Broadcom Inc. (AVGO)

5 Dividend Stocks That Investors May Bank On for Growth

Tapestry, RTX, Cintas, Broadcom and Corning promise growth for investors.

Top 5 growth stocks to watch in 2025 as market momentum builds

While concerns about a potential US recession persist, growth stocks have continued to outperform value stocks in 2024. Investors remain optimistic that the Federal Reserve's expected interest rate cuts will further support high-growth companies.

Top AI Stocks You Should Buy to Revitalize Your Portfolio

Here, we pick three AI stocks, NVDA, AVGO and PLTR, which are well poised to benefit from AI's growing pervasiveness and huge spending by tech giants.

Should You Forget Amazon? Why These Unstoppable Stocks Are Better Buys.

If you've been an investor for any length of time at all, you've almost certainly been encouraged to buy stock in Amazon. It doesn't just dominate the e-commerce arena, after all.

3 Tech Stocks that Could Soar After Earnings

More than a month into 2025, investors have plenty of earnings to digest.

Forget DeepSeek, Buy 5 Stocks to Tap Robust AI-Infrastructure Spending

Five U.S.-based AI infrastructure developers have strong potential to tap robust spending by big techs. These are: NVDA, AVGO, CEG, MRVL, INOD.

The Big 3: AVGO, MU, GOOGL

The A.I. evolution remains at the forefront of the market's mind. Joe Tigay turns to Broadcom (AVGO), Micron (MU) and Alphabet (GOOGL) as three names he expects to gather plenty of attention in the quarters to come.

The Smartest Growth Stock to Buy With $1,000 Right Now

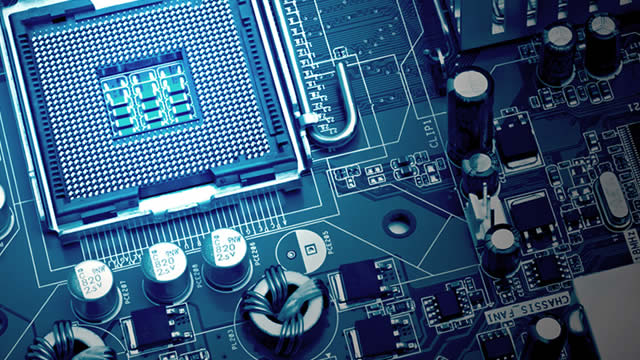

Broadcom (AVGO -0.28%) doesn't have the same name recognition as some of its peers, like Nvidia, but that doesn't make the company any less influential in the artificial intelligence (AI) space. The company is making huge waves in the AI semiconductor market as companies ramp up spending to build new AI infrastructure.

Prediction: This Artificial Intelligence (AI) Chip Stock Will Win Big From DeepSeek's Feat

Chinese artificial intelligence (AI) start-up DeepSeek sent shockwaves through the U.S. tech sector after its cost-effective, open-source, large language model (LLM) topped the download charts in Apple's App Store in the U.S., overtaking OpenAI's ChatGPT, which has been pouring billions of dollars in its AI infrastructure and burning through cash.

2 no-brainer semiconductor stocks to buy for 2025 and beyond

The semiconductor industry staged a strong comeback in 2024, fueled by growing demand across multiple sectors and the accelerating adoption of artificial intelligence.

Billionaire Stanley Druckenmiller says the AI boom could get much bigger – These are the stocks he owns

Stanley Druckenmiller is one of those legendary investors who are worth listening to and learning from.

Semis are still under pressure and there's more to shakeout, says Renaissance Macro's Jeff deGraaf

Jeff deGraaf, Renaissance Macro Research, joins 'Closing Bell' to discuss market trends as investors navigate a choppy February.