jump Turn into More Strength?

ATI (ATI) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock suggests that there could be more strength down the road.

ATI Inc. (ATD) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has ATI Inc. ever had a stock split?

ATI Inc. Profile

| Metals & Mining Industry | Materials Sector | Kimberly A. Fields CEO | XSTU Exchange | US01741R1023 ISIN |

| US Country | 7,800 Employees | 16 Aug 2016 Last Dividend | 2 Jul 1993 Last Split | - IPO Date |

Overview

ATI Inc., previously known as Allegheny Technologies Incorporated, is a global leader in the production and sale of specialty materials and complex components. Its operations are strategically divided into two main segments: High Performance Materials & Components (HPMC) and Advanced Alloys & Solutions (AA&S), aiming to cater to a diverse range of industries. The company's roots trace back to its incorporation in 1996, and it has since then established its headquarters in Dallas, Texas. ATI Inc. prides itself on serving a variety of critical markets, including aerospace and defense, energy, automotive, construction and mining, food equipment and appliances, and medical sectors, signaling its crucial role in supporting various facets of global industries.

Products and Services

ATI Inc.'s extensive product and service offerings are segregated into two primary segments, each responsible for different ranges of specialty materials and components:

- High Performance Materials & Components (HPMC):

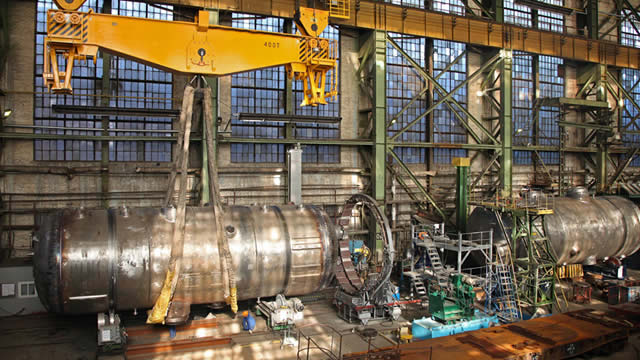

This segment specializes in producing a wide array of materials, among them titanium and titanium-based alloys, nickel- and cobalt-based alloys and superalloys, as well as metallic powder alloys. These advanced powder alloys and other specialty materials are available in various forms, including ingot, billet, bar, rod, wire, shapes, rectangles, and even seamless tubes. Beyond raw material forms, the HPMC segment also fabricates precision forgings, components, and machined parts, demonstrating ATI Inc.'s commitment to offering high-value solutions to its customers.

- Advanced Alloys & Solutions (AA&S):

In the AA&S segment, ATI Inc. focuses on the production of zirconium and related alloys (which also encompasses hafnium and niobium), nickel-based alloys, titanium and titanium-based alloys, and specialty alloys. These materials are transformed into various product forms, including plate, sheet, and precision rolled strip products. Apart from its broad materials portfolio, the AA&S segment extends its services to offer hot-rolling conversion services, addressing not only specialty alloys but also including carbon steel products. This diversity in products and services underscores ATI Inc.'s position as a versatile and comprehensive provider in the material science industry.